|

Getting your Trinity Audio player ready...

|

Dogecoin (DOGE) is currently in a consolidation phase, raising concerns about its next price direction. Despite a minor recovery, the memecoin’s sluggish momentum and declining whale activity suggest uncertainty in the short term.

DOGE Price Stuck in Consolidation

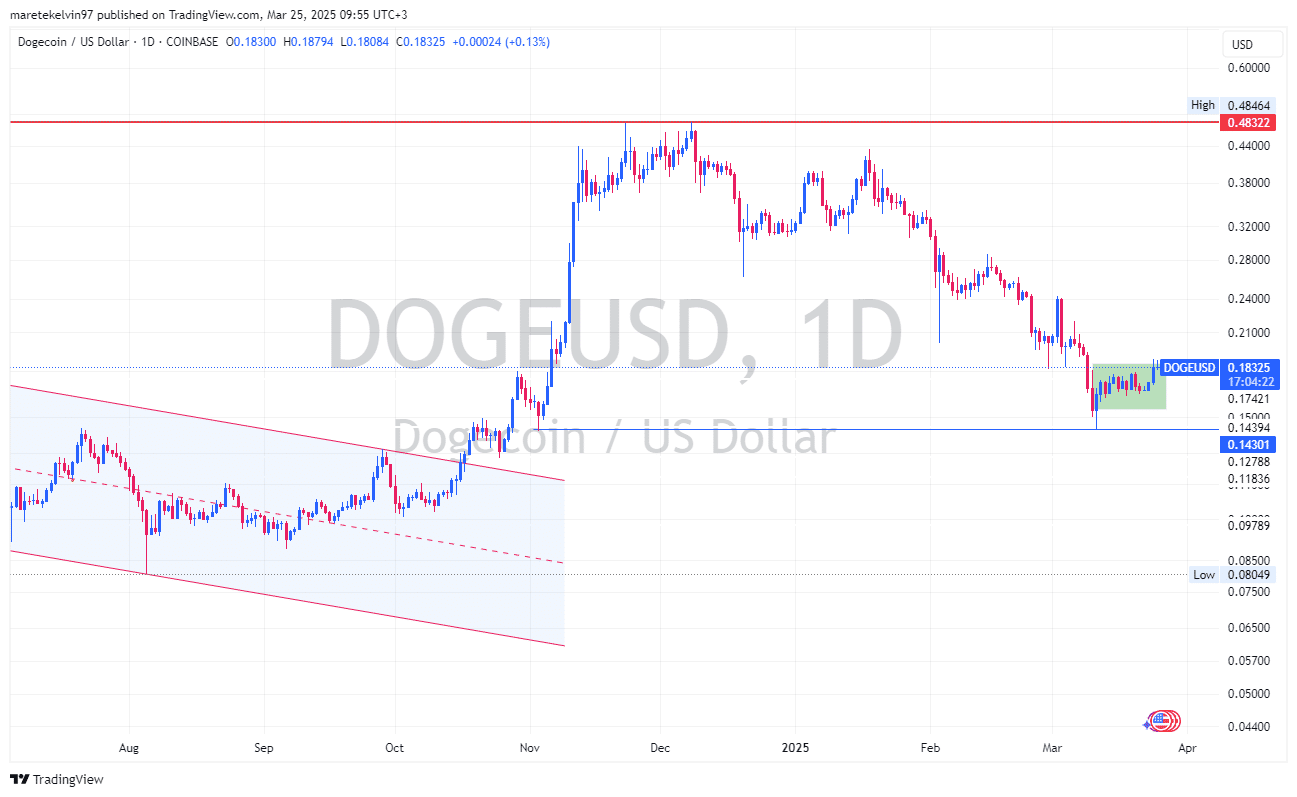

On the daily chart, DOGE has struggled to maintain a bullish trajectory, trading sideways after dipping below the critical $0.143 support level. Over the past week, the altcoin has shown limited movement, remaining in a tight range around $0.172.

At the time of writing, DOGE is trading at $0.1837, reflecting a 4.4% gain over the past 24 hours. However, despite the uptick, on-chain metrics paint a mixed picture of its future potential. The weekly chart offers a more promising outlook, hinting at a slow yet gradual bullish shift that could lead to a breakout if market conditions improve.

