|

Getting your Trinity Audio player ready...

|

The world’s second-largest cryptocurrency, Ethereum (ETH), has managed to stay afloat above the crucial $3,000 mark. After a strong first quarter, investors remain hopeful for an upward price swing. However, recent developments within the Ethereum ecosystem paint a mixed picture.

Ethereum Network Activity Slumps

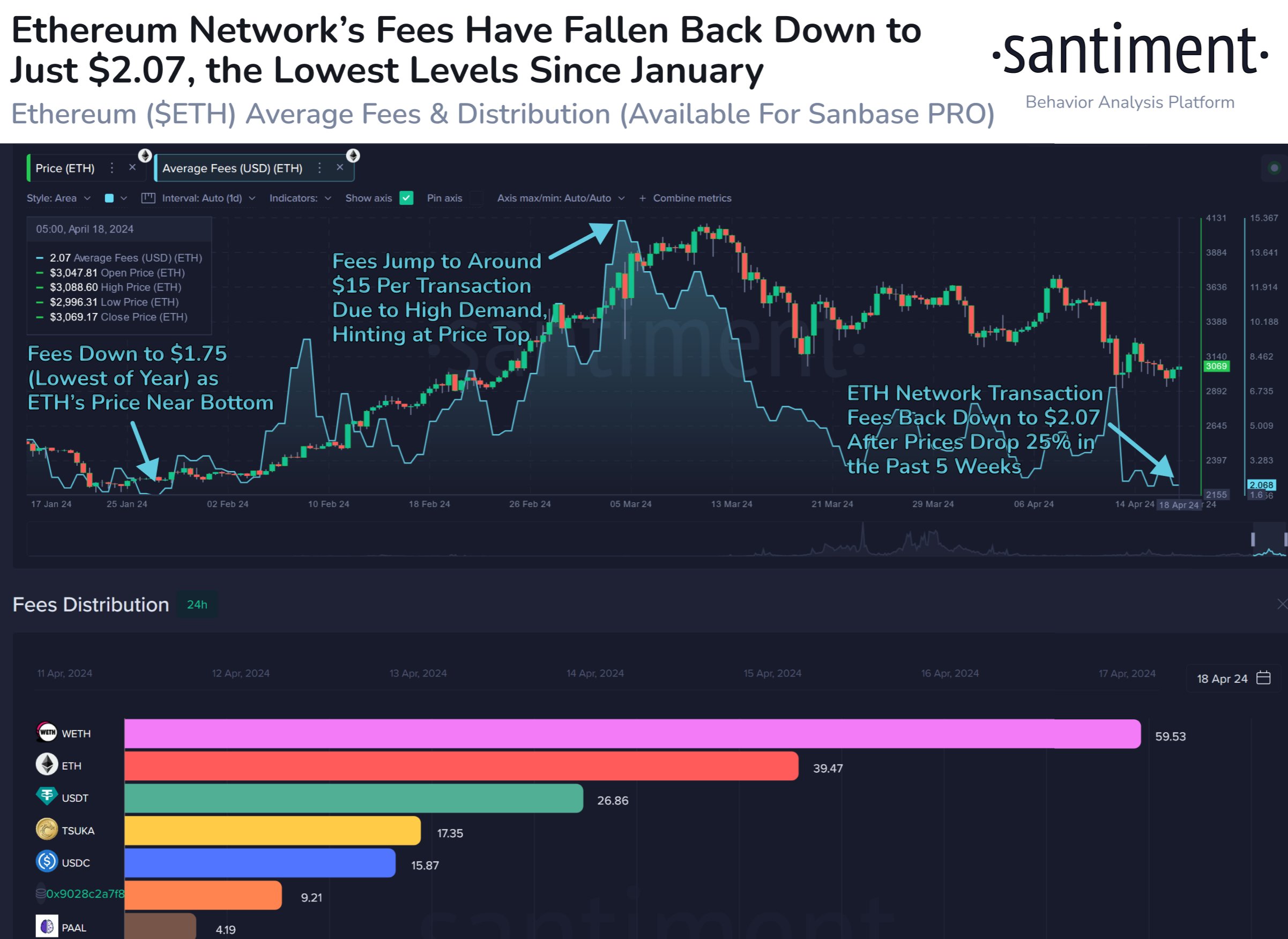

A key concern is the significant decline in Ethereum’s transaction fees, currently at a rock-bottom $2.34 – an 84% drop from its 2024 peak of $15. This data, courtesy of Santiment, points towards reduced user activity. Artemis’ data confirms this trend, revealing a 7% drop in daily unique addresses interacting with Ethereum over the past month. Daily transaction count has also fallen by 14% in the last 30 days, with only 1.2 million transactions completed on April 17.

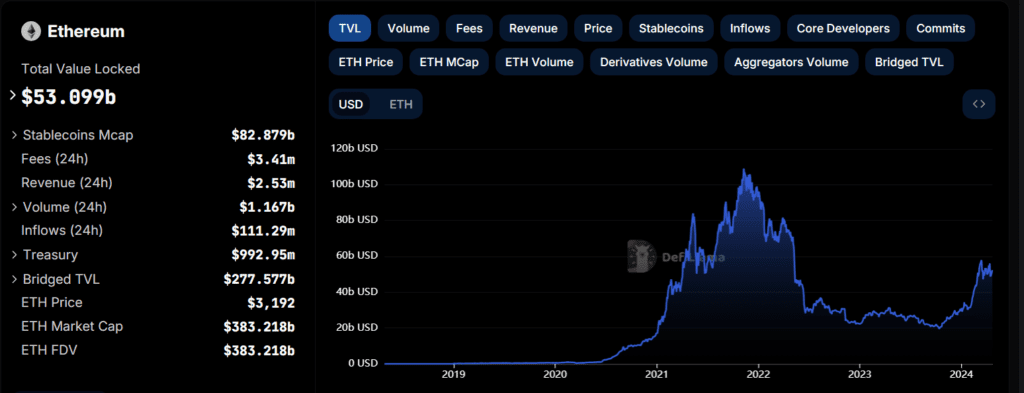

This user activity slump has impacted Ethereum’s vibrant NFT and DeFi sectors. CryptoSlam reports a staggering 57% decline in NFT sales volume on the Ethereum network in the past month, reaching just $288 million. Similarly, DefiLlama indicates a 14% drop in Ethereum’s Total Value Locked (TVL) in DeFi – currently at $49 billion – from its 2024 peak of $57 billion.

Ethereum Price Under Pressure

The decline in network activity has resulted in an inflationary situation for Ethereum. With more ETH coins entering circulation, the price faces downward pressure. As of writing, ETH is trading at $3,052, down 0.73%, with a market cap of $367 billion. Daily trading volumes have also dipped by 31% to $13.84 billion.

Looking for Signs of a Price Rebound

Despite the current slowdown, Santiment suggests the recent drop in fees might be a sign of a potential price bottom. Here’s where the “Age Consumed” metric comes into play. This metric tracks the movement of previously inactive ETH coins.

Age Consumed: A Key Indicator for Price Movement: An increase in ETH’s Age Consumed signifies that long-dormant coins are being reactivated, potentially indicating a shift in long-term holder behavior. Conversely, a decrease suggests these coins remain idle. This metric is crucial for identifying market bottoms and tops, as long-term holders typically avoid moving their coins during downturns.

Also Read: Ethereum’s Vitalik Buterin Champions Online Privacy as Facial Recognition Tech Spreads

According to Santiment, a significant uptick in ETH’s Age Consumed on April 18 offers a glimmer of hope. This movement could indicate that a bottom may have been reached, paving the way for a future price rally. However, close monitoring of both network activity and the Age Consumed metric is essential to confirm this possibility.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.