|

Getting your Trinity Audio player ready...

|

Ethena (ENA) has witnessed a significant price upswing over the past week, gaining strong bullish traction. The altcoin surged from a local low of $0.25 to a recent high of $0.35, marking an 8.04% increase on the weekly chart. At the time of writing, ENA is trading at $0.3342, with a daily gain of 6.67%.

Despite a 3.54% dip on the monthly timeframe, ENA’s recent momentum has shifted market sentiment. According to prominent crypto analyst Ali Martinez, the token is currently forming an inverse head and shoulders pattern—a classic bullish indicator. Martinez believes a breakout from this formation could propel ENA toward the $0.39 mark. Historically, this setup has proven profitable for Ethena; in December 2024, a similar breakout led to a surge from $0.90 to $1.32.

#Ethena $ENA looks to be breaking out of an inverse head and shoulders pattern, potentially setting the stage for a move toward $0.39. pic.twitter.com/IwUGIWuVIB

— Ali (@ali_charts) April 13, 2025

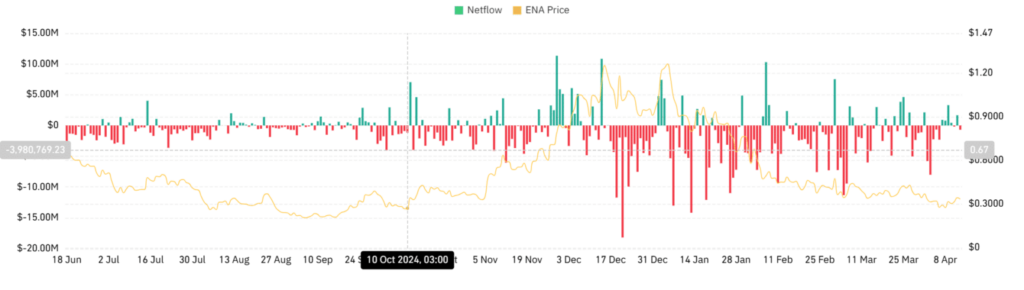

Market data further supports the bullish outlook. AMBCrypto reports a strong return of buyers, reflected by negative Spot Netflow, currently at -693.2k. Negative Netflow indicates more tokens are leaving exchanges than entering, typically a sign of accumulation by investors.

Futures data adds weight to the bullish narrative. Ethena’s futures buy volume jumped to 173.72 million tokens in the past 24 hours, indicating aggressive long positioning. Concurrently, Aggregated Open Interest climbed from $262 million to $278.2 million, signaling that new positions are being opened as traders anticipate further upside.

Adding to the optimism, Coinalyze data shows a positive Aggregated Funding Rate, confirming the dominance of long positions in the market.

Also Read: Ethena (ENA) Faces 16% Drop Ahead of Upcoming $52M Token Unlock: What’s Next for the Price?

As bullish momentum builds, all eyes are on the $0.37 resistance level. A successful breakout could pave the way for ENA to target $0.39 in the near term. However, should momentum wane, a temporary pullback to $0.30 remains a possibility.

For now, Ethena appears to be riding a wave of renewed investor confidence, with the charts pointing toward a potential breakout that could define its short-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!