|

Getting your Trinity Audio player ready...

|

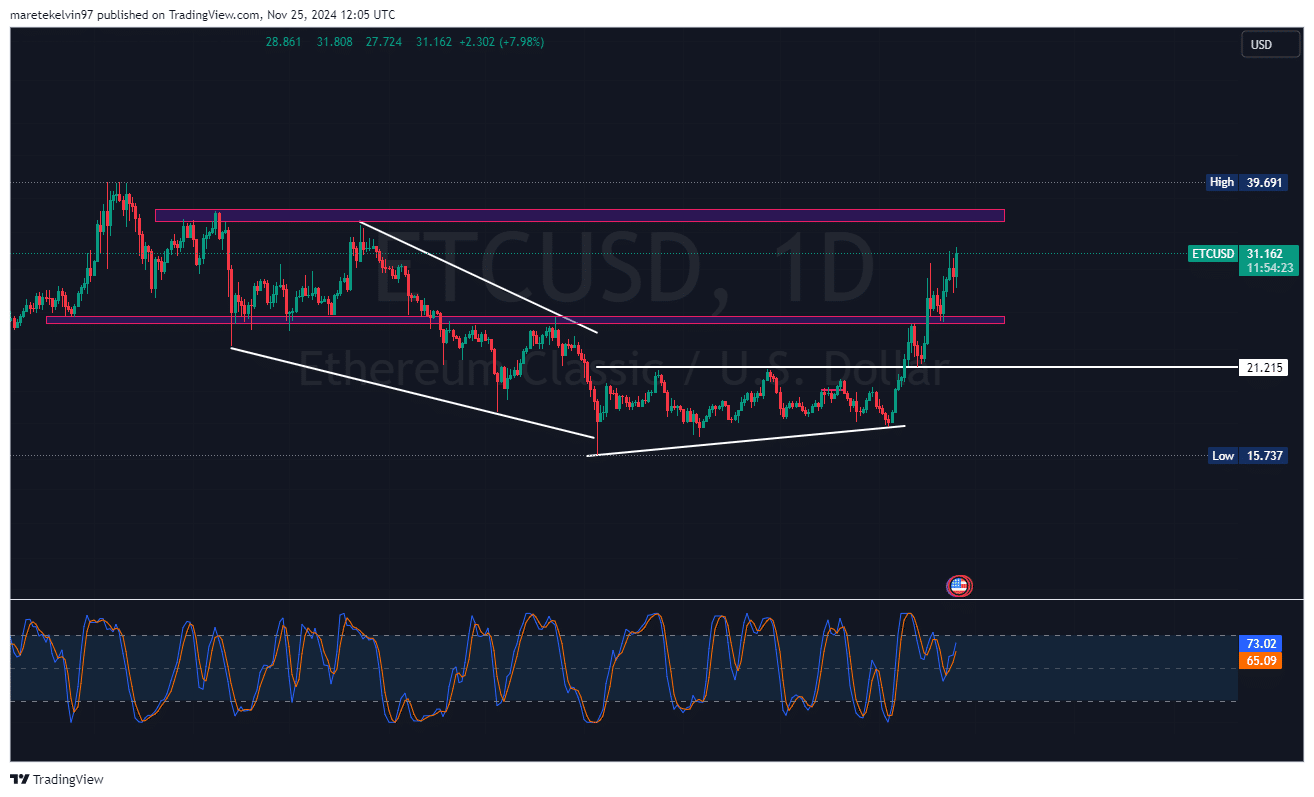

Ethereum Classic (ETC) has recaptured investor attention, staging an impressive rally that has propelled its price upwards by over 10% in the past 24 hours. This surge has positioned the altcoin within striking distance of the critical $35 resistance level, sparking speculation about its potential trajectory in the near future.

Bullish Momentum Gathers Pace

After a brief correction to the $25 support level, ETC has staged a remarkable recovery, rallying over 23% to its current trading price of $31. This decisive breakout and subsequent consolidation above the $25 support level suggest that bullish sentiment has regained control of the market.

