|

Getting your Trinity Audio player ready...

|

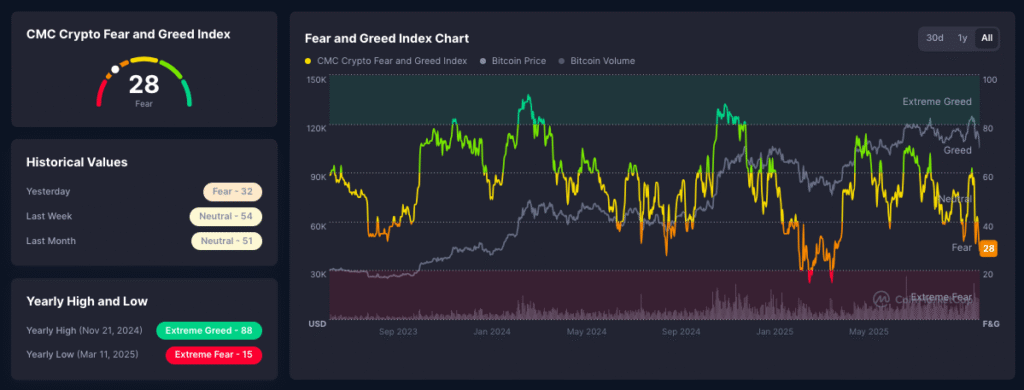

- Crypto fear index falls to 28, signaling growing market anxiety.

- $230 billion in value erased in one day amid broad sell-off.

- Bitcoin, Ether, and major altcoins suffer heavy declines as sentiment turns bearish.

Investor sentiment across the crypto market turned sharply negative this week as the Fear & Greed Index tumbled to its lowest level since April. A wave of selling wiped out over $230 billion in value in a single day, leaving traders bracing for further volatility.

Fear Takes Hold as Markets Slide

According to CoinMarketCap, the global crypto market capitalization dropped to $3.54 trillion on Friday — a 6% decline from the previous day’s $3.78 trillion. The site’s Crypto Fear & Greed Index fell to 28, marking a clear shift into “fear” territory and nearing “extreme fear.”

The downturn mirrors jitters in traditional markets, where the Fear & Greed Index for equities also fell to 22. Analysts cited a mix of factors fueling the sell-off — including renewed US-China trade tensions, regional bank stress, and broader risk-off sentiment.

Bitcoin and Altcoins Suffer Sharp Losses

Major cryptocurrencies extended steep declines. Bitcoin (BTC) dropped nearly 6% to about $105,000, while Ether (ETH) slid almost 8% to $3,700. Among top altcoins, BNB led losses with a 12% fall, followed by Chainlink (LINK) at 11% and Cardano (ADA) at 9%.

Solana (SOL) and XRP also tumbled over 7%, erasing recent gains from early October. On average, the largest non-stablecoin assets lost between 8% and 9% over the past 24 hours.

Data from CoinGlass showed roughly $556 million in leveraged positions were liquidated — far less than last week’s $20 billion wipeout, suggesting some traders had already reduced exposure.

Broader Market Pain: Memecoins, NFTs, and ETFs Hit

The sell-off didn’t spare other corners of the digital asset space. Memecoins plunged about 33%, with leading tokens like DOGE and SHIB dropping 9–11%. NFT markets also took a hit, falling below a $5 billion total valuation — levels not seen since July.

Also Read: Bitcoin Retail Demand Collapses: Spot Buying Drops 111,000 BTC Amid Bearish Sentiment

Meanwhile, spot Bitcoin ETFs recorded $536 million in outflows, while Ether ETFs saw over $56 million exit on Thursday alone.

Market Outlook

With fear gripping both crypto and traditional markets, analysts warn that short-term volatility may persist until confidence returns. For now, traders are watching whether Bitcoin can hold above the psychological $100,000 level — a key test for market stability heading into year-end.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.