|

Getting your Trinity Audio player ready...

|

Dogecoin (DOGE) is gearing up for another potential surge, following a recent 46% rally. The meme coin has formed a strong bullish price action pattern on its daily time frame, signaling a potential breakout.

Technical Analysis: A Bullish Outlook

According to technical analysis, DOGE is poised to break through a crucial resistance level, the high of March 2024. If the coin successfully closes a daily candle above this level, it could potentially soar by 50% to reach the $0.35 level in the coming days. This bullish outlook is further supported by DOGE trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

On-Chain Metrics: A Bullish Signal

On-chain metrics provide additional evidence for DOGE’s bullish potential. IntoTheBlock’s analysis reveals that DOGE’s Net Network Growth, In the Money, Concentration, and Large Transactions Volume metrics are all pointing to a bullish signal.

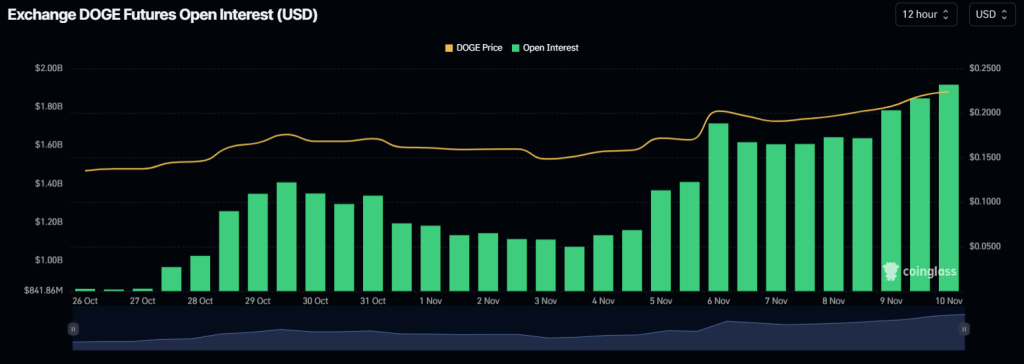

Furthermore, traders are placing significant bets on DOGE’s future contracts. The open interest for DOGE futures has surged by 18% in the past 24 hours and 11% in the past four hours, according to Coinglass. The Long/Short ratio currently stands at 1.02, indicating a bullish sentiment among traders.

Current Price Momentum

At the time of writing, DOGE is trading near $0.227, with a 14% price increase in the past 24 hours. The trading volume has also surged by 23%, indicating heightened trader interest.

Combining technical analysis and on-chain metrics, it appears that bullish sentiment is dominating the DOGE market. If the coin successfully breaks through the crucial resistance level, a significant price rally could be on the horizon. However, it’s essential to remember that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.