Whale Activity and Social Engagement Fuel the Rally

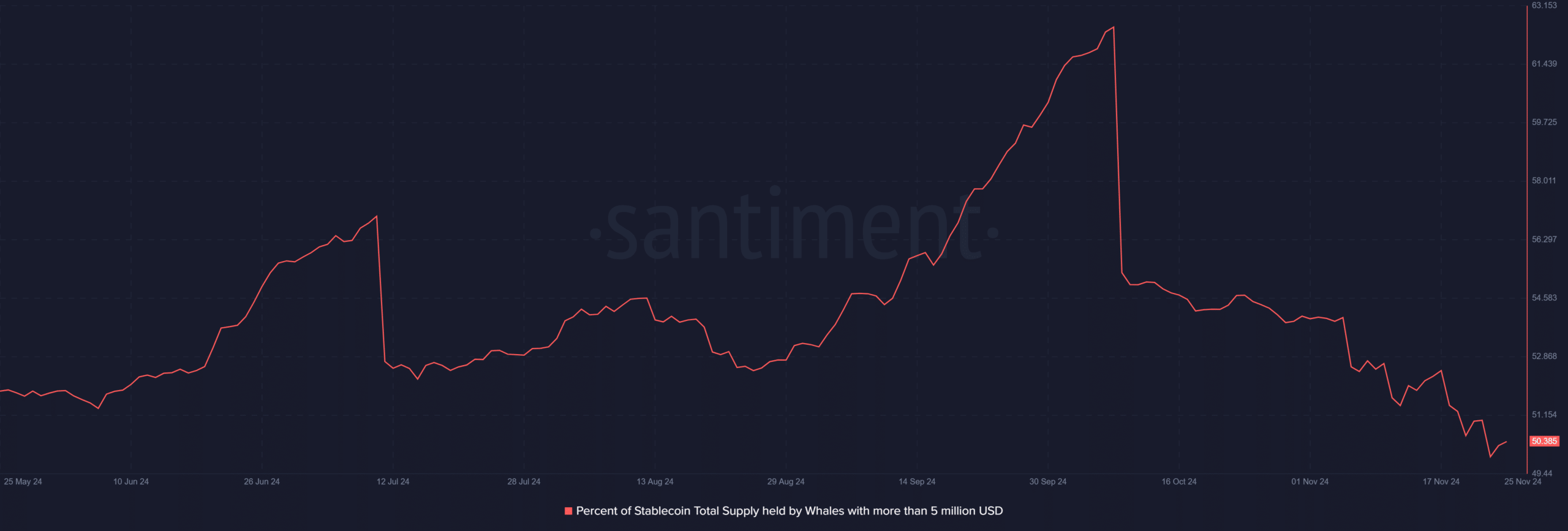

According to data from Santiment, a significant shift in whale behavior has been observed. Large holders have been actively accumulating ETC, as evidenced by a recent spike in their holdings. Additionally, the percentage of stablecoin total supply held by whales with over $5 million USD has surged in the past 24 hours, indicating strategic positioning by major market players.

