|

Getting your Trinity Audio player ready...

|

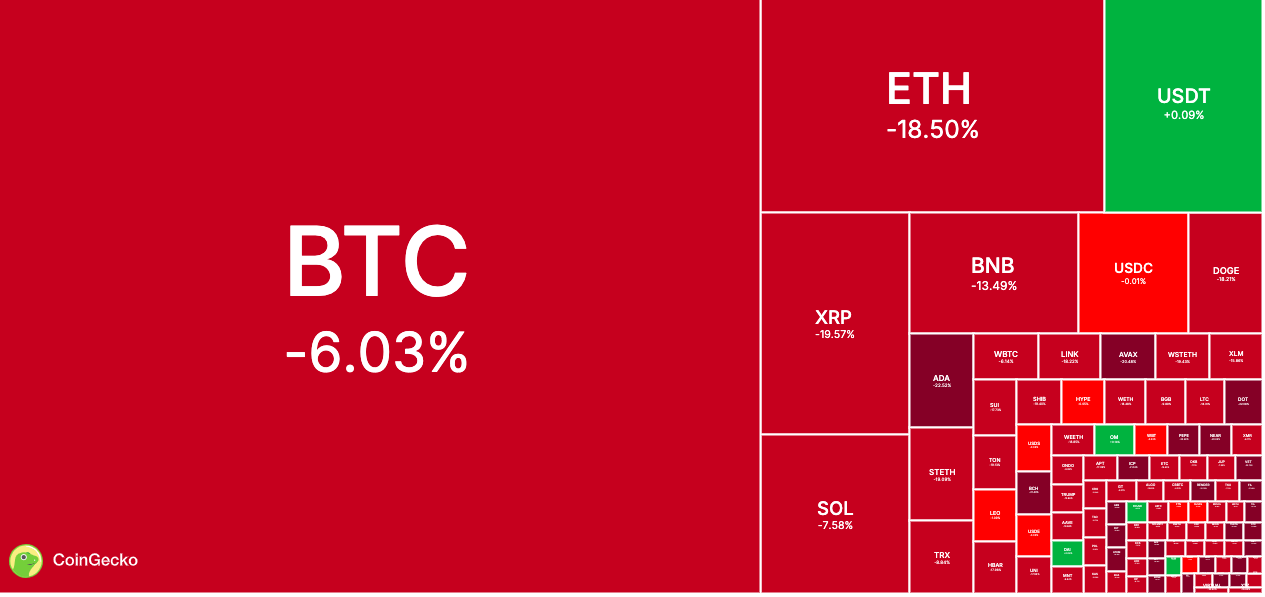

The cryptocurrency market has taken a major hit following U.S. President Donald Trump’s first round of tariffs on imports from China, Canada, and Mexico. Major altcoins, including Ether (ETH), Cardano (ADA), Avalanche (AVAX), XRP, Chainlink (LINK), and Dogecoin (DOGE), all suffered double-digit losses within a single day, signaling heightened investor anxiety.

Ether and Altcoins in Freefall

Ether, the second-largest cryptocurrency by market capitalization, saw a dramatic 16% drop in just one hour, plummeting to $2,368 before recovering slightly to $2,521. This marks a 38% decline from its 2024 high of $4,078, recorded six weeks after Trump’s election victory.

The broader altcoin market also suffered severe losses:

- Avalanche (AVAX): Down over 20%, now at $24.90

- XRP: Dropped to $2.34, reflecting a significant decline

- Chainlink (LINK): Fell sharply to $18.59

- Dogecoin (DOGE): Now trading at $0.2507

According to CoinGecko, the overall crypto market cap plummeted by 11.4%, settling at $3.17 trillion.

Investor Sentiment Turns Bearish

Market analysts attribute the sharp decline to a mix of stop-loss triggers and a drop in retail investor activity. Markus Thielen, founder of 10x Research, noted that trading volumes had been falling for weeks, indicating waning confidence among investors. Many were unprepared for the tariffs’ impact, as attention had been diverted to recent DeepSeek developments.

The Crypto Fear & Greed Index, which measures market sentiment, also reflected this shift, dropping 16 points into the “Fear” zone at 39 out of 100—its lowest level since October 2023.

Impact on the Broader Financial Market

The crypto crash coincided with a sharp downturn in traditional markets:

- Nasdaq 100 futures fell 2.7%

- S&P 500 futures dropped 2%

- Dow Jones futures declined 1.5%

These moves suggest that uncertainty over Trump’s trade policies is spilling into equities, potentially prolonging market instability.

Bitcoin’s Relative Strength

Unlike altcoins, Bitcoin (BTC) held up better, experiencing a 6.8% decline to $94,743. However, its market dominance surged from 61.1% to 64%, indicating that traders are shifting funds from riskier altcoins to Bitcoin as a safer bet amid market turmoil.

What’s Next?

The market’s next moves will largely depend on how U.S. equities perform in the coming days. If investors remain risk-averse, the downward pressure on altcoins may continue. However, if support zones hold and sentiment stabilizes, a market rebound could be on the horizon.

For now, crypto investors remain on edge, watching both the political and economic landscape for the next big move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!