|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Bitcoin faces stiff resistance at $110K with bearish divergences signaling potential retracement.

- Ethereum shows bullish golden cross signals, but futures data suggests cautious optimism.

- XRP rallies after Ripple’s banking license move, with bullish technical patterns forming.

The cryptocurrency market presented a mix of bullish and bearish signals this week, with Bitcoin (BTC) nearing $110,000 before hitting resistance, XRP surging on Ripple’s regulatory progress, and Ethereum (ETH) flashing a bullish golden cross. Meanwhile, major regulatory and security developments added further intrigue to a volatile market landscape.

Bitcoin Struggles at $110,000 Despite Brief Surge

Bitcoin briefly climbed to $110,500 on Thursday but failed to maintain momentum. A series of bearish divergences on short-term charts revealed weakening momentum indicators like the Relative Strength Index (RSI), suggesting that bulls may be losing control. Analysts are now watching key support zones between $107,500 and $106,000.

The rejection at the $110K psychological level was reinforced by stronger-than-expected US Non-Farm Payroll data, which initially pushed BTC higher but failed to sustain a breakout. Flat funding rates indicate traders remain skeptical about a long-term upward move, reinforcing short-term caution.

Ethereum Eyes $3,200 Amid Bullish Technical Pattern

Ethereum gained 9% mid-week, fueled by a golden cross—when the 50-day moving average crosses above the 200-day average—signaling potential bullish continuation. While ETH faces immediate resistance at $2,600, technical projections hint at a possible rally toward $3,200.

However, futures market data remains conservative. The ETH futures premium still lags below the 5% neutral benchmark, indicating traders aren’t yet fully bullish. Moreover, Ethereum’s pivot to layer-2 scaling has reduced direct demand for ETH, as rollup fees are significantly lower compared to base-layer transactions.

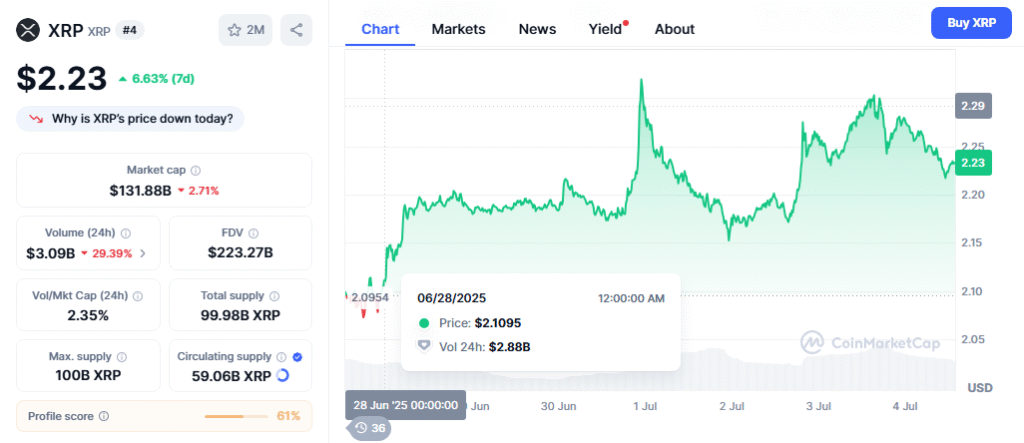

XRP Jumps as Ripple Seeks US Banking License

XRP emerged as a standout performer after Ripple Labs applied for a national banking license with the US Office of the Comptroller of the Currency (OCC). This move is seen as a major step toward institutional legitimacy and regulatory clarity, sparking bullish sentiment around the token.

Technically, XRP broke above its 50-day moving average at $2.23, and traders are eyeing an inverse head-and-shoulders pattern with a breakout potential toward $2.76 or even $3.00. Key resistance levels lie at $2.34 and $2.65, which could determine the next bullish leg.

Also Read: Bitcoin Whale News: $2.12B BTC Transfer Sparks Market Concerns at $109K

On the legislative front, US Senator Cynthia Lummis introduced a new crypto tax bill proposing exemptions for small transactions and capital gains under $300. It also delays taxation on mining and staking until assets are sold—a move welcomed by many in the crypto community.

In contrast, security experts at Koi Security flagged over 40 fake Firefox extensions mimicking wallets like MetaMask and Coinbase, aimed at stealing credentials through phishing. These malicious plugins have been active since April, highlighting the continued risk to retail investors.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!