|

Getting your Trinity Audio player ready...

|

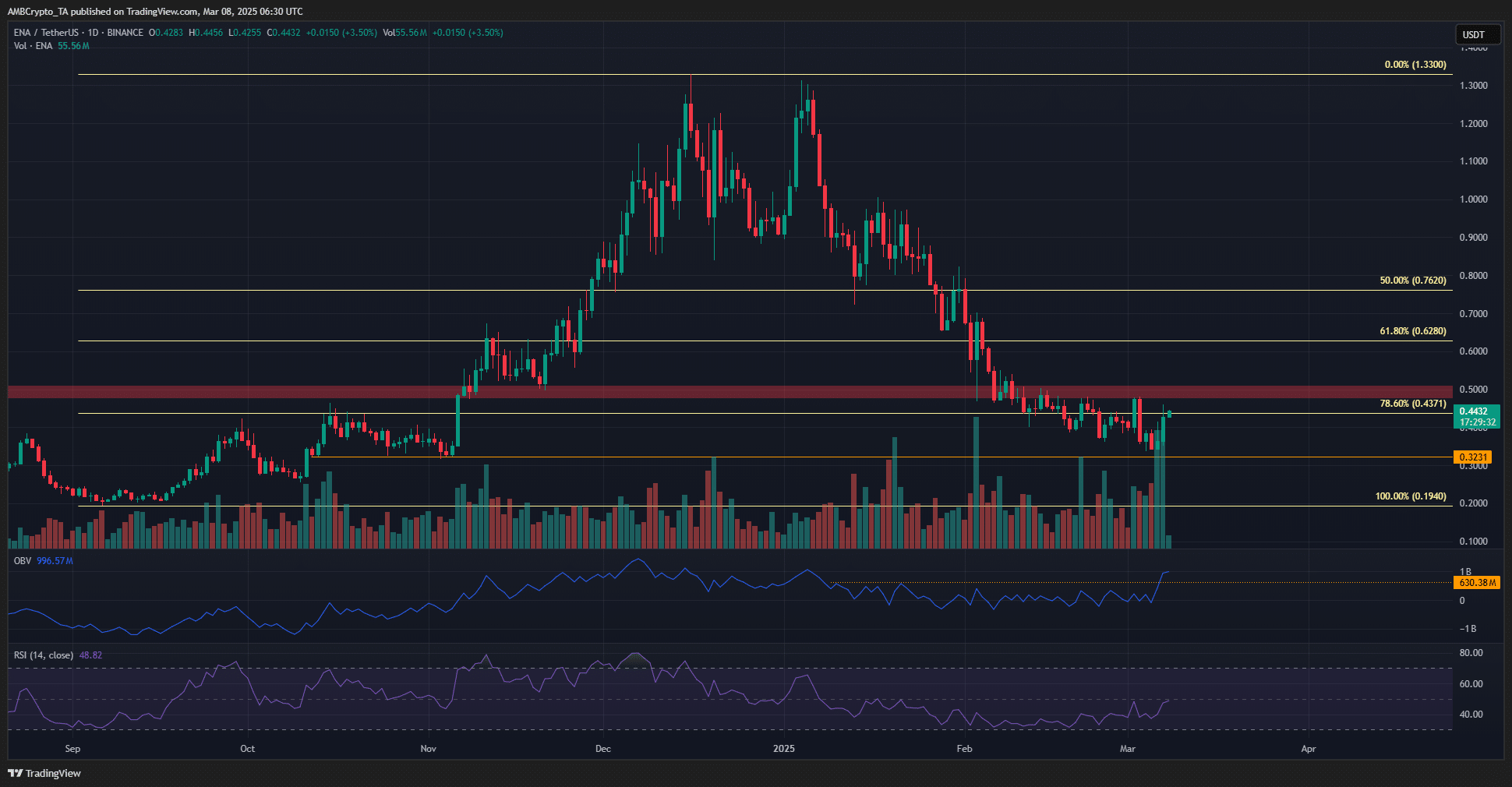

Ethena’s (ENA) price tumbled below the $0.5 support zone in February, but recent market movements indicate a possible halt in its decline. A new range formation below the $0.5 resistance level has emerged, presenting traders with potential profit-making opportunities. However, with Bitcoin’s (BTC) volatility still in play, the trajectory of ENA remains uncertain heading into the weekend.

Bulls Gaining Strength?

Analyzing the daily chart, ENA’s market structure remains bearish. The token has consistently formed lower highs and lower lows throughout 2025. The last recorded lower high was at $0.48, and a daily close above this level could indicate a potential shift in market sentiment.

