|

Getting your Trinity Audio player ready...

|

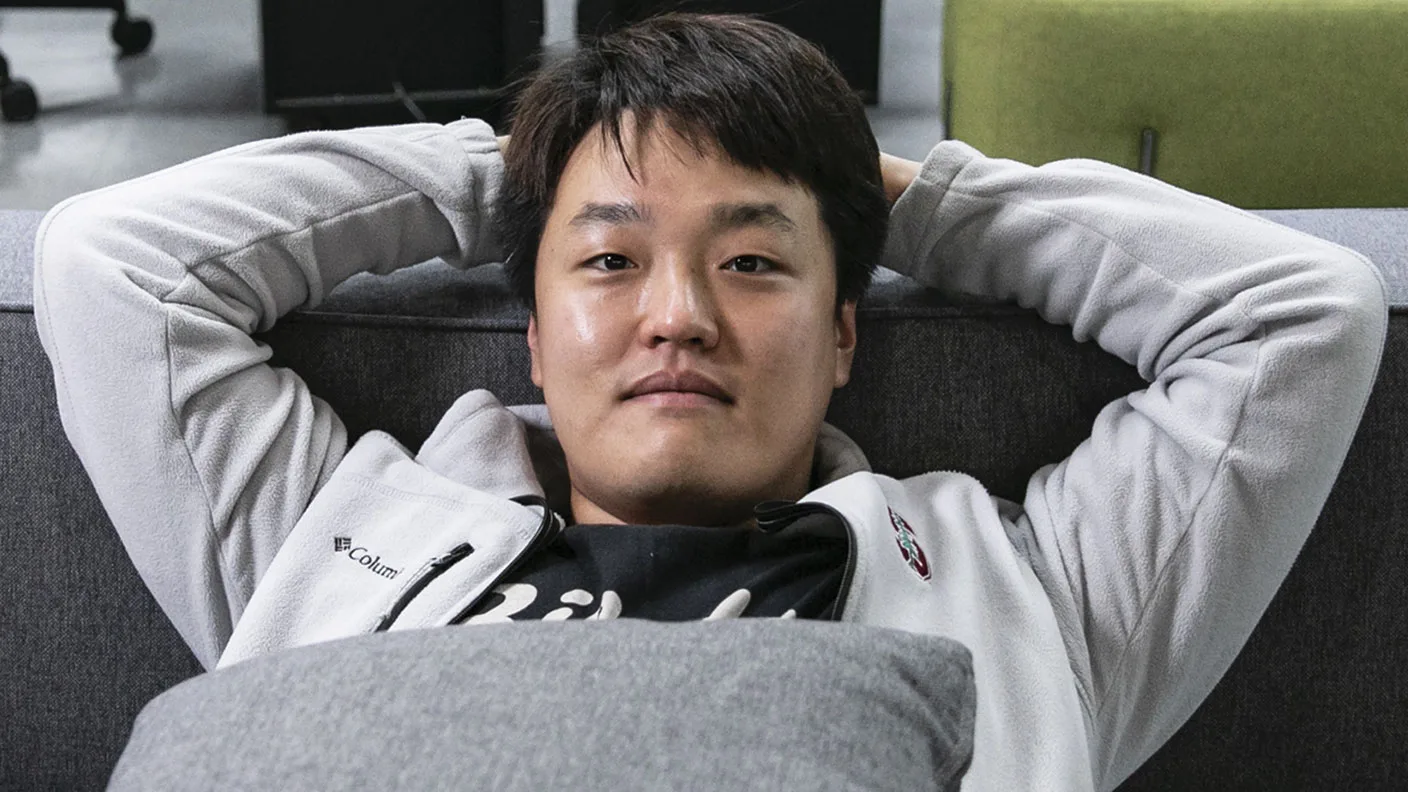

As the legal saga surrounding Do Kwon unfolds, Montenegrin media reports indicate that the Terraform Labs co-founder’s extradition process may soon reach its conclusion, with a decision expected by Sunday, October 19. Justice Minister Bojan Bozovic confirmed on October 17 that the government has chosen the destination for Kwon’s extradition, a pivotal move amid mounting charges related to cryptocurrency fraud from both the United States and South Korea.

A Step Towards Resolution

The news has sent ripples through the cryptocurrency community, as Kwon’s extradition could mark a significant milestone in the legal fallout from the catastrophic collapse of Terra’s stablecoin in May 2022. The implosion wiped out billions of dollars in investor funds, sparking global outrage and legal scrutiny. Kwon has been in custody in Montenegro since March after being arrested for using fake documents while allegedly attempting to flee to the Middle East.

The Minister’s comments suggest that the necessary documentation for Kwon’s extradition could be signed by the end of the week, although the exact destination remains undisclosed. This uncertainty adds another layer of intrigue to an already complicated situation.

Competing Claims from Global Powers

Kwon faces serious allegations not just in South Korea but also in the US and Singapore, with all three nations vying for his extradition. Crypto legal expert David Lespernce emphasized the complexity of the extradition process, explaining that international law does not prioritize one country’s request over another. “The ultimate decision as to where Do Kwon will be first sent will be a political one rather than a legal one,” he noted.

This diplomatic tug-of-war raises questions about the implications for Kwon’s case and the broader crypto market. Will his extradition pave the way for accountability in the cryptocurrency industry, or will it further complicate the legal landscape surrounding crypto regulation?

Impacts on the Market

Interestingly, despite the turmoil surrounding Kwon, the price of Terra Luna Classic has been trending upward since July, even amid a broader market downturn on August 5. This resilience reflects a complex sentiment in the crypto market, where investor confidence can fluctuate rapidly based on news and developments.

In September, Interpol issued a red notice against Kwon, emphasizing the gravity of the situation as the fallout from the $40 billion collapse continues to echo across the crypto landscape. The Supreme Court of Montenegro previously ruled that all legal conditions for Kwon’s extradition are satisfied, placing the final decision firmly in the hands of the Minister of Justice.

Settlement with the SEC

Complicating matters further, Terraform Labs recently reached a $4.47 billion settlement with the US Securities and Exchange Commission (SEC) related to allegations of misconduct in the company’s operations. This settlement mandates the winding down of Terraform’s business and the liquidation of its assets, bringing a new layer of financial reckoning for Kwon and his associates.

As the clock ticks down to October 19, all eyes are on Montenegro and the potential ramifications of Kwon’s extradition. The decision could not only determine Kwon’s fate but also influence the future of regulatory actions in the cryptocurrency space, highlighting the increasing scrutiny and the push for accountability in a market often characterized by its volatility and uncertainty.

With a potential decision imminent, the outcome of Do Kwon’s extradition saga could reshape the narrative around cryptocurrency regulations and investor trust. Stay tuned for updates as this developing story unfolds.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!