|

Getting your Trinity Audio player ready...

|

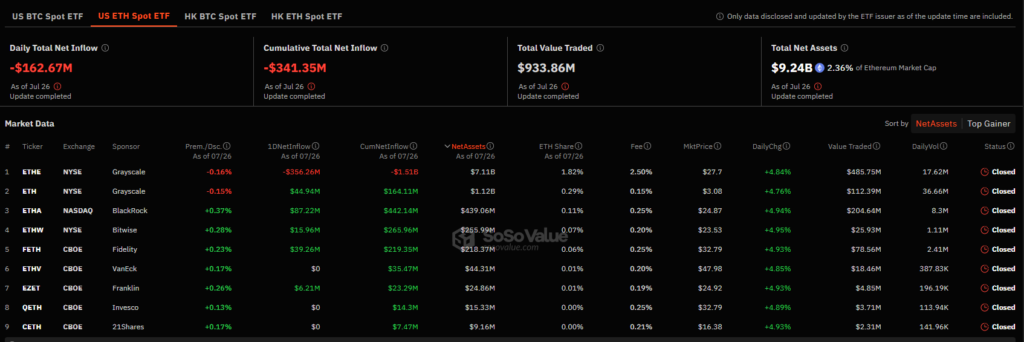

Grayscale’s Ethereum Trust ETF (ETHE) is experiencing significant outflows as investors flock to newly launched spot Ethereum ETFs. Since the debut of these spot ETFs on July 23, ETHE has seen over $1.5 billion in net outflows, with a staggering $356 million withdrawn on July 26 alone.

This trend is part of a broader shift in investor sentiment towards spot Ethereum ETFs, which offer direct exposure to the cryptocurrency’s price. While the overall net outflow for spot Ethereum ETFs stands at $341 million, BlackRock’s iShares Ethereum Trust ETF (ETHA) has emerged as a frontrunner, attracting $442 million in net inflows.

Grayscale’s Ethereum Mini Trust ETF (ETH) has bucked the trend, recording net inflows of $164 million since its launch. However, this pales in comparison to the massive inflows seen by ETHA.

The total net asset value of spot Ethereum ETFs has reached $9.2 billion, representing 2.36% of Ethereum’s total market capitalization. While this figure may seem substantial, it’s essential to consider the outflows that have accompanied this growth.

The launch of multiple spot Ethereum ETFs by eight investment firms on July 23 marks a pivotal moment for the cryptocurrency industry. It has intensified competition for investor funds and accelerated the evolution of Ethereum-based investment products.

Also Read: Bitcoin’s Dominance at Risk: $17.5B Ethereum ETF Gold Rush Threatens Crypto King – Analyst

As the ETF landscape continues to evolve, it will be interesting to observe how Grayscale responds to these challenges and whether it can regain investor confidence.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!