|

Getting your Trinity Audio player ready...

|

The cryptocurrency market continues to face bearish pressure, with top-tier coins like Bitcoin, Ethereum, and Solana experiencing significant declines. Amidst this downturn, Ethena (ENA) has also faced selling pressure, with whales dumping a notable 22 million ENA tokens, valued at $6.9 million, onto Binance.

Whale Activity Raises Concerns

On-chain analytics firm SpotOnChain revealed that these whales unstaked ENA from various exchanges between April and August 2024. Despite buying the dip in both July and August, the whales ultimately decided to sell their ENA holdings, potentially signaling a bearish outlook for the token.

Another Ethena whale, identified by the wallet address 0x0A7, also dumped 6.49 million ENA worth $1.65 million onto Binance, incurring a loss of $1.96 million.

Data from IntoTheBlock indicates that ENA could be easily manipulated due to its highly concentrated ownership. Eight whales hold a staggering 90.09% of Ethena’s total supply, while 22 sharks own 6.55%. This leaves retailers with only 3.36% of the total supply, making ENA a potentially risky investment.

Key Liquidation Levels and Price Action

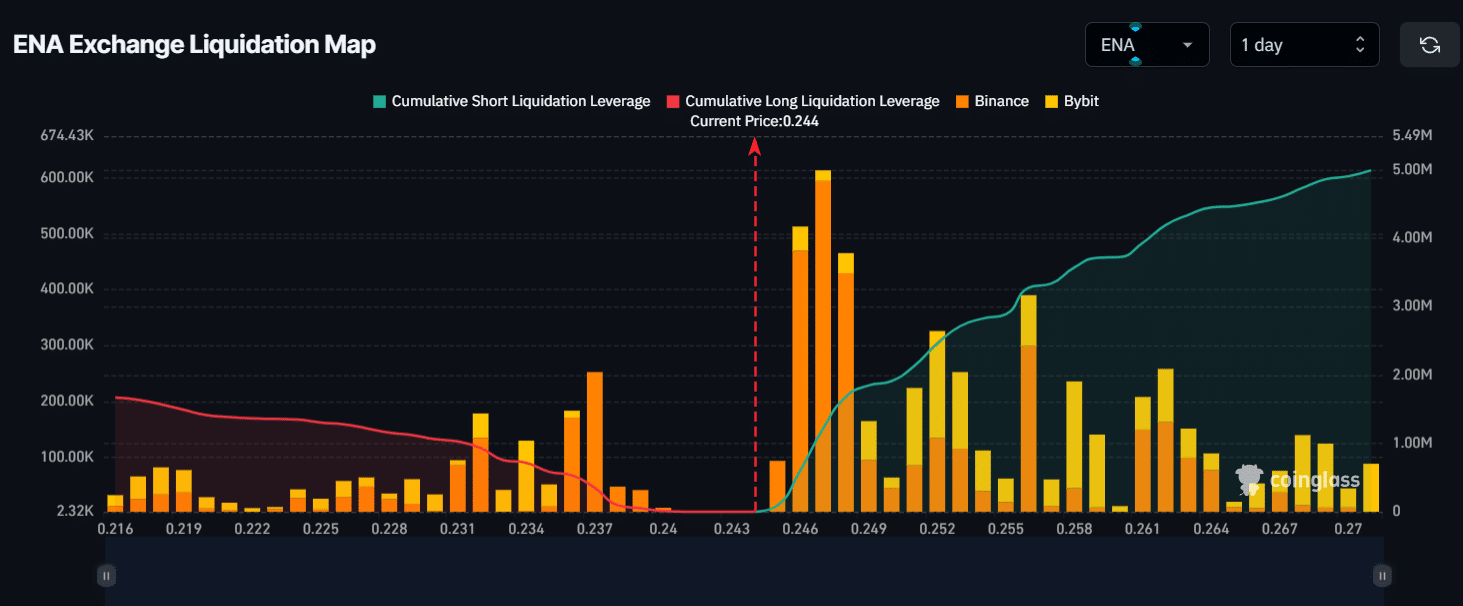

Coinglass data reveals that the major liquidation levels for ENA are near $0.232 on the lower side and $0.260 on the upper side. Traders who have over-leveraged at these levels could face liquidation if the price moves in their unfavorable direction.

At press time, ENA was trading near $0.2288, having experienced a price drop of over 10% in the last 24 hours. The trading volume and Open Interest for ENA have also declined, indicating lower participation and potential liquidation fears.

The decline in ENA’s price is part of a broader market downturn. Bitcoin, Ethereum, and Solana have also experienced price declines, indicating a general bearish sentiment in the cryptocurrency market.

Also Read: Shiba Inu Community Rallies as 96 Million SHIB Tokens Burned in Single Transaction

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!