|

Getting your Trinity Audio player ready...

|

- Over 54M LINK accumulated around $16 signals strong on-chain support.

- Exchange reserves drop 6.18%, suggesting reduced sell pressure.

- A breakout above $20 could confirm Chainlink’s bullish reversal.

Chainlink (LINK) is showing renewed strength as on-chain data reveals heavy whale accumulation near the $16 level. Over 54.47 million LINK have been added to wallets around this price, forming one of the strongest support clusters in recent months. This surge in accumulation follows a rebound from the lower boundary of a descending channel—often a signal that selling pressure is waning and investor confidence is returning.

The $16 region has now become a critical line in the sand for LINK. Holding above it could pave the way for a bullish reversal, while losing it might extend the corrective trend that began earlier this quarter.

Market Data Signals Growing Confidence

Recent data from CryptoQuant shows Chainlink’s exchange reserves have dropped by 6.18%, now sitting at roughly $2.88 billion. This decline suggests investors are moving LINK off centralized platforms—a move typically linked with lower short-term sell pressure and rising confidence in price stability.

Meanwhile, derivatives metrics echo this optimism. The Futures Taker CVD (90-day) indicates strong buy-side activity, reflecting a clear bias toward long positions. Together, these signals point to a market that’s gradually shifting toward a bullish stance.

Key Levels to Watch: $20 and Beyond

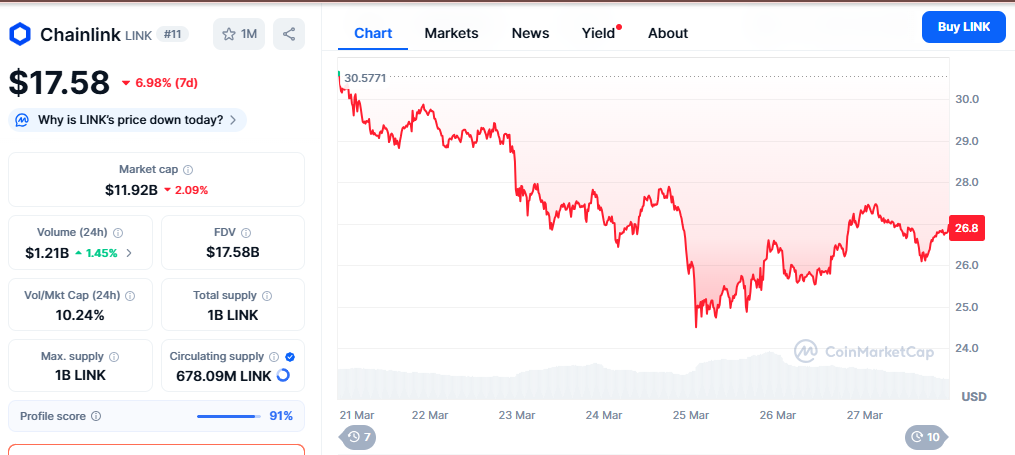

Technically, LINK’s price is trading near $18, testing mid-channel resistance. A successful breakout above $20 could open the door to higher targets at $23.75 and $27.81. However, failure to clear these zones might lead to short-term consolidation before any larger move unfolds.

With exchange supply tightening and whales accumulating at strategic levels, the setup appears primed for a potential breakout—if bullish momentum can sustain.

$16 as Chainlink’s Launchpad

Chainlink’s convergence of whale activity, reduced exchange reserves, and derivatives confidence paints a constructive picture. The $16 support zone is emerging as a launchpad for potential recovery, and a decisive move above $20 could confirm the start of a broader bullish phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink Whales Withdraw $15M — Is a $27 Rally Next?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.