At press time, Ethereum (ETH) is trading at $2,290, marking a 4% increase over the past 24 hours. The broader crypto market is experiencing bullish pressure, and ETH appears poised to extend its gains further.

ETH Sees $20 Million Spot Inflows, Signaling Bullish Sentiment

According to Coinglass, Ethereum recorded $20 million in spot inflows on Thursday, reversing a 10-day streak of continuous outflows that saw over $600 million leave the market. The shift indicates a renewed investor interest in ETH, replacing previous selling pressure with fresh buying demand.

Spot inflows suggest that more buyers are entering the market, willing to acquire ETH at current prices. This trend, combined with increasing market participation, supports Ethereum’s potential for further upside.

Rising Open Interest Reinforces Bullish Trend

Ethereum’s open interest has also surged, reaching $20 billion—an increase of 4% over the last 24 hours. Open interest measures the total number of outstanding derivative contracts, such as futures or options, that remain unsettled. A rise in open interest generally indicates an influx of capital into the futures market, reinforcing ETH’s bullish trajectory.

Technical Indicators Suggest ETH Could Target $2,361

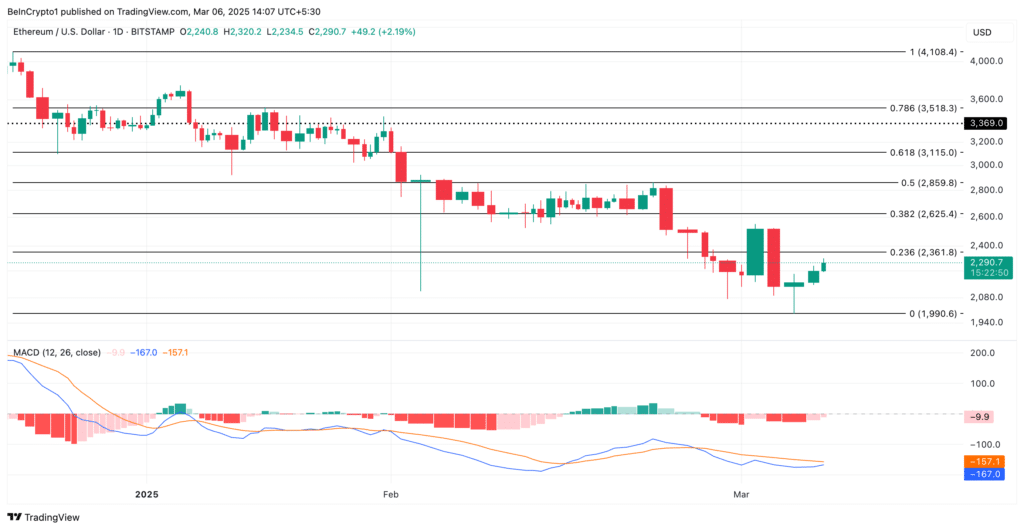

Technical analysis on the daily chart suggests further upside potential for Ethereum. The Moving Average Convergence Divergence (MACD) indicator shows the blue MACD line approaching a crossover above the signal line. This setup signals strengthening upward momentum and is often interpreted as a buy signal.

If ETH maintains its current demand trajectory, its price could climb toward $2,361 in the near term. However, in the event of a market correction, Ethereum could retrace below $2,000, testing support at $1,990.

With bullish sentiment growing, Ethereum appears set for continued gains, especially as traders anticipate Friday’s Crypto Summit. The combination of rising spot inflows, increased open interest, and bullish technical indicators suggests ETH could maintain its upward momentum in the short term. Investors should keep an eye on key resistance and support levels to navigate potential price fluctuations effectively.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Flashes ‘Undervalued’ Signal—Is a $4K ETH Comeback on the Horizon?