|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- ETH has surged nearly 16% in a week, recently crossing the $3,000 mark before a slight correction.

- Staking ETF approval, expected by October, could turn ETH into a yield-bearing institutional product.

- Post-Merge supply dynamics hint at a possible Ethereum supply shock, supporting bullish price targets like $10,000.

Ethereum (ETH) has surged in recent days, breaking the long-awaited $3,000 resistance before experiencing a minor pullback. As excitement builds around Ethereum’s next leg up, analysts are making bold predictions, with one forecasting a price jump to $10,000, fueled by upcoming ETF approvals and a potential supply crunch.

ETH Surges Past $3K Before Brief Pullback

Ethereum saw an impressive 15.8% gain over the past week, recently trading around $2,969, according to CoinMarketCap data. The rally comes on the heels of Bitcoin hitting new all-time highs, dragging the broader crypto market upward. However, a 3% dip in the past 24 hours suggests some traders are taking profits ahead of what could be a volatile week.

This surge is seen as Ethereum’s attempt to catch up after lagging behind Bitcoin in earlier phases of the 2025 bull market.

Ethereum Staking ETF Could Be Game-Changer

Market analyst and MJ Capital founder Eric Jackson believes ETH is poised for a dramatic upward move, forecasting a price target of $10,000. According to Jackson, the key catalyst lies ahead — the approval of Ethereum staking ETFs, expected before October.

“Once that hits, ETH becomes the first yield-bearing crypto ETF in U.S. history,” said Jackson.

The staking ETF would allow investors to earn passive yields, increasing Ethereum’s attractiveness in traditional finance. Coupled with ETH’s post-Merge deflationary supply model, demand may significantly outpace new issuance, potentially creating a supply shock.

In my view, and the view of our model at @EMJCapital ETH is going to $10,000.

— Eric Jackson (@ericjackson) July 13, 2025

And almost no one understands why.

Here’s what our model sees coming — and why the next leg up could catch everyone off guard 👇

Ethereum Supply Shock May Be Imminent

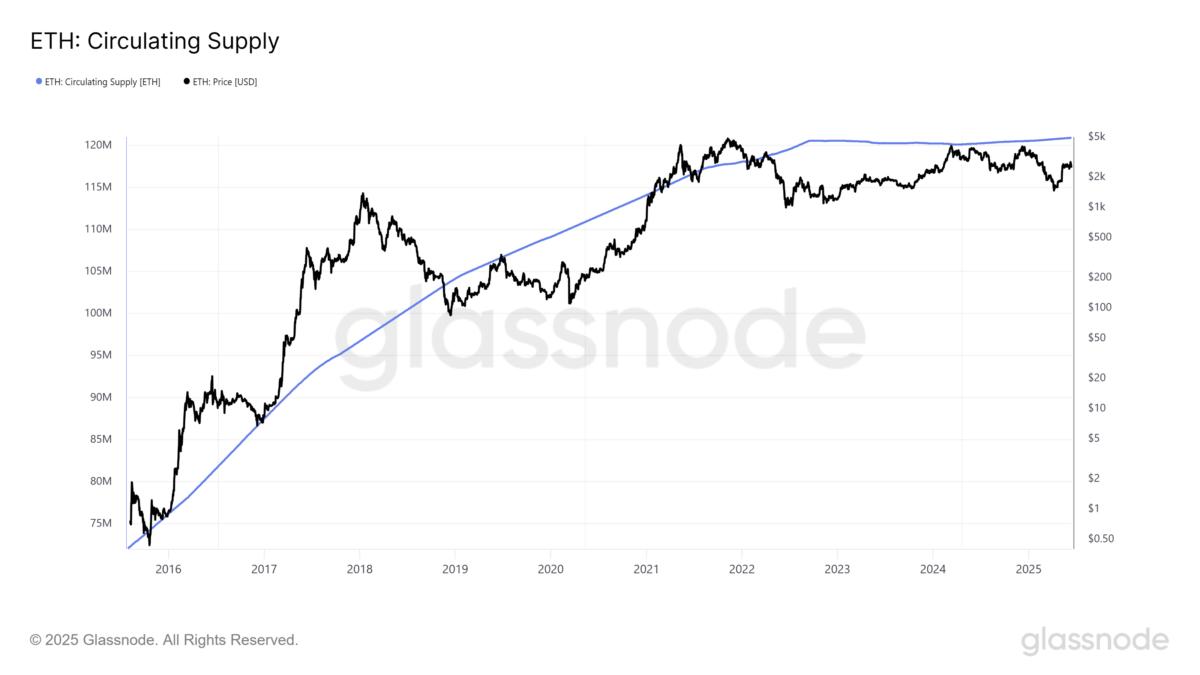

Since the Merge upgrade in 2022, Ethereum’s net issuance has become negative, effectively reducing the available circulating supply. Currently, ETH’s market supply stands at 120.71 million, with a steady pace of token burning continuing to reduce supply.

Jackson argues this deflationary trend, combined with new ETF-driven demand, could lead to a structural supply crunch — a scenario that might justify a $10,000 ETH valuation.

Also Read: Institutional ETH Inflows Hit 12-Week Streak as Ethereum Treasuries Surge Past 545K ETH

“Our analysis suggests the ETH network is underpriced… it’s no longer just digital oil, it’s an institutional-grade yield product,” Jackson added.

While Ethereum’s price has cooled slightly after its latest rally, the underlying fundamentals — rising institutional interest, ETF momentum, and a shrinking supply — suggest strong bullish potential in the months ahead. Analysts believe a $10,000 ETH might not be as far-fetched as it sounds, especially if the staking ETF receives approval and broader investor adoption follows.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.