|

Getting your Trinity Audio player ready...

|

Ethereum (ETH) has broken its downward trend, surging past the $3,400 mark as the market reacts to political shifts in the U.S. and key developments in the blockchain space. After struggling for a week, from January 11 to 17, Ethereum’s price saw a boost, climbing to $3,406.72 at the time of writing.

This upswing in Ethereum’s price can be attributed to growing optimism surrounding the upcoming presidential inauguration of Donald Trump on January 20. Speculation is rife that Trump may sign an executive order addressing cryptocurrency policies. This order could direct all federal agencies to review their crypto regulations, with discussions hinting at suspending ongoing litigation against major players in the industry.

The broader crypto market has also benefited from these political developments. On January 16, the U.S. Securities and Exchange Commission (SEC) settled with crypto lender Abra over unregistered products, setting a positive tone for the sector. This resulted in a 3.54% uptick in the overall crypto market, according to CoinMarketCap.

Trump’s crypto-friendly stance has been further bolstered by the election of Congressman Tom Emmer as Vice Chair of the Digital Assets Subcommittee on January 15. Emmer, a vocal proponent of digital assets, is expected to influence legislation that could be more favorable to the crypto sector.

In addition to political developments, Ethereum’s price rise is also supported by the upcoming Pectra Upgrade. Announced during the Execution Layer Meeting 203, this upgrade aims to address some of Ethereum’s long-standing challenges, such as network congestion and high gas fees. By improving the consensus layer and enhancing transaction efficiency, the Pectra Upgrade is poised to lay the groundwork for greater interoperability between Ethereum’s mainnet and Layer 2 solutions.

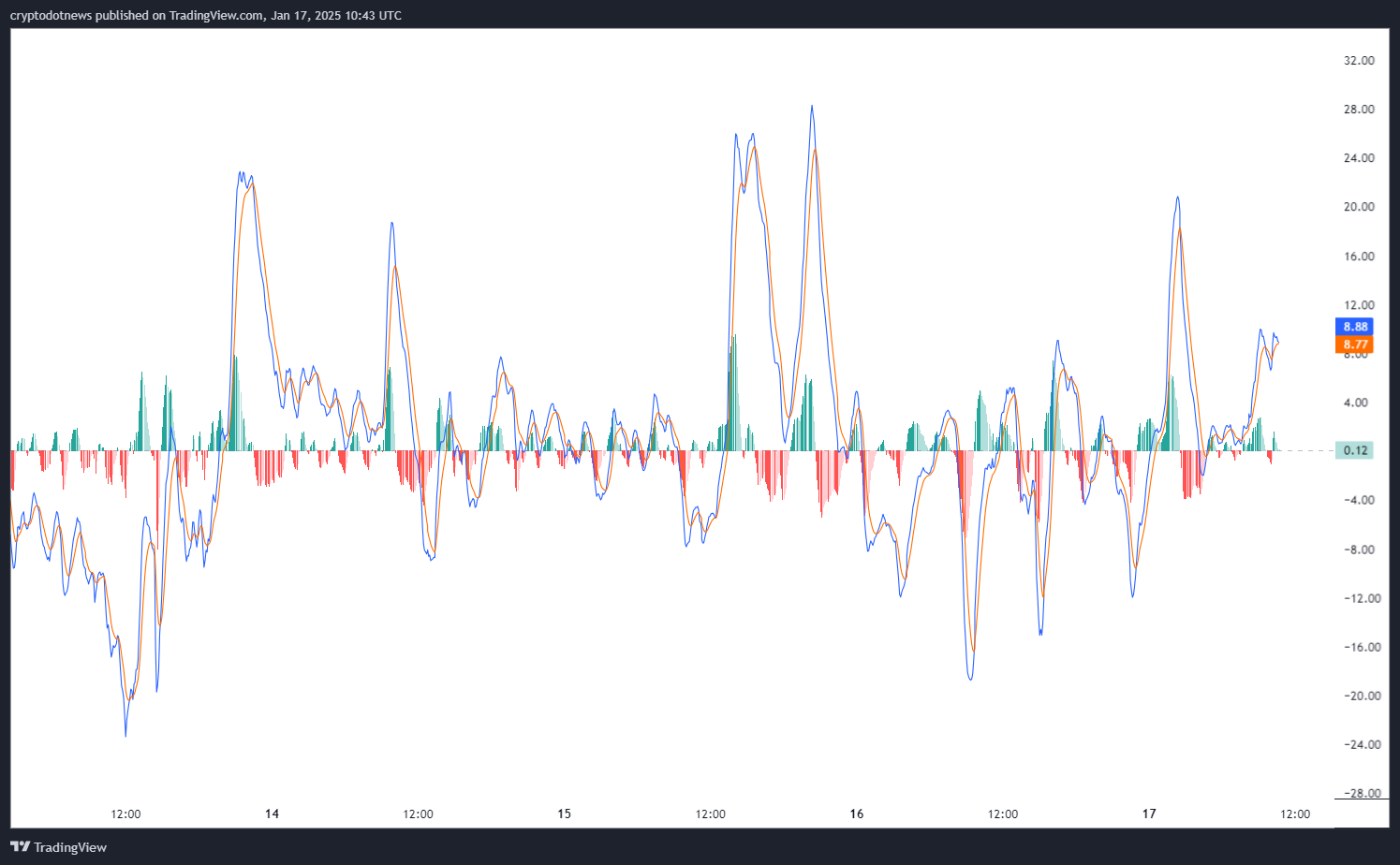

With positive signals from technical indicators like the Moving Average Convergence Divergence (MACD), Ethereum’s price could continue to rise, despite potential minor fluctuations in the short term. Strong long-term holding behavior, as indicated by the HODL Waves, shows continued investor confidence in ETH, pointing to a promising outlook for the cryptocurrency.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Struggles Below $4K as Nebula Stride (NST) Emerges as the Next Big Crypto Opportunity

Crypto and blockchain enthusiast.