|

Getting your Trinity Audio player ready...

|

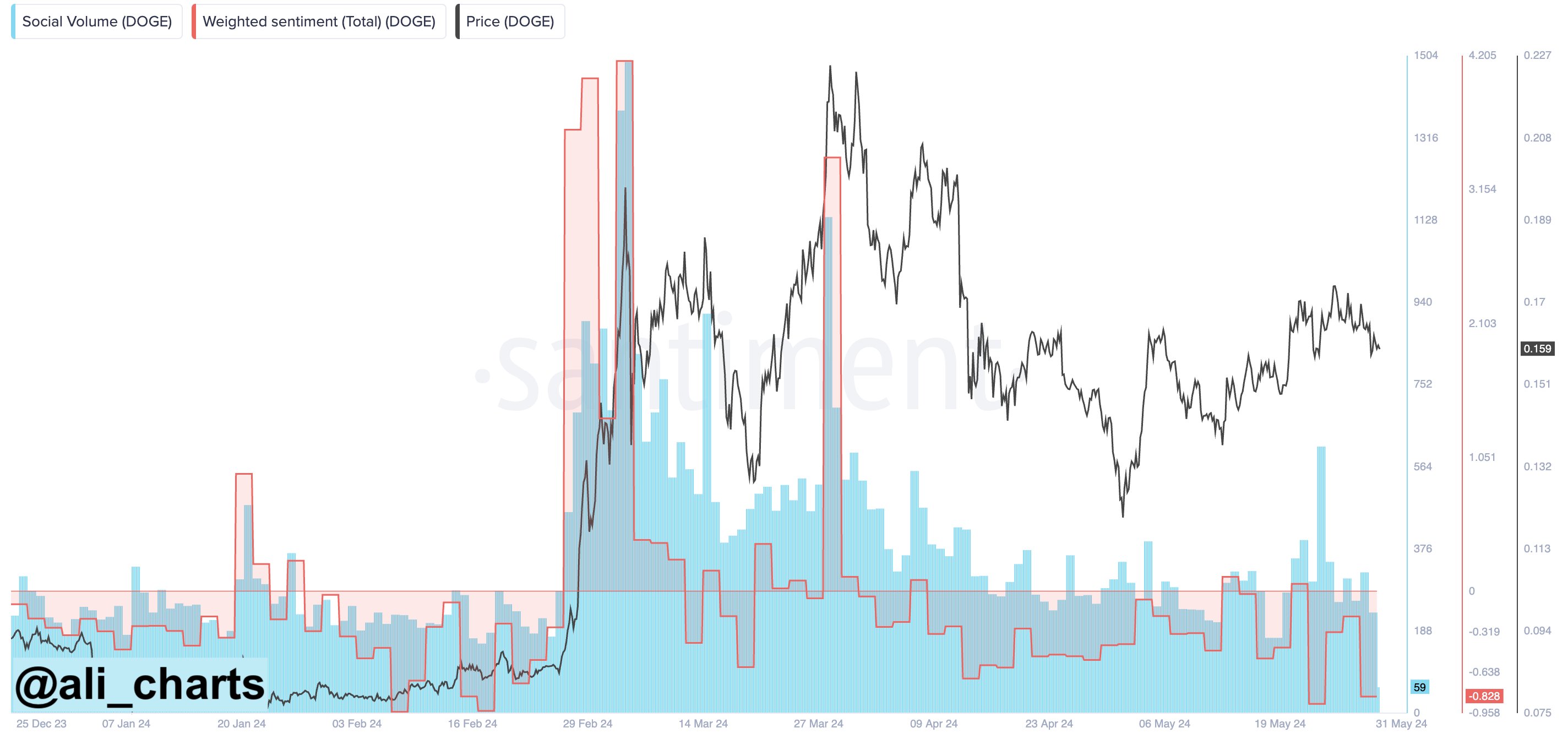

Dogecoin defied the odds last month, surging over 26% while Bitcoin lagged behind. However, a curious disconnect emerges: on-chain data reveals continued bearish sentiment among investors. Can this apparent contradiction predict Dogecoin’s future price movements?

Bearish Sentiment

Ali Martinez, a prominent crypto analyst, points to a “weighted sentiment metric” on social media platform X. This metric combines positive and negative sentiment alongside discussion volume to gauge overall market sentiment. Interestingly, Martinez highlights that Dogecoin’s current bearish sentiment mirrors what happened in early February, just before a 200% price surge. This historical precedent suggests that investor fear might be a bullish signal, with the market potentially poised for another significant price increase. Could Dogecoin break past the $0.3 barrier if this pattern holds true?

Whales Accumulate Millions, But Price Remains Unfazed

Adding another layer of intrigue, Martinez also shared on X that Dogecoin whales have accumulated a staggering 700 million tokens (roughly $112 million) in just three days. Historically, large-scale buying sprees by whales can indicate bullish confidence in a token’s future. However, in this case, the recent accumulation hasn’t translated to immediate price movement. As of now, Dogecoin hovers around $0.159, with a slight decline in the last 24 hours.

Also Read: Dogecoin (DOGE) Woof! Whales Accumulate $112 Million, Is a 7x Price Surge Incoming?

The Dogecoin Enigma: A Brewing Bull Run?

Dogecoin’s recent performance presents a conundrum. Despite surpassing Bitcoin’s gains and witnessing significant whale accumulation, investor sentiment remains bearish. This scenario raises questions: could the current bearishness be a buying opportunity for those who believe history will repeat itself? Or will Dogecoin defy historical trends and succumb to the prevailing negativity? Only time will tell if the whales’ confidence and past price action foreshadow another Dogecoin boom, or if the current bearish sentiment holds sway.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.