|

Getting your Trinity Audio player ready...

|

Ethena (ENA) has shown remarkable volatility, surging 63% over the past month but retreating 11% in the last week. Despite the pullback, ENA maintains a strong market cap of $3 billion, signaling robust investor interest. However, key technical indicators suggest the token is in a consolidation phase, leaving traders searching for directional clarity.

RSI Indicates Market Neutrality

ENA’s Relative Strength Index (RSI) sits at 47.3, indicating a neutral market state since December 21. This level suggests neither buyers nor sellers hold a decisive advantage, with balanced trading momentum prevailing.

RSI, a momentum indicator ranging from 0 to 100, typically signals overbought conditions above 70 and oversold scenarios below 30. ENA’s neutral RSI highlights a lack of significant directional strength, implying that the token may continue trading sideways in the short term.

DMI Reflects Weak Trend Strength

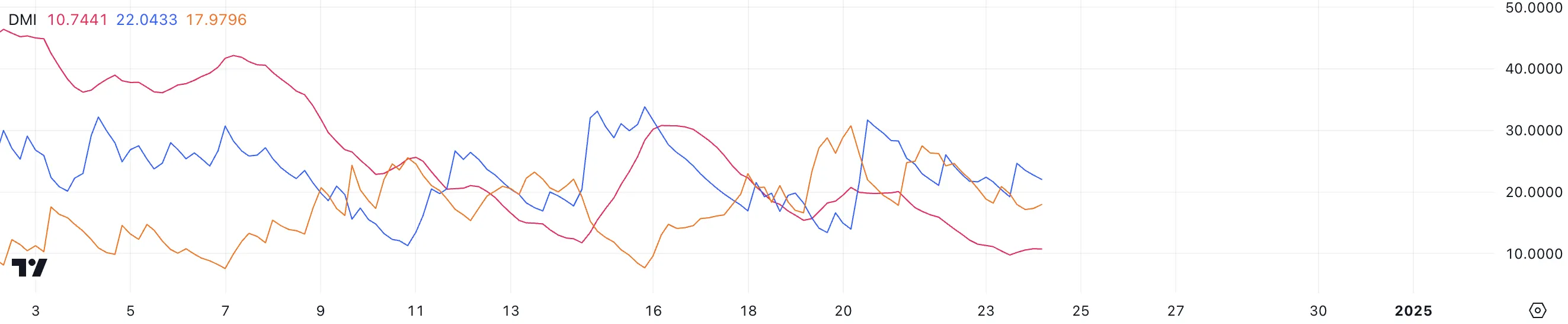

The Directional Movement Index (DMI) further underscores ENA’s current indecisive state. The Average Directional Index (ADX), a key DMI component, has dropped to 10.7 from 20 earlier in December, indicating a weakening trend.

While the positive directional indicator (D+) at 22 slightly outweighs the negative directional indicator (D-) at 17.97, the low ADX suggests insufficient strength for a sustained bullish or bearish trend. This combination points to potential range-bound trading unless a significant catalyst shifts momentum.

Key Support and Resistance Levels

ENA’s immediate price range is defined by support at $0.94 and resistance at $1.07. A break above $1.07 could set the stage for a rally toward $1.14, with further bullish momentum potentially driving the price to $1.22—a potential 18% upside from current levels.

However, failure to maintain support at $0.94 could lead ENA to test lower levels, with $0.80 emerging as a critical floor.

Also Read: Ethena (ENA) Surges Past Key Resistance Levels, Signaling Bullish Momentum Ahead – Analyst

While ENA’s recent performance reflects consolidation, a rise in ADX or a breach of critical price levels could signal the next significant move. Traders should watch these technical indicators closely for clues to ENA’s short-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!