Trading volume has surged over the past few days, as reflected by the volume bars beneath the price chart. This influx of activity pushed the On-Balance Volume (OBV) above its local highs from the past two months, hinting at growing buying pressure. Meanwhile, the Relative Strength Index (RSI) was testing the neutral 50 level, suggesting a potential momentum shift in favor of the bulls.

Key Resistance and Range Formation

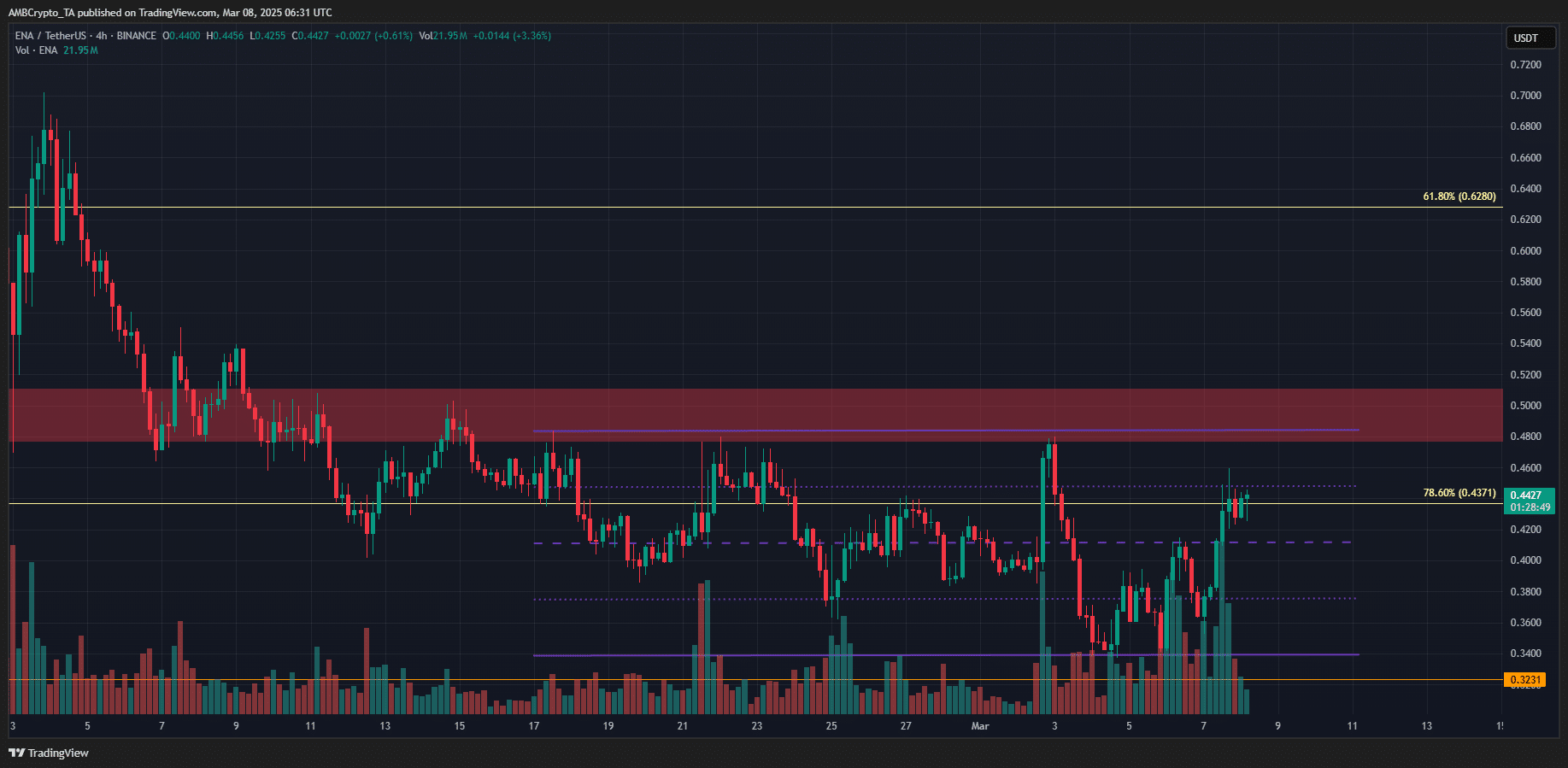

Zooming in on the 4-hour chart, a range formation (marked in purple) has become evident, with the highs aligning within the $0.5 resistance zone. At the time of writing, ENA bulls were attempting to break past the range’s 25% level at $0.448. However, a clean breakout beyond $0.5 still seems unlikely in the short term.

Despite the OBV breakout, traders should remain cautious. Given the higher timeframe’s bearish bias, the optimal strategy might involve selling near the $0.48-$0.5 zone upon a retest. A breakout above $0.52, however, would invalidate the bearish outlook and signal a potential trend reversal.

