|

Getting your Trinity Audio player ready...

|

Ethereum, the world’s second-largest cryptocurrency, is facing headwinds as network activity dwindles. Recent data reveals a significant decline in Ethereum’s fees and active addresses, raising concerns about the network’s health.

IntoTheBlock’s findings show that Ethereum fees have hit a nine-month low, with gas fees plunging to just 1 gwei. Surprisingly, despite the reduced fees, the blockchain continues to generate substantial revenue, ranking as the top crypto in terms of revenue over the past six months, according to Token Terminal.

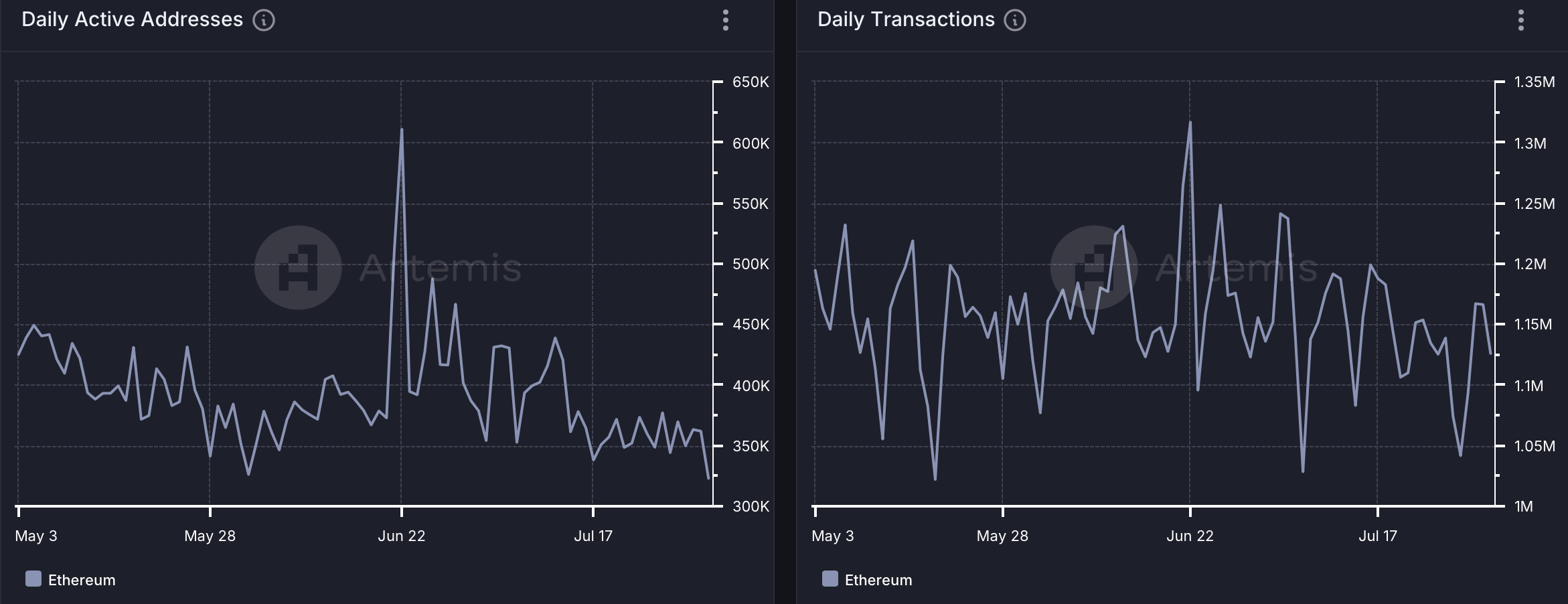

However, the decline in fees is accompanied by a drop in daily active addresses, indicating decreased user activity on the network. This trend is mirrored by a slight decline in daily transactions.

The correlation between network activity and price is evident as Ethereum’s value has plummeted by over 9% in the past week. While the bearish sentiment is prevalent, there are some glimmer of hope. Lookonchain’s identification of a smart money buyer with a perfect track record and Glassnode’s data suggesting Ethereum is undervalued could signal a potential price rebound.

Additionally, the whale vs retail delta metric indicates that large investors are maintaining their bullish stance on Ethereum. This could be a positive sign for the token’s future performance.

Also Read: Ethereum Crashes 6% Amidst Recession Fears, Schiff Predicts Further Drop To $2,000

Despite these indicators, the overall market sentiment remains bearish, and Ethereum’s price trajectory remains uncertain.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.