|

Getting your Trinity Audio player ready...

|

- Nevada judge declined to immediately block Coinbase’s event contract markets.

- Coinbase argues federal law gives the CFTC exclusive authority over prediction markets.

- Bitcoin’s Coinbase Premium Gap hit a yearly low, signaling institutional selling pressure.

Coinbase is facing pressure on two very different fronts at once: a growing legal fight with state regulators over prediction markets and fresh data pointing to weakening institutional demand for Bitcoin. Together, the developments highlight a tense moment for the largest U.S. crypto exchange as it defends its business model while navigating a shifting market environment.

Nevada Judge Declines to Immediately Block Coinbase’s Prediction Markets

A Nevada state court has declined to grant an emergency order sought by the Nevada Gaming Control Board (NGCB) to immediately halt Coinbase’s event contract markets. Instead, the judge scheduled a hearing for next week, giving Coinbase time to formally respond.

The NGCB accuses Coinbase of offering unlicensed sports wagering through event contracts listed via Kalshi, a Commodity Futures Trading Commission (CFTC)-regulated exchange. Regulators are seeking both a temporary restraining order and a preliminary injunction that would block the products for Nevada residents.

Coinbase argues that Nevada’s request goes far beyond sports betting and would effectively bar any CFTC-regulated event contracts in the state, including those tied to financial or commodity outcomes. Chief legal officer Paul Grewal said Coinbase has now taken the dispute to federal court, claiming the state’s enforcement effort violates federal law.

“Congress gave the CFTC exclusive jurisdiction over these listed contracts,” Grewal said, adding that states cannot reclassify federally regulated derivatives as gambling.

A Broader State-Level Pushback Against Prediction Markets

Nevada’s action follows similar moves in other states. In January, Tennessee regulators ordered Kalshi, Polymarket, and other platforms to halt sports-related event contracts. In December, Coinbase joined Kalshi in suing regulators in Connecticut, Illinois, and Michigan, arguing that prediction markets operating on CFTC-regulated venues fall squarely under federal oversight.

The clash also comes days after a Nevada judge granted a 14-day restraining order forcing Polymarket to suspend certain markets in the state, signaling that legal outcomes may vary platform by platform.

Coinbase Premium Gap Hits Yearly Low as Institutions Pull Back

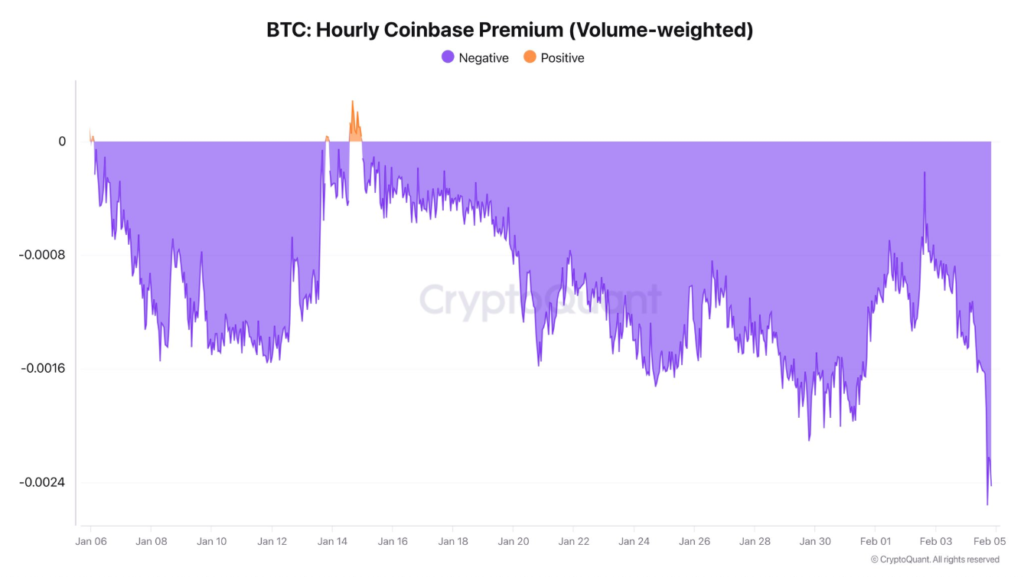

While Coinbase fights in court, on-chain data is flashing warning signs about institutional behavior. The Coinbase Premium Gap — which measures the price difference between Bitcoin on Coinbase and Binance — has fallen to its lowest level in over a year.

CryptoQuant analyst Darkfost said the deeply negative reading suggests selling pressure is intensifying on Coinbase-linked venues, which are commonly associated with professional and institutional traders. The current gap sits near -168, the lowest level since December 2024.

Volume-weighted hourly Coinbase Premium falls to yearly lows. Source: CryptoQuant

CryptoQuant also reports that U.S. spot Bitcoin ETFs, which were heavy buyers last year, are now net sellers in 2026, offloading more than 10,600 BTC. Over the past week alone, spot ETFs recorded roughly $1.2 billion in outflows, as Bitcoin slid below $71,000 to a 15-month low.

Also Read: Hyperliquid Defies Crypto Slump as HYPE Eyes $50 on Major Product Expansion

Coinbase’s legal showdown over prediction markets and the collapse in its Bitcoin premium both point to mounting challenges. Even as the exchange presses a high-stakes federal preemption argument, institutional investors appear to be reducing risk exposure. Whether Coinbase can secure regulatory clarity while market conditions stabilize may prove critical for its position in the evolving U.S. crypto landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.