Liquidity and Swing Trading Strategies

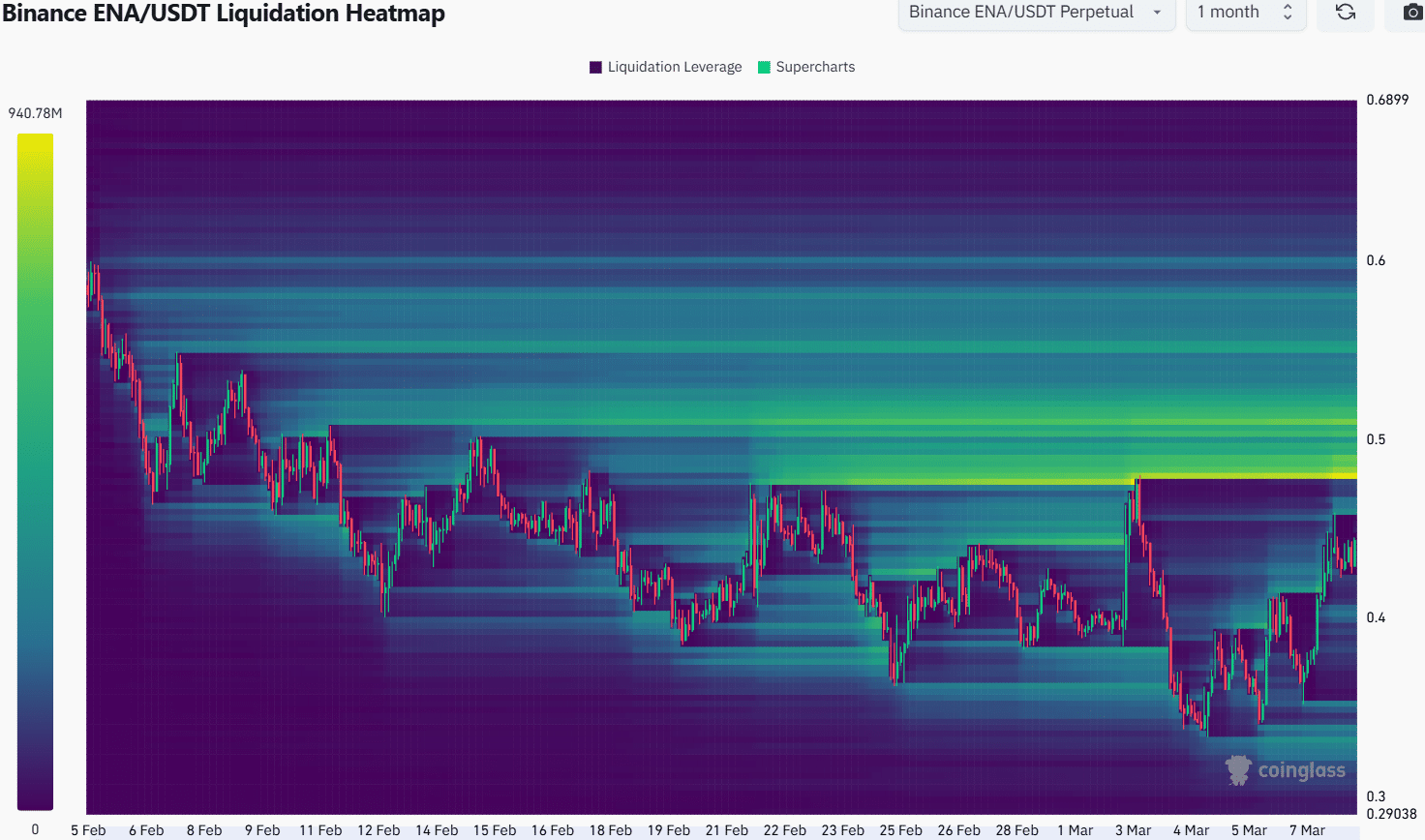

According to Coinglass’ liquidation heatmap, the $0.48-$0.515 region remains a high-liquidity zone, making it a prime area for price reversals. If price action moves beyond $0.515-$0.52, short sellers may need to reconsider their positions, as a breakout could shift the market dynamics. Conversely, a failure to break resistance could see ENA revisit the mid-range level at $0.412 or even the lows at $0.34.

Also Read: 2.07 billion Ethena (ENA) tokens ($820M) set for release, making up 66% of circulating supply

While ENA buyers are gaining strength, the overall market bias remains bearish. A breakout above $0.52 would invalidate the downside scenario, while a failure to breach key resistance levels could trigger another sell-off. Traders should watch Bitcoin’s price action closely, as its volatility could significantly impact ENA’s trajectory in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.