|

Getting your Trinity Audio player ready...

|

- CPI and PPI data will heavily influence the Fed’s September 17 rate decision.

- Bitcoin could rally to $135K or fall below $107K depending on CPI results.

- Lower inflation could boost both crypto and stock markets in coming weeks.

Stay ahead with real-time updates and insights—Join our Telegram channel!

As global markets brace for heightened volatility, a new report from crypto exchange Bybit and financial analysis firm FXStreet warns that next week’s U.S. inflation data could become a pivotal turning point for both stocks and cryptocurrencies. The outcome of the upcoming Producer Price Index (PPI) on September 11 and Consumer Price Index (CPI) on September 12 is expected to heavily influence the Federal Reserve’s interest rate decision on September 17.

CPI and PPI to Guide Fed Policy Path

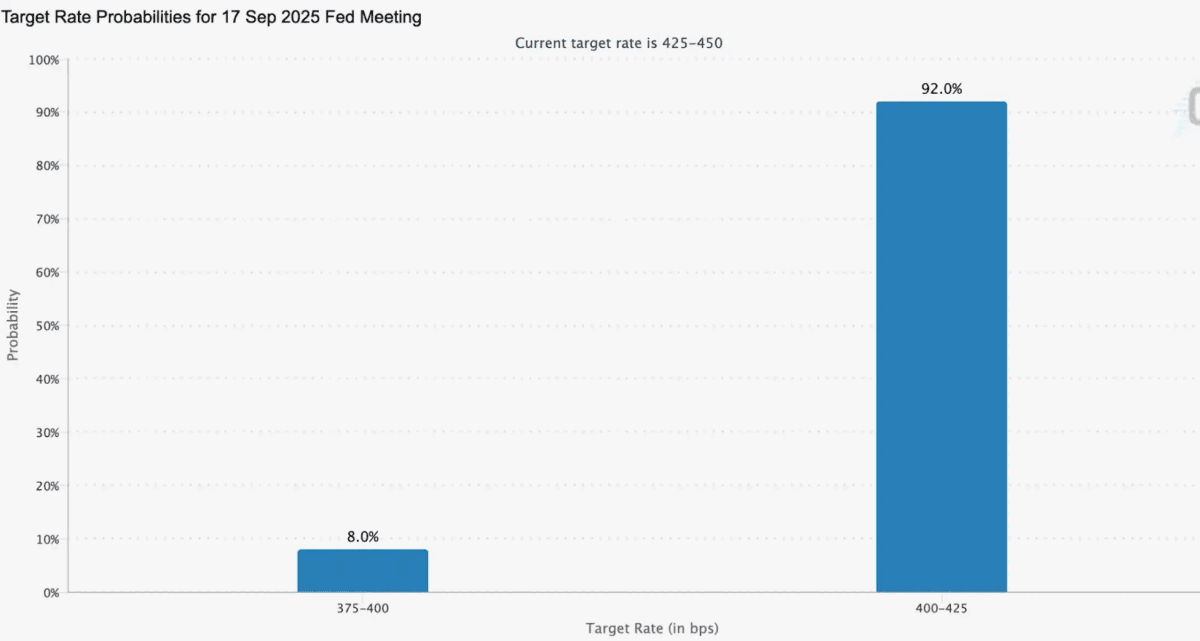

According to the Bybit x FXStreet TradFi Report, these inflation indicators will be the last crucial data points before the Fed meeting. The CME FedWatch tool currently shows a 92% probability that the Fed will cut its benchmark rate from 4.5% to 4.25%.

However, consensus forecasts predict a slight uptick in year-over-year CPI from 2.7% to 2.9%. If inflation comes in higher than expected, the odds of a rate cut could shrink significantly, prompting a broad market correction. Softer inflation readings, on the other hand, would reinforce expectations for monetary easing—a scenario that typically boosts risk assets by increasing liquidity.

Bitcoin Faces Breakout or Breakdown

The report highlights Bitcoin as particularly sensitive to the CPI release, describing the market as “on the brink of a breakout or breakdown.” A lower-than-expected CPI could propel Bitcoin past its critical $117,300 resistance level, potentially setting the stage to revisit its all-time high of $124,500. Analysts even see a path toward $135,000 by year-end if monetary conditions loosen.

Conversely, a drop below the $107,200 support level could trigger accelerated selling, marking a shift to bearish sentiment across the crypto market.

Also Read: Bitcoin Holds $111K Amid CPI and FOMC Pressure: What Traders Must Know

Equity Markets Also at a Tipping Point

The S&P 500 is holding above its 6,500-point pivot level, and a favorable inflation print could push it toward 7,000, according to the report. Lower inflation would strengthen the case for a Fed rate cut, which could extend the current equity rally and inject fresh momentum into risk assets globally.

Next week’s PPI and CPI releases are more than routine updates—they are key catalysts that could determine the near-term trajectory of monetary policy. Whether they unlock a new bull phase or trigger a correction, their impact on Bitcoin, equities, and broader financial markets will be profound.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!