|

Getting your Trinity Audio player ready...

|

- ETHzilla sold $74.5M in ETH to repay debt and improve liquidity.

- The company is moving away from an ETH treasury-focused model.

- Future growth is tied to real-world asset tokenization and revenue generation.

ETHzilla has taken a decisive step away from its Ethereum-heavy treasury strategy, selling roughly $74.5 million worth of ETH to pay down debt and stabilize its balance sheet. The move signals a broader strategic reset as the company pivots toward revenue-focused blockchain infrastructure and real-world asset tokenization.

The December sale marks ETHzilla’s second major Ethereum liquidation in recent months and underscores a clear change in priorities: financial flexibility now outweighs long-term crypto accumulation.

Debt Reduction Takes Priority

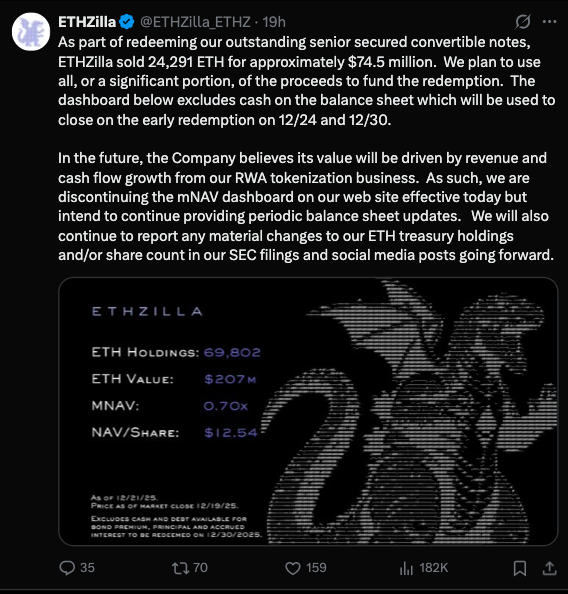

Regulatory filings show ETHzilla sold about 24,291 ETH at an average price slightly above $3,000 per token. The transaction was tied to a mandatory redemption agreement used to settle outstanding convertible notes. Following the sale, the company’s remaining Ethereum holdings dropped to around 69,800 ETH, valued at roughly $207 million at current market prices.

The decision follows an earlier ETH sale in October, when the company liquidated roughly $40 million in Ethereum to fund a share buyback. Together, the two moves highlight how ETHzilla now views its crypto holdings primarily as a liquidity buffer rather than a core long-term investment.

A Strategic Pullback From ETH Accumulation

Management has made it clear that strengthening the balance sheet is now the top priority. By using Ethereum to reduce leverage, ETHzilla is aiming to lower financial risk amid softer ETH prices and tighter capital markets.

The company has also indicated it may continue to assess funding options, including further asset sales or equity issuance, depending on future capital needs. For smaller crypto-focused firms, the shift reflects a more cautious stance as aggressive treasury strategies lose appeal in volatile market conditions.

Pivot Toward Real-World Asset Tokenization

Beyond balance sheet repair, ETHzilla is repositioning its business model. The company is now focusing on blockchain infrastructure and the tokenization of real-world assets, including loans, equipment, and real estate. Management has emphasized that future growth will be driven by recurring revenue and cash flow rather than mark-to-market gains on crypto holdings.

To support this transition, ETHzilla has added two independent directors with backgrounds in institutional investing, technology, and capital allocation, signaling a renewed focus on governance and execution.

Also Read: Bitmine’s Ether Holdings Top 4 Million ETH After Aggressive Buying Spree

Market Reaction and Broader Implications

The crypto community has largely viewed ETHzilla’s move as pragmatic rather than bearish. With ETH prices down sharply over recent months, selling assets to reduce debt is increasingly seen as balance sheet discipline, not capitulation.

ETHzilla’s $74.5 million Ethereum sale reflects a growing shift among crypto-linked firms—from accumulation toward sustainability. The real test now is whether its pivot to real-world asset tokenization can deliver consistent revenue and long-term shareholder value.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!