|

Getting your Trinity Audio player ready...

|

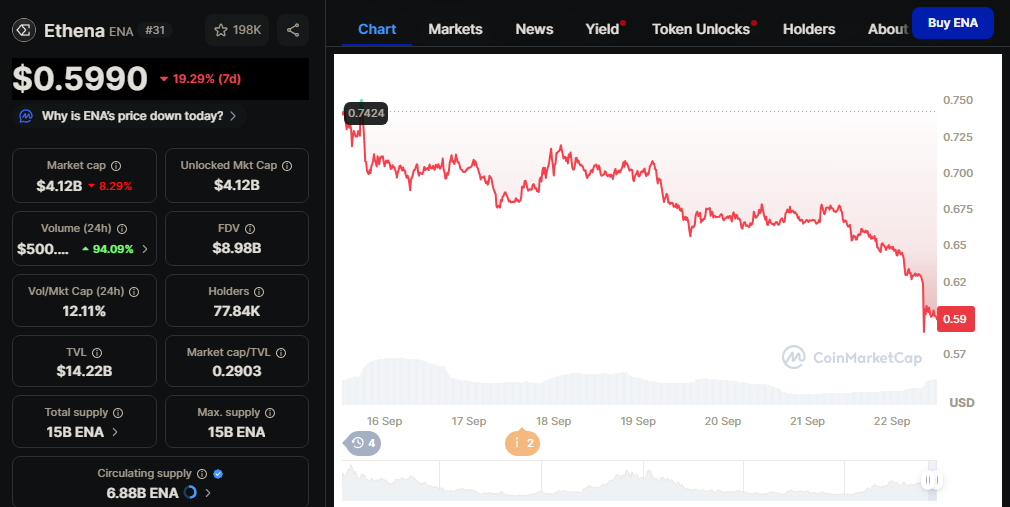

- ENA price fell 1.6% as volume shrank and selling pressure rose.

- Institutional investors remain bullish, with record $13.8B TVL.

- Technicals suggest risk of breakdown, but fundamentals remain strong.

Stay ahead with real-time updates and insights—Join our Telegram channel!

The cryptocurrency market appears set for a broad correction this week, with most altcoins trading lower. Ethena’s ENA token is no exception, slipping around 1.6% in the past 24 hours, while trading volume dropped sharply. Yet, beneath the short-term weakness, ENA’s fundamentals continue to show resilience.

Institutional Support vs. Retail Selling

Data from Nansen AI highlights the split between institutional and retail sentiment. Smart Money wallets increased holdings by 4.48%, while prominent individuals added 1.68%. In contrast, whales trimmed positions by 3.43%, and exchanges cut holdings by a steep 17.45%.

Despite this divergence, Arca maintained a $4.57 million ENA position, reflecting long-term conviction. The token also reached a new high in Total Value Locked (TVL), hitting $13.88 billion with $151 million in fresh inflows — clear evidence that institutional appetite for ENA remains intact.

Rising Network Activity and Rewards

Beyond capital flows, on-chain activity paints a bullish picture. Active addresses have climbed to 32,000, while Ethena’s yield rewards are now at their highest since March. The monthly APY of 0.072 continues to attract demand, supporting usage and staking growth.

These fundamentals have underpinned ENA’s upward trend since July, though price action has turned flat since mid-August.

Why ENA’s Price is Struggling

Technical analysis shows a possible double-top pattern, with the $0.60 support level now under pressure. If it breaks, $0.50 could be the next key zone to watch.

TradingView data revealed shrinking volume since September 11, coinciding with $5.4 million in ENA moved to centralized exchanges — likely for profit-taking. This sparked short-term selling pressure, pushing the Funding Rate into negative territory at -0.0046%.

However, exchange netflows are easing, which could allow buyers to regain control if sellers run out of momentum.

While short-term price weakness has raised questions, ENA’s fundamentals — strong institutional backing, growing adoption, and record TVL — remain positive. If selling pressure subsides, ENA may be positioned for a recovery once broader market conditions stabilize.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethena (ENA) Price Falls 13% Despite Record $13.8B TVL and Surging On-Chain Activity

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!