|

Getting your Trinity Audio player ready...

|

Floki Inu [FLOKI] has been on a tear over the past day, surging by an impressive 14% to reach a two-month peak of $0.000084. This high, last seen on March 3rd, 2024, underscores a strong bullish momentum for the popular memecoin. Looking at broader timeframes, FLOKI has also registered significant gains, boasting a 44.27% increase over the past week and a 14.77% rise over the last 30 days. This price surge has been accompanied by a substantial increase in trading activity, with volume skyrocketing by 104.98% to $213.5 million and Open Interest climbing by 28.3% to $35 million. Consequently, FLOKI’s market capitalization has mirrored this upward trajectory, hitting a two-month high of $792 million.

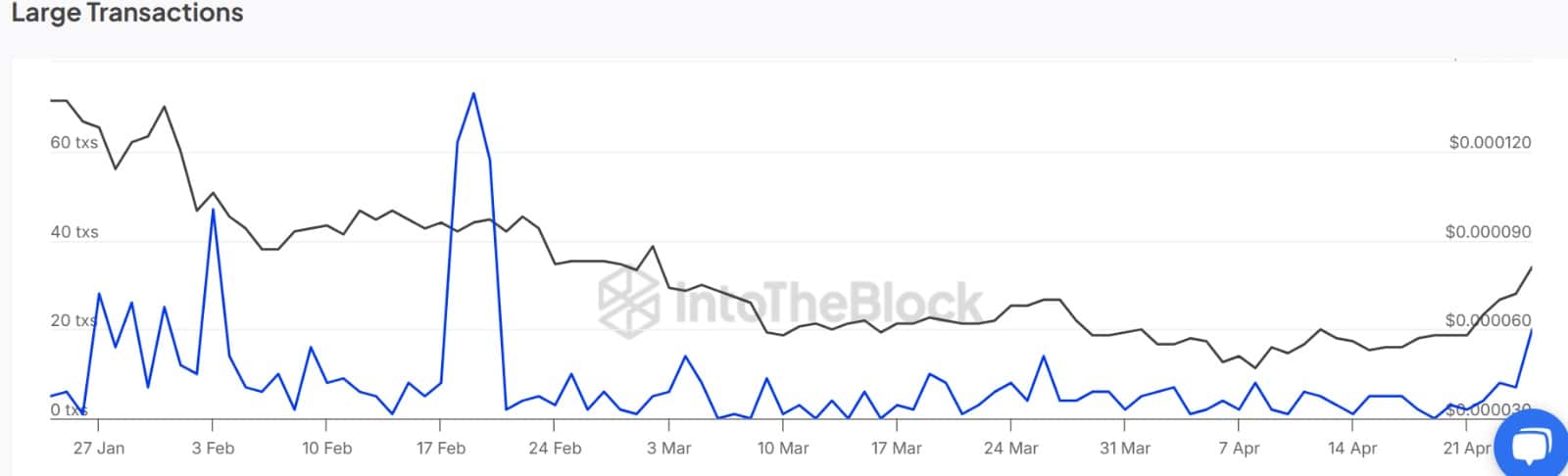

The question then arises: what’s fueling this remarkable rally? Analysis points towards a resurgence in whale activity as a key driver. Data from IntoTheBlock reveals a significant 185.7% spike in FLOKI whale transactions, reaching a two-month high of 20 transactions. This surge initially suggested aggressive network engagement, potentially through accumulation. Indeed, Large Holders Inflow data indicates that FLOKI whales bought a substantial 61.22 billion tokens.

However, a closer look reveals a more nuanced picture. While whales are buying, they are selling even more aggressively, offloading a significant 71.62 billion tokens over the same period. This results in a net negative whale inflow of -10.4 billion tokens. This selling pressure isn’t isolated to whale activity; the spot market also reflects this trend. Spot Netflow has remained positive, hitting a high of $2.1 million, indicating more tokens flowing into exchanges than being withdrawn.

This divergence between price action and underlying whale and spot market activity suggests that the current rally might be driven more by speculative fervor, potentially fueled by the broader memecoin frenzy gripping the market, rather than strong fundamental support. Investors, seemingly wary of the rally’s sustainability, appear to be locking in profits.

Also Read: FLOKI Breaks Out in Volume — Analysts Predict 270% Price Surge to $0.00027

While technical analysis suggests that if current market conditions persist, FLOKI could potentially target $0.000090 and even $0.00010 before facing resistance, the underlying data paints a cautionary tale. The increasing selling pressure from both whales and the broader spot market indicates that this upward momentum may be unsustainable, making a correction inevitable.

Should a retracement occur, FLOKI could potentially see a drop back to the $0.000072 level. Therefore, while FLOKI enjoys the current wave of enthusiasm, investors should remain vigilant and consider the underlying selling pressure as a potential harbinger of a future price correction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.