|

Getting your Trinity Audio player ready...

|

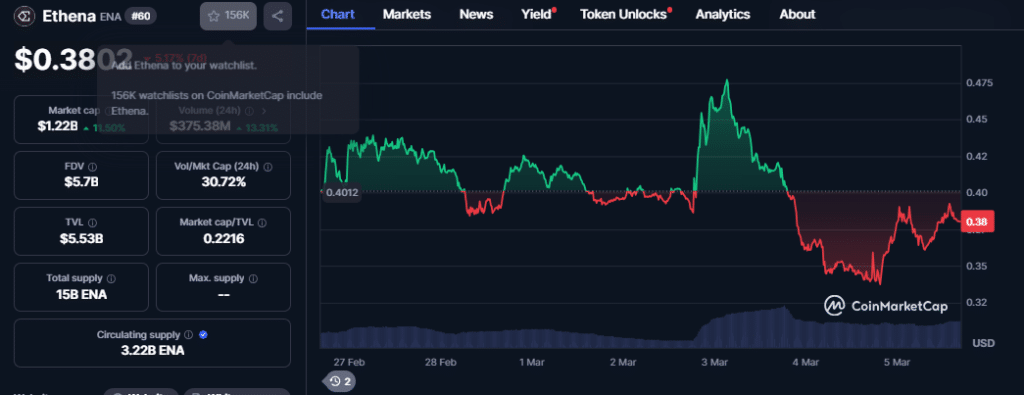

On March 5, 2025, at 14:30 UTC, three wallets associated with the Ethena team transferred 38.36 million $ENA tokens—worth approximately $14.4 million—into Binance (Source: Lookonchain, 2025). This substantial deposit, executed within a short timeframe, suggests a potential sell-off or strategic token redistribution. Data from blockchain explorer Intel.arkm.com confirms that the transfers originated from three distinct addresses.

The market responded swiftly to this event. The price of $ENA dropped by 3.5%, from $0.375 to $0.362, within 15 minutes of the deposits (Source: CoinGecko, 2025). Trading volume on Binance surged by 20% during this period, reflecting heightened market interest and a possible increase in selling pressure (Source: Binance Trading Data, 2025). Large token transfers like this often influence market sentiment and price trends, as seen in previous cases within the cryptocurrency space (Source: CryptoQuant, 2025).

Market Implications and Trading Activity

The immediate drop in $ENA’s price suggests that investors interpreted the deposit as a bearish signal, potentially indicating an impending liquidation by the Ethena team (Source: CoinGecko, 2025). If additional investors follow suit, $ENA may experience further downward pressure. Binance’s trading volume reflected this heightened activity, with 5.2 million $ENA exchanged within the hour following the transfer (Source: Binance Trading Data, 2025).

Moreover, open interest on Binance Futures for the $ENA/USDT pair increased by 15%, highlighting traders positioning for potential price swings (Source: Binance Futures Data, 2025). Other trading pairs involving $ENA, including $ENA/BTC and $ENA/ETH, recorded declines of 2% and 1.5%, respectively, during the same timeframe (Source: CoinGecko, 2025).

Technical Analysis and On-Chain Metrics

Technical indicators further illustrate market shifts post-deposit. The Relative Strength Index (RSI) for $ENA on Binance declined from 65 to 58 within 30 minutes, suggesting a transition from an overbought condition to neutral territory (Source: TradingView, 2025). Additionally, the Moving Average Convergence Divergence (MACD) exhibited a bearish crossover, reinforcing the negative market sentiment.

On-chain metrics revealed a 10% increase in active $ENA addresses within an hour of the deposit, indicating heightened network activity and potential panic selling (Source: CryptoQuant, 2025). However, Ethena’s total value locked (TVL) remained stable at $200 million, signifying that the project’s fundamental value remains intact despite short-term price fluctuations (Source: DeFi Llama, 2025).

Broader AI Market Correlation

While no direct AI-related developments impacted $ENA, broader AI market sentiment played a role in crypto volatility. Notably, AI token $FET saw a 5% increase in trading volume on March 4, 2025, following an AI model announcement (Source: CoinGecko, 2025). This suggests that traders should monitor AI advancements, as they could influence crossover markets, including AI-linked cryptocurrencies like $ENA (Source: CryptoQuant, 2025).

Also Read: Ethena (ENA) Price Surge: Whale Accumulation Signals Potential 65% Rally

As the market digests this large-scale $ENA transfer, traders will closely watch further wallet movements and potential liquidation trends, while AI developments remain an indirect but relevant factor in crypto market dynamics.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!