Whale Activity Declines, Liquidity Shrinks

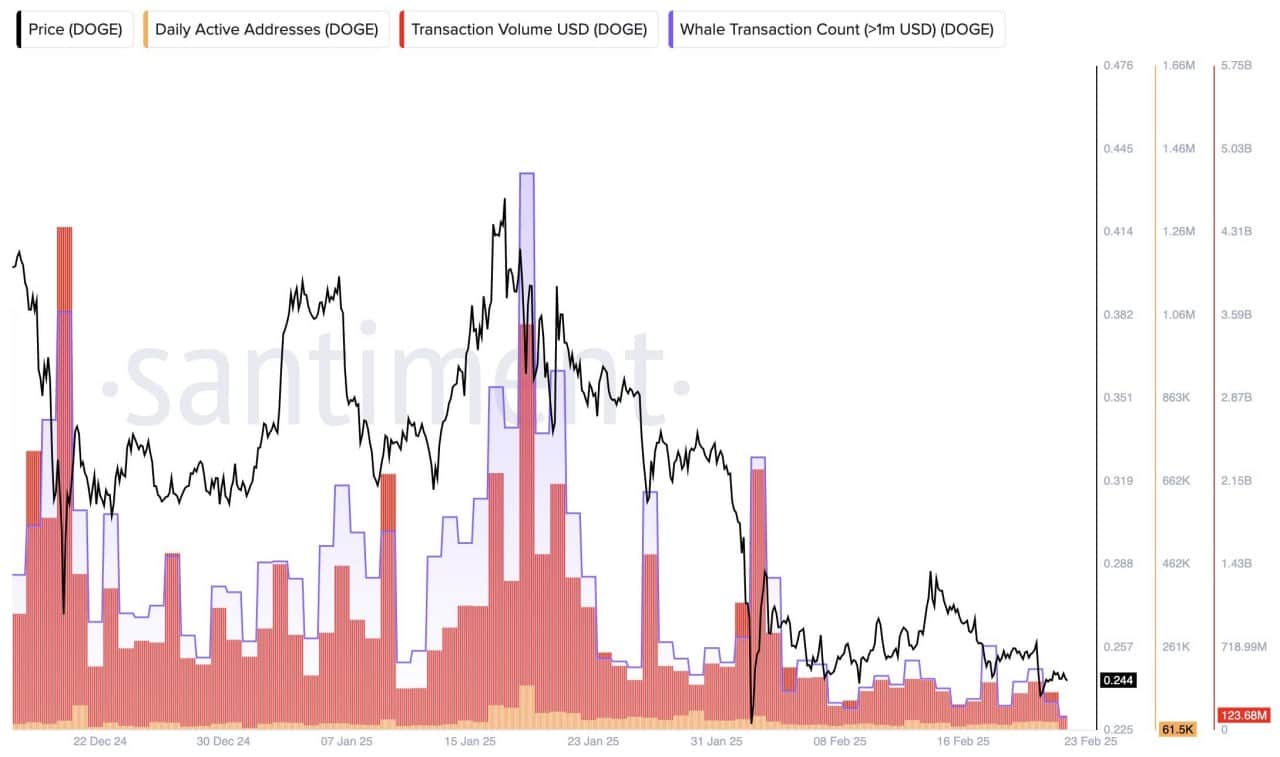

A key indicator of DOGE’s price movement is whale activity. Historically, large transactions signal strong investor interest and often precede major price swings. However, Santiment data shows a decline in high-volume trades, with whale transactions dropping to just 66. This suggests reduced institutional participation, limiting the likelihood of an immediate surge.

Retail activity is also on the decline, as evidenced by the drop in active addresses. Fewer daily transactions mean reduced liquidity, making DOGE more susceptible to volatility without significant upward momentum.

Will DOGE Break Out?

In the near term, DOGE’s lack of movement and weakened network activity could keep its price subdued. If the memecoin dips below $0.143, further losses toward $0.12 may follow. However, the weekly chart signals a slow accumulation phase, implying that if Bitcoin and the broader crypto market recover, DOGE could gain momentum and test higher resistance levels.

Also Read: Dogecoin Surges 5% as Foundation Builds Reserves – Is a 100% Rally Incoming?

For now, Dogecoin remains in a holding pattern. Traders should monitor whale activity and overall market sentiment for clearer signs of a breakout. A decisive move above resistance levels could reignite bullish momentum and pave the way for higher gains.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!