|

Getting your Trinity Audio player ready...

|

HBAR, the native token of the Hedera network, is showing strong signs of bullish momentum as technical indicators point to renewed investor interest. After weeks of stagnation, HBAR is gaining upward traction, with price action suggesting a potential breakout amid increased buying pressure.

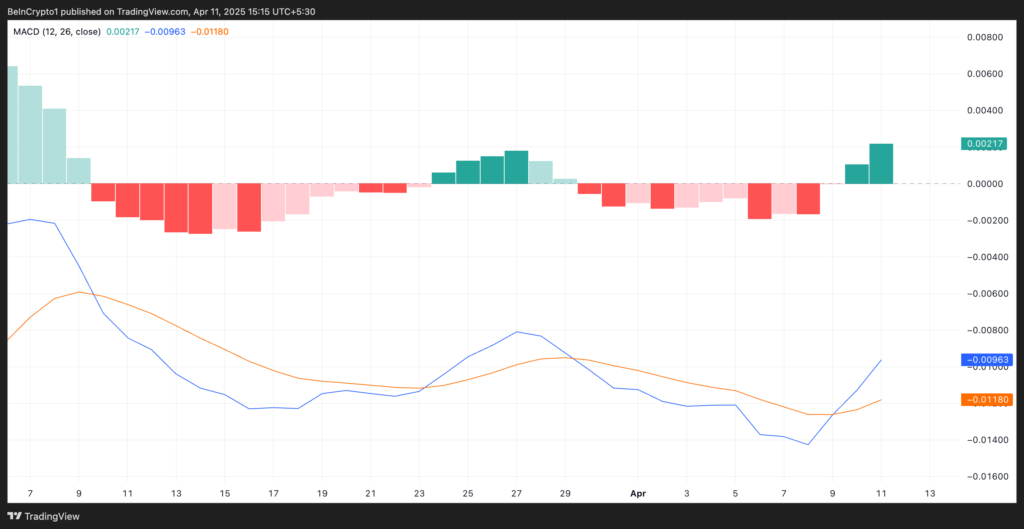

On April 9, the Moving Average Convergence Divergence (MACD) indicator signaled a bullish crossover, often referred to as a “golden cross.” This occurs when the MACD line climbs above the signal line—an event widely interpreted by traders as a buy signal. This technical development suggests that bullish momentum is building, potentially drawing more traders into the market.

Complementing this signal is a strengthening Relative Strength Index (RSI), which currently sits at 49.17 and is trending upward. The RSI is a momentum oscillator that ranges between 0 and 100, with values above 70 indicating overbought conditions and below 30 signaling oversold. HBAR’s RSI, nearing the neutral 50 mark, underscores a steady resurgence in demand. If it crosses above 50, it would further affirm growing bullish sentiment and support continued price appreciation.

HBAR has also broken past the $0.16 resistance level that had kept it subdued since March 30. This breakout could turn the former resistance into a new support level. Should buying pressure persist, analysts suggest that the next target could be $0.19.

However, the rally isn’t without risk. If profit-taking kicks in, HBAR’s price could slide back below the $0.16 level and revisit the $0.12 support zone, stalling the current momentum.

Despite potential pullbacks, market sentiment is turning increasingly optimistic as technical signals align in favor of the bulls. With investor confidence on the rise and critical resistance levels falling, HBAR appears poised for further gains—provided the broader crypto market remains supportive.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hedera (HBAR) Loses $1B After Fake Nvidia Deal, But Long-Term Outlook Remains Strong

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.