|

Getting your Trinity Audio player ready...

|

Dogecoin (DOGE) has been consolidating in recent days, with market data showing a steady price outlook. Despite the stagnation, analysts predict a significant rally for the popular memecoin, contingent on broader market trends and the potential approval of a Dogecoin exchange-traded fund (ETF).

Dogecoin Price Analysis and Forecast

On Wednesday, crypto analyst Ali Martinez highlighted in an X post that DOGE is trading within an ascending parallel channel. According to Martinez, as long as Dogecoin maintains support above $0.16, it has the potential to surge to $2.74 in the mid-channel range or even reach $6.24 at the upper boundary.

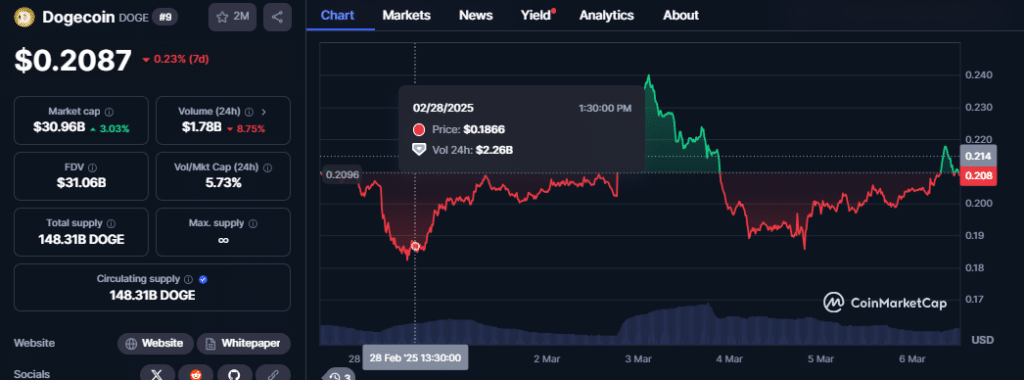

Currently ranked 9th among global digital assets, Dogecoin is trading at $0.2039, up 2.47% in the last 24 hours, per CoinMarketCap data. The memecoin continues to enjoy strong community support and growing interest from crypto whales, fueling optimism among investors.

Martinez’s technical analysis suggests that DOGE’s price movements align with past breakout patterns observed in ascending parallel channels. If this historical trend holds, Dogecoin could be on the verge of a significant uptrend, provided key conditions are met.

DOGE Price Trends and Market Expectations

Dogecoin has a history of sharp price surges, especially during bullish market cycles. In 2021, it skyrocketed from under $0.01 to an all-time high of $0.739, driven primarily by retail hype and endorsements from billionaire Elon Musk.

Currently, technical indicators support a bullish outlook for DOGE. The Relative Strength Index (RSI) is rebounding from oversold levels, while the Average Directional Index (ADX) at 27.95 suggests a strengthening bullish trend. A decisive breakout above $0.26 and $0.30 could confirm further gains, with increasing wallet addresses and positive network activity further supporting bullish momentum.

Could a Dogecoin ETF Change the Game?

The possibility of a Dogecoin ETF has sparked renewed interest in the crypto market. Leading investment firms, including Grayscale, CoinShares, and WisdomTree, have submitted ETF applications to the U.S. Securities and Exchange Commission (SEC). Approval could attract institutional investors, boosting liquidity and price stability.

Also Read: Dogecoin (DOGE) Forms Bullish Cup-and-Handle Pattern: Is a Breakout to $1 Next?

With shifting regulatory sentiment and Dogecoin’s strong presence in the crypto market, a $6.24 price target is becoming increasingly plausible. However, investors should monitor Bitcoin’s performance, regulatory developments, and DOGE’s ability to sustain its $0.16 support level. If these factors align, Dogecoin could be on the verge of another explosive rally.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.