|

Getting your Trinity Audio player ready...

|

Circle, the issuer of the USD Coin (USDC) stablecoin, has officially filed for an Initial Public Offering (IPO), marking a significant milestone in the company’s journey toward mainstream financial integration. The firm intends to list its Class A common stock on the New York Stock Exchange (NYSE) under the ticker symbol “CRCL.” However, while the move underscores Circle’s ambitions, analysts have raised red flags about its financial health and long-term viability.

Financial Discrepancies Raise Concerns

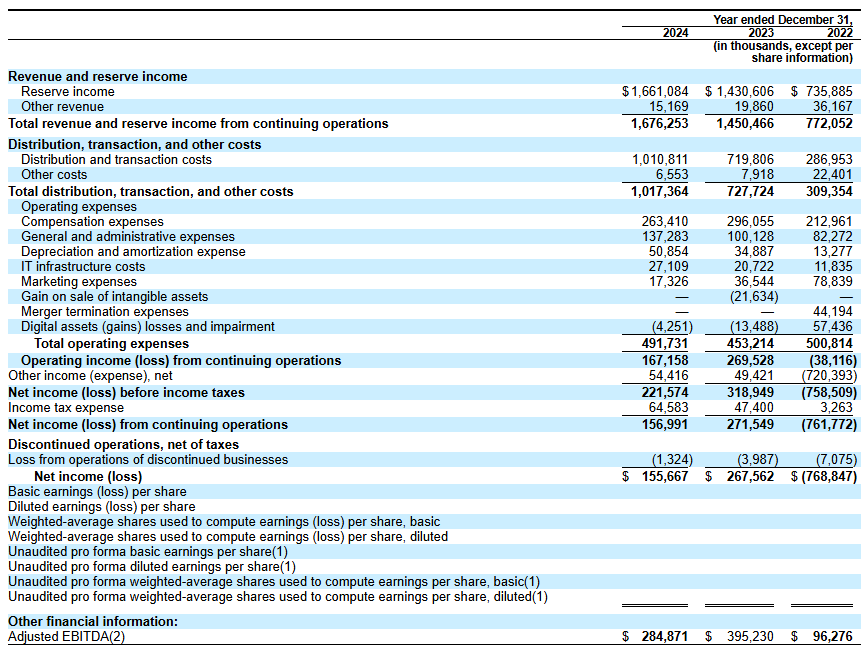

Circle’s IPO filing revealed impressive revenue growth, with earnings reaching $1.67 billion in 2024, a 16% increase year-over-year. However, a deeper dive into its financials paints a less optimistic picture. Notably, EBITDA fell by 29%, while net income saw a staggering 42% decline.

Matthew Sigel, Head of Digital Assets Research at VanEck, attributed this decline to multiple factors, including Circle’s rapid expansion, discontinued services like Circle Yield, and rising distribution and transaction costs. In 2024 alone, Circle spent over $1 billion on distribution and transaction expenses, a figure that far exceeds industry benchmarks. According to Farside Investors, this suggests the company is overextending itself in an effort to maintain market dominance.

Circle's revenues grew 16% but EBITDA and Net Income fell sharply.

— matthew sigel, recovering CFA (@matthew_sigel) April 1, 2025

Why? Four main reasons –>

Increased Partner Costs: A significant rise in distribution and transaction costs driven by higher fees paid to partners like Coinbase, due to increased reserve income and strategic… https://t.co/CHEv1PFdOk

Skepticism Over Valuation and Sustainability

Market analysts have also cast doubt on Circle’s $5 billion valuation. A crypto analyst known as Omar criticized the company’s high spending, pointing out that it allocates over $250 million annually to compensation and an additional $140 million to general administrative expenses. Moreover, with interest rates—a key income source for Circle—expected to decline, future profitability remains uncertain.

Adding to the skepticism, Circle has a history of significant financial losses. In 2022, the company recorded a $720 million loss amid a turbulent crypto market, raising concerns about its resilience to market downturns. Analysts suggest that the IPO might be a strategic move to secure liquidity before facing further financial struggles.

Circle has just filled for an IPO

— Farside Investors (@FarsideUK) April 1, 2025

In 2024, the company spent over $1bn on "distribution and transaction costs", probably much higher than Tether as a % of revenue

In 2022, the company lost $720m, the year FTX/3AC etc failedhttps://t.co/rStHS07yrF pic.twitter.com/d5zZz7ALvz

Potential Buyout Scenarios

Amid the uncertainty, industry experts have speculated on possible acquisition scenarios. Wyatt Lonergan, General Partner at VanEck, suggested that Coinbase could acquire Circle at a discount if market conditions worsen. Alternatively, Ripple might drive up Circle’s valuation to $15–$20 billion and execute a takeover.

Ok, upon reviewing the S-1 further here are my predictions for how this plays out:

— Wyatt Lonergan (@Wyatt_Lonergan) April 2, 2025

– Base case: Circle IPOs, rides the stablecoin narrative and buys themselves 12 months ish to 1) diversify revenue streams and 2) sign tier 1 distribution partners (eg Visa) who can scale USDC…

While Circle’s IPO presents an opportunity for public investment, the company must address fundamental financial inefficiencies to gain investor confidence. As the stablecoin market grows increasingly competitive, Circle’s ability to navigate economic headwinds will determine its success in the public markets.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: SBI Holdings & Circle Launch USDC Trading in Japan

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!