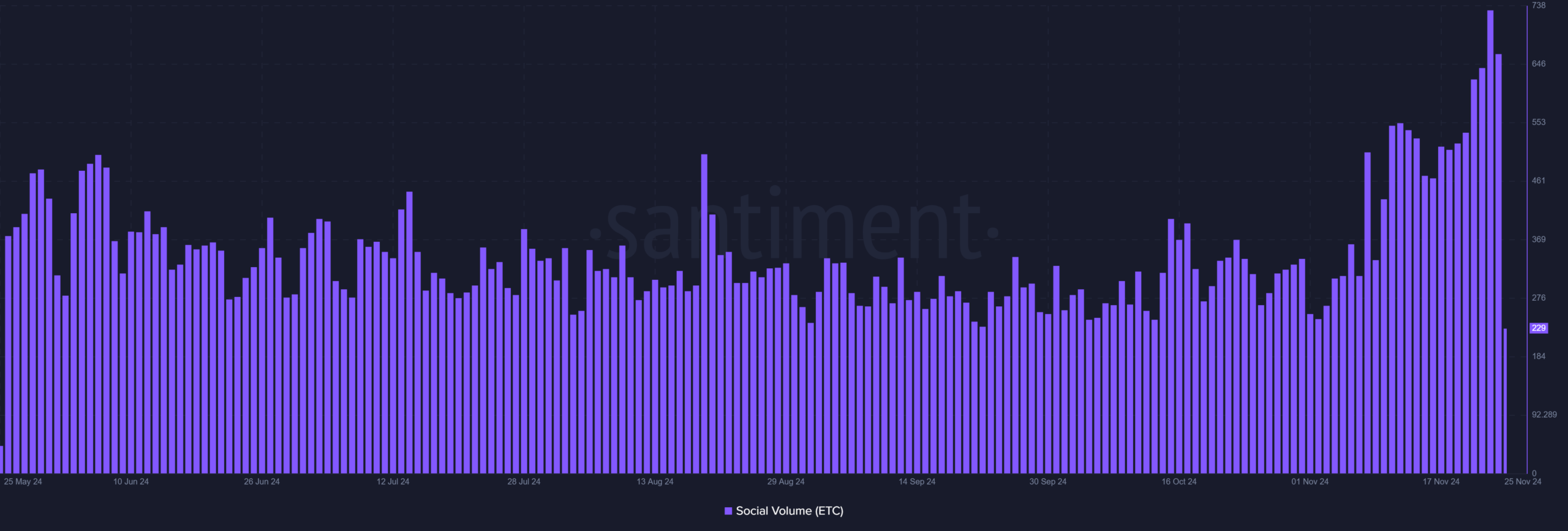

The growing retail interest in ETC is further reflected in the surge in social volume, which has reached its highest levels since May 2024. Historically, increased social engagement has often preceded significant price movements, and ETC appears to be following this trend. The rising social volume could be a precursor to a potential incoming rally.

Technical Outlook and Price Targets

The immediate resistance level at $35 poses a crucial psychological barrier for ETC. A successful breach of this level could trigger a wave of buying pressure, potentially propelling the altcoin towards higher resistance levels.

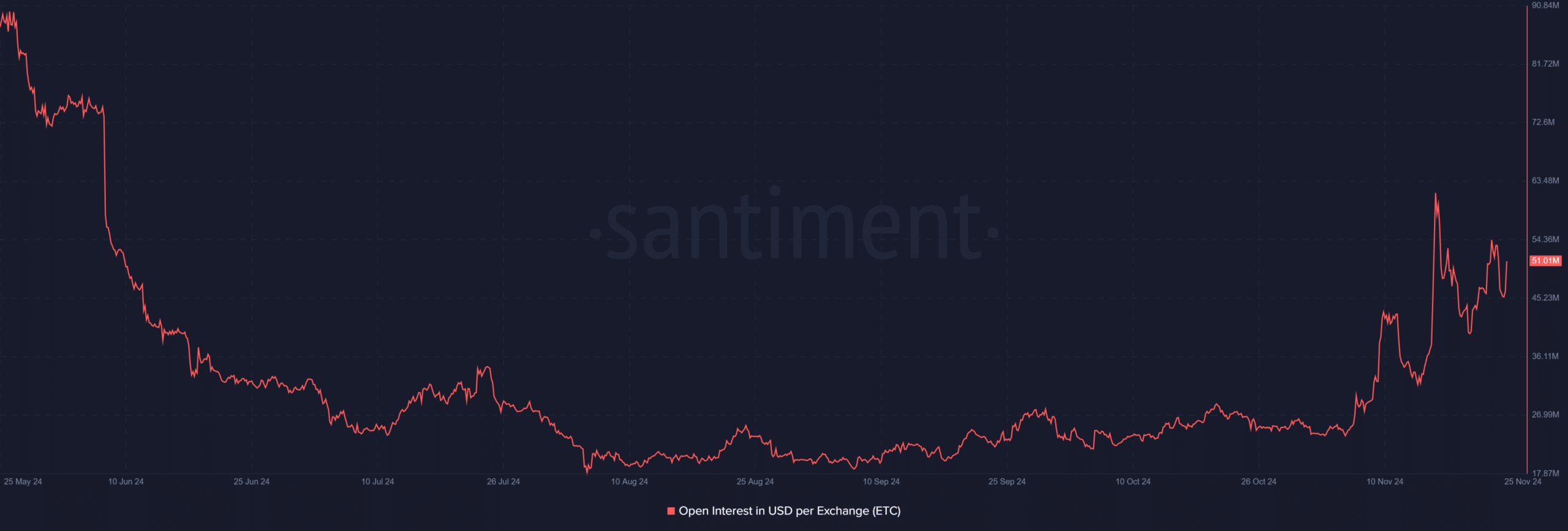

2The continuation of the current bullish rally will likely depend on broader market conditions and sustained institutional interest. However, the uptick in Open Interest in USD per Exchange suggests a supportive market structure for further gains.

As Ethereum Classic continues to gain momentum, investors and traders are closely monitoring its price action and technical indicators to capitalize on potential opportunities.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.