|

Getting your Trinity Audio player ready...

|

- Danske Bank now offers Bitcoin and Ether ETPs to self-directed investors.

- Tokenized gold market surpasses $6 billion amid strong inflows.

- Bank of England begins pilot testing blockchain-based settlement infrastructure.

Crypto markets are seeing a fresh wave of institutional movement across Europe. From Denmark’s largest bank opening access to Bitcoin and Ether exchange-traded products (ETPs), to tokenized gold surpassing $6 billion, and the Bank of England testing distributed ledger settlement infrastructure, the intersection of traditional finance and digital assets is accelerating.

Here’s what happened in crypto today.

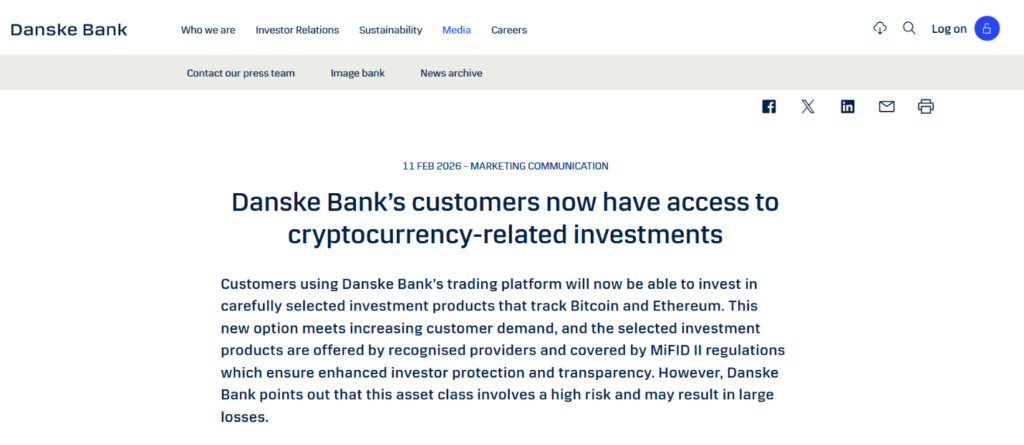

Danske Bank Opens Door to Bitcoin and Ether ETPs

Danske Bank, Denmark’s largest lender with more than five million customers, is now allowing certain clients to invest in Bitcoin and Ether ETPs through its digital banking platforms. The products, issued by BlackRock and WisdomTree, are available to self-directed investors who trade without advisory support.

The decision marks a notable shift for the bank, which had previously taken a cautious stance toward crypto assets. The move comes amid rising client demand and greater regulatory clarity in the European Union following the implementation of the Markets in Crypto-Assets (MiCA) framework.

By offering regulated exchange-traded products instead of direct crypto ownership, the bank emphasizes investor protection, cost transparency, and simplified custody. However, it continues to warn that cryptocurrencies remain high-risk assets.

The development underscores how Bitcoin ETF-style products are increasingly becoming the bridge between traditional banks and digital assets.

Tokenized Gold Market Surpasses $6 Billion

The tokenized commodities market — largely dominated by gold-backed tokens — has surged to more than $6.1 billion, up roughly 53% in just six weeks.

Since the start of the year, nearly $2 billion has flowed into tokenized commodities, driven primarily by gold’s strong price performance. Tether Gold (XAUt) and PAX Gold (PAXG) account for the majority of the growth, with both tokens recording significant market cap increases in recent weeks.

Year-over-year, the sector has expanded by 360%, outpacing tokenized stocks and funds. The rally highlights growing interest in real-world asset (RWA) tokenization, especially as investors look for yield-bearing or inflation-resistant alternatives onchain.

Bank of England Tests Tokenized Asset Settlement in Sterling

Meanwhile, the Bank of England is advancing its exploration of blockchain-based settlement systems. The central bank has launched a six-month industry testing initiative to examine how tokenized assets could be settled using synchronized delivery-versus-payment mechanisms in British pounds.

Eighteen firms will participate in the pilot, which will simulate interactions between the Bank’s next-generation real-time gross settlement system and external distributed ledger platforms. No real funds will be used during testing.

The goal is to assess interoperability between central bank money and tokenized assets, potentially laying the groundwork for a more modernized financial infrastructure.

A Broader Shift Toward Institutional Crypto Integration

Taken together, these developments signal deeper institutional engagement with digital assets. European banks are cautiously expanding crypto exposure, tokenized commodities are gaining traction, and central banks are actively testing blockchain-based settlement models.

While risks remain — from volatility to regulatory fragmentation — the direction is clear: crypto, tokenization, and traditional finance are becoming increasingly intertwined.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!