|

Getting your Trinity Audio player ready...

|

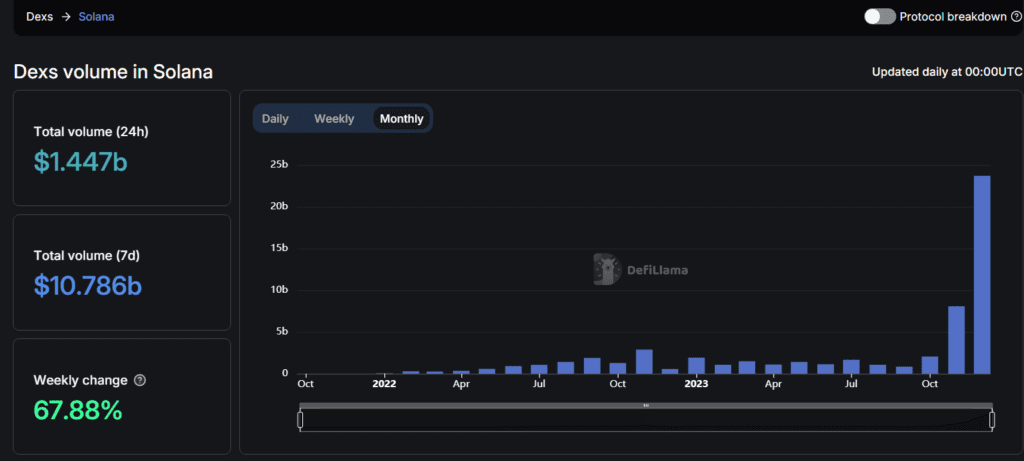

The once-struggling Solana blockchain is roaring back to life, with its decentralized exchanges (DEXs) recording record-breaking volumes that rival Ethereum’s DeFi powerhouse. This surge appears to be fueled by a potent cocktail of airdropped tokens and growing optimism within the Solana ecosystem.

From Laggard to Leader:

Historically, Solana’s DEX volume paled in comparison to Ethereum’s dominant grip on DeFi. However, December witnessed a remarkable shift. Solana’s DEXs not only surpassed Ethereum’s volume during certain periods but also achieved a near triple-digit increase compared to its previous monthly high. In the past week alone, Solana’s DEX volume leaped 26%, reaching an impressive $5.8 billion, while Ethereum’s remained stagnant at $8.5 billion.

The Airmass Arrives:

This dramatic ascent coincides with two substantial airdrops within the Solana DeFi space. The oracle network Pyth showered its users with $87 million worth of tokens, followed by Jito, the second-largest liquid staking protocol on Solana, distributing $228 million in JTO tokens. These airdrops, likened to “DeFi stimulus checks” by some, injected newfound liquidity and excitement into the Solana ecosystem.

Beyond Free FOMO:

While airdrops undoubtedly spurred activity, it’s important to acknowledge potential challenges. Jito, for instance, encountered difficulties with “sybil abusers” trying to game the system for extra tokens. Their final distribution implemented anti-sybil measures to ensure fairer allocation.

Related: Unlocking the Secrets of Crypto Airdrops

Jupiter Ascending:

Jupiter, a liquidity aggregator optimizing trading prices on Solana, also played a significant role in the volume surge. Their upcoming token launch, with 40% reserved for community airdrops, has further fueled anticipation and trading activity.

This correlation between airdrops and DeFi growth isn’t unprecedented. Ethereum saw a similar five-month volume boost following the 2020 Uniswap airdrop, demonstrating the potential of free tokens to incentivize participation and grow network usage.

Also Read: Solana Slays the Doubts: 300% Surge Makes “Ethereum Killer” Title Ring True

Staking Slowdown Amidst DEX Boom:

It’s worth noting that while DEX volume soared, liquid staking on Solana dipped slightly with total staked SOL decreasing in the past week. This suggests a shift in investor priorities within the ecosystem, with DEX engagement taking center stage for now.

Solana’s Resurgence:

Solana’s recent performance, fueled by airdrops and growing ecosystem confidence, paints a promising picture for the blockchain’s future. Whether this momentum can be sustained remains to be seen, but one thing is clear: Solana is no longer playing second fiddle in the DeFi arena. The battle for DeFi dominance has entered a fascinating new chapter, with both blockchains flexing their muscles and vying for investor attention.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.