|

Getting your Trinity Audio player ready...

|

The Ethereum Foundation’s recent sale of 100 ETH for over 300,000 DAI has reignited market anxieties surrounding the organization’s ongoing asset management strategy. This transaction, identified by on-chain data provider Spot On Chain on December 10th, marks the latest chapter in a saga of periodic ETH selloffs by the non-profit.

Market Apprehensive of Continued Selling Pressure

This latest sale adds to the 4,266 ETH already offloaded by the Ethereum Foundation in 2024, generating a cumulative total of $12.21 million. The average price per ETH sold sits at $2,796, highlighting a consistent approach to managing their cryptocurrency holdings. However, the timing, nearly a month after the previous sale, has sparked concerns among market participants. The worry lies in the potential for further selloffs, which could introduce additional selling pressure on the already volatile cryptocurrency market.

Large ETH Holdings Raise Questions

Adding fuel to the fire is a previous report by CoinGape, which revealed the Ethereum Foundation’s sizable treasury. With a reported $970.2 million in assets, the vast majority (99.45%) is held in Ethereum. This substantial ETH holding raises a crucial question: could the Foundation decide to capitalize on a potential bull market by selling more ETH, further impacting the asset’s price?

ETH Price Fluctuations and Market Sentiment

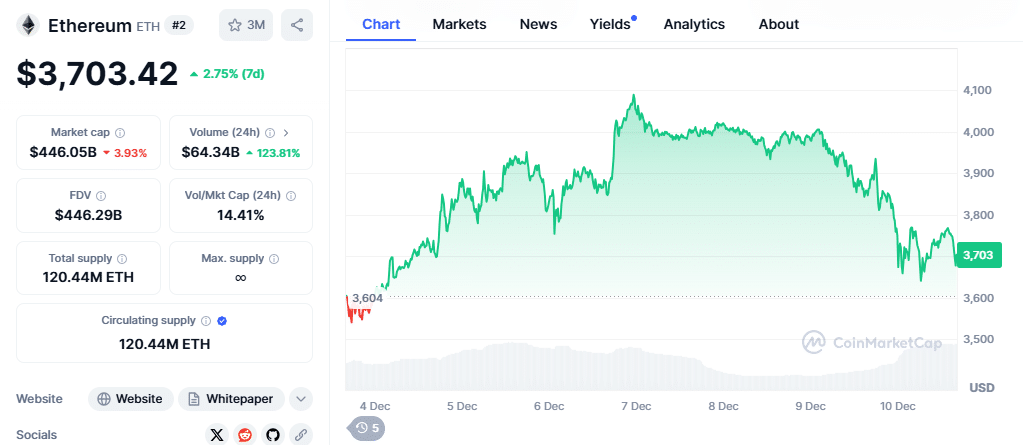

The recent ETH selloff coincides with a slight decline in the cryptocurrency’s price. At the time of writing, ETH is down nearly 3%, trading at $3,752. While this dip could be coincidental, the timing raises eyebrows. It’s important to note that despite the recent drop, ETH has experienced significant gains in the broader timeframe, with a 4% and 17% increase observed in monthly and weekly charts, respectively. This positive trend leaves market watchers questioning whether further Ethereum Foundation selloffs are imminent as the price continues to climb.

Investors remain cautious regarding the future direction of ETH. This apprehension is further amplified by bearish technical indicators identified in recent Ethereum price analyses. While crypto enthusiasts eagerly await any significant price movements, the market braces for potential volatility as the Ethereum Foundation’s asset management strategy continues to unfold.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.