|

Getting your Trinity Audio player ready...

|

The cryptocurrency market experienced a downturn today, with most top-ten coins trading in the red. However, Floki (FLOKI) faced a more significant decline, dropping nearly 17% in the last 24 hours.

The sharp decline in FLOKI’s price can be attributed to several factors, including concerns about selling activity by a wallet linked to the Floki Inu team. This wallet, which had been dormant for over two years, recently deposited $2.27 million worth of FLOKI tokens to Binance.

Bears Gain Control of FLOKI

The recent selling pressure has pushed FLOKI’s Relative Strength Index (RSI) to 22, indicating oversold conditions. This could present a buying opportunity, but traders should remain cautious as the broader market sentiment remains bearish.

The Bollinger bands have widened, suggesting increased volatility and uncertainty. While this could signal an exhaustion of the downtrend, traders should await confirmation. The RSI must form higher lows above 30 and crossover above the signal line to indicate a potential reversal.

Also Read: Floki [FLOKI] Surges 2.6% Amid Bearish Market – Key Stats Show Potential 20% Upsurge To $0.00019

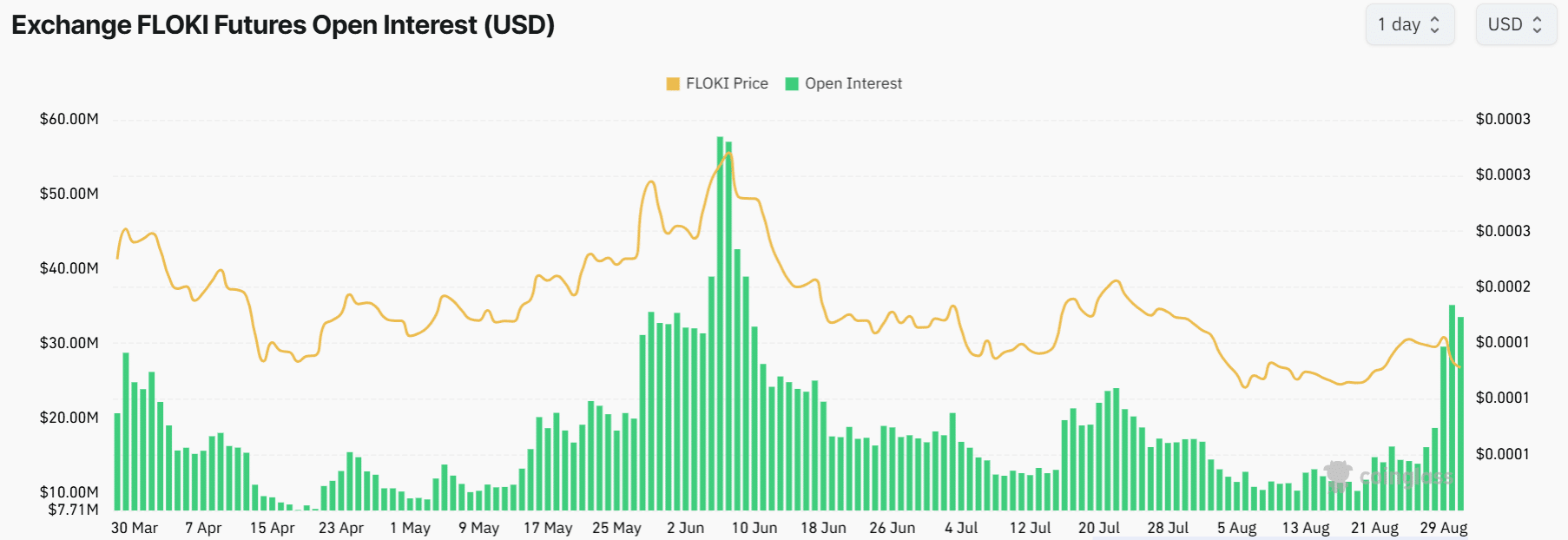

Open Interest Surges Amidst Bearish Sentiment

FLOKI’s Open Interest (OI) has soared to $33 million, its highest level since June. This surge in OI, coupled with a sharp drop in price and negative Funding Rates, suggests that traders are betting on further price declines.

The recent price drop has also led to over $408,000 in FLOKI liquidations, with a majority of the liquidated traders holding long positions. This indicates that many traders who were betting on a price increase have been caught off guard by the recent downturn.

Overall, the bearish sentiment surrounding FLOKI is evident in the price decline, the oversold RSI, the widening Bollinger bands, the surging Open Interest, and the negative Funding Rates. While there is a possibility for a short-term rebound, traders should remain cautious and monitor these indicators closely.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.