|

Getting your Trinity Audio player ready...

|

Dogwifhat (WIF), a relatively new cryptocurrency, has recently experienced a significant surge in price. Over the past 24 hours, WIF has climbed 6.63%, reaching a price of $3.29. This impressive performance has been accompanied by a 19.38% increase in trading volume, indicating growing investor interest.

Technical Analysis: A Bullish Outlook

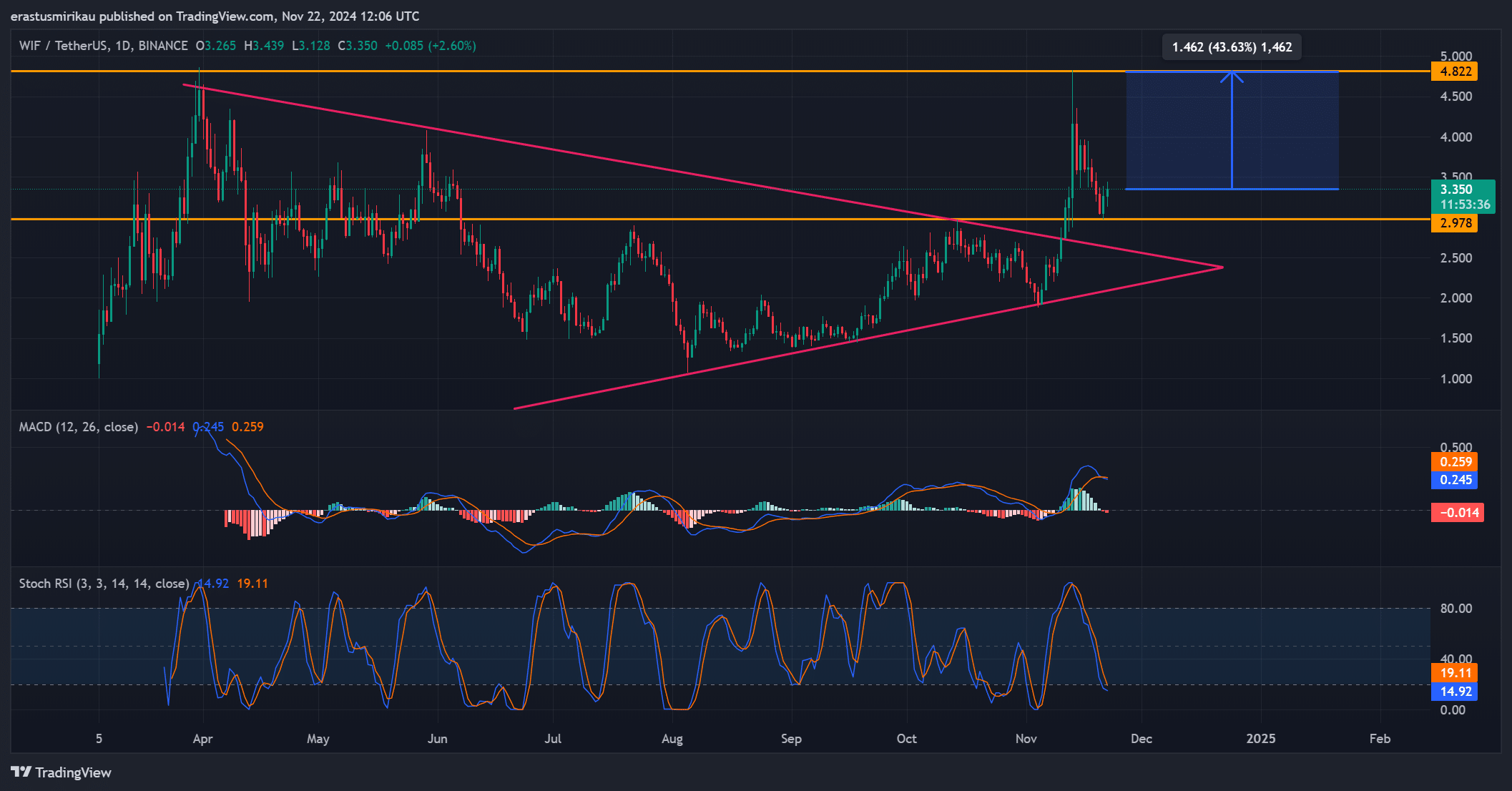

A key factor driving WIF’s upward momentum is its recent breakout from a symmetrical triangle pattern. This technical formation often signals an impending trend reversal, and in WIF’s case, it suggests a shift from consolidation to bullish momentum.

Furthermore, WIF has successfully reclaimed its critical support level of $2.978. This level now acts as a strong foundation for further price appreciation. Technical indicators also support a bullish outlook. The MACD has crossed above the signal line, indicating a bullish crossover. Additionally, the Stochastic RSI is currently oversold, suggesting that a short-term correction may be on the horizon. However, the overall trend remains firmly bullish.

Market Sentiment and Trading Volume

While WIF’s price has surged, its social dominance has slightly declined. However, the increase in trading volume indicates strong market interest. This suggests that the current rally is primarily driven by technical factors rather than social sentiment.

Potential Price Targets

Based on the current technical analysis, WIF has the potential to reach the $4.822 price target, representing a 43.63% upside from its current level. However, it’s important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

Dogwifhat’s recent price surge and strong technical indicators suggest a bullish outlook. However, investors should exercise caution and conduct thorough research before making any investment decisions. As always, it’s crucial to monitor market trends, technical analysis, and fundamental factors to assess the potential risks and rewards associated with investing in cryptocurrencies.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.