|

Getting your Trinity Audio player ready...

|

- ETH needs a 4% move to $4,400 to recover losses.

- On-chain metrics show rising network activity and staking.

- Institutional accumulation supports ETH’s structural uptrend.

Ethereum (ETH) is showing strong signs of bouncing back from recent market losses. A modest 4% move to $4,400 would restore ETH holders to profit, marking a critical milestone for the network and investors alike. But while short-term gains are possible, maintaining momentum toward the $5,000 mark will require more than just market optimism.

On-Chain Activity Validates Ethereum’s Strength

Fundstrat’s Tom Lee doubled down on Ethereum’s “supercycle” thesis, citing strong fundamentals across both Layer 1 and Layer 2 networks. On-chain data underlines this narrative: Ethereum’s Total Value Locked (TVL) jumped 5% to $90 billion in 24 hours, while stablecoin supply surpassed $162 billion. Total ETH staked remains near its all-time high at 36.19 million, reflecting ongoing investor conviction.

These metrics indicate liquidity is moving into yield-bearing protocols, reducing circulating supply and signaling confidence among long-term holders. Since the October crash, roughly 160,000 ETH have been staked, highlighting continued structural support for the network.

Institutional Flows Strengthen ETH Outlook

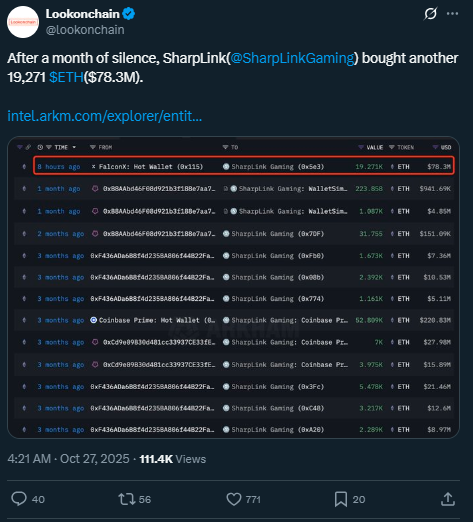

Ethereum’s market positioning is increasingly diverging from Bitcoin. ETH dominance (ETH.D) climbed 3% to 13.2% over 48 hours, while BTC dominance has faced consecutive declines. Institutional activity mirrors this trend: SharpLink (SBET) recently accumulated nearly 20,000 ETH, valuing $78.3 million, hinting at strategic confidence in ETH’s growth potential.

Rising market share, combined with tightening liquid supply, creates favorable conditions for sustained price appreciation. These converging signals suggest Ethereum is not only recovering but also preparing for a structurally bullish phase.

Ethereum’s Long-Term Structural Upside

Ethereum’s path to recovery is being driven by robust on-chain metrics, institutional accumulation, and improving macro sentiment. While short-term volatility may continue, the fundamentals now align to support a broader “supercycle,” as Tom Lee predicts. For investors, the convergence of liquidity rotation, network utilization, and strategic positioning points to sustained structural growth in ETH.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Reserves Drop to 5-Month Low as Demand Rebounds

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!