|

Getting your Trinity Audio player ready...

|

A significant Chainlink (LINK) whale has made a notable re-entry into the market, spending $2 million to acquire 139,860 LINK at an average price of $14.3. This accumulation has increased the whale’s total holdings to 147,553 LINK, signaling strong confidence in the asset’s future price trajectory.

Interestingly, this same whale previously realized $161K in profit from past trades, reinforcing the notion that this is a calculated move rather than a speculative gamble. The strategic timing of this accumulation suggests anticipation of heightened volatility, especially as LINK’s price action consolidates within a technical squeeze.

Will LINK Break Out or Face Rejection?

At the time of writing, LINK is trading at $13.43, reflecting a 4.27% decline over the last 24 hours. The price is currently compressing within a symmetrical triangle and descending wedge, both of which hint at an imminent major move.

A breakout above the $15.68 resistance level could trigger a sharp rally to $18.18, representing a potential 35% surge. However, repeated rejections near the whale’s accumulation level at $14.3 indicate that bulls are facing significant resistance.

Conversely, a drop below the crucial $12.57 support would invalidate the bullish setup, likely leading to a deeper correction. As a result, this price range remains pivotal for LINK’s next directional move.

On-Chain Metrics Favor Accumulation

MVRV Z-Score Suggests Strong Accumulation Zone

LINK’s MVRV Z-score currently stands at 3.09, well below the overheated levels of 7 seen in late 2024. Historically, Z-scores between 2 and 3 have marked strong accumulation phases and early stages of price rallies. This suggests that the market is not in a profit-heavy position, reducing the likelihood of mass sell-offs.

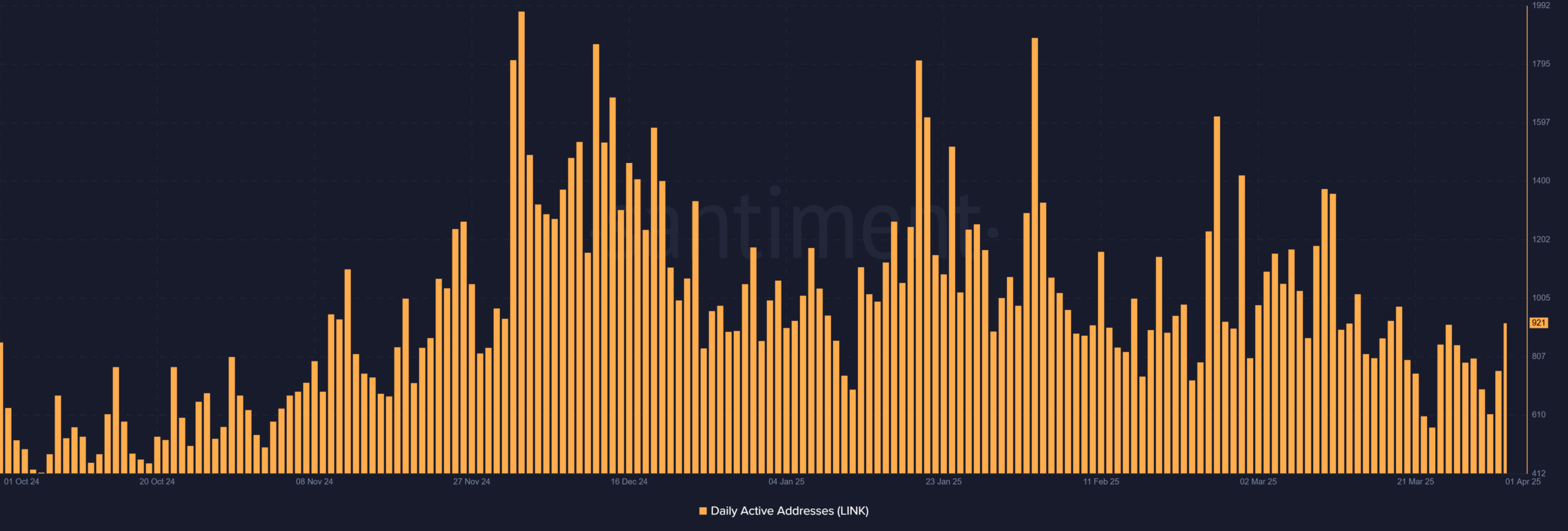

Rising Daily Active Addresses Reflect Growing Interest

Santiment data reveals a moderate increase in daily active addresses, reaching 921 at press time. While this remains below late 2024’s high-activity levels, it signifies a steady recovery from March’s downturn. A continuous rise in network activity could strengthen LINK’s bullish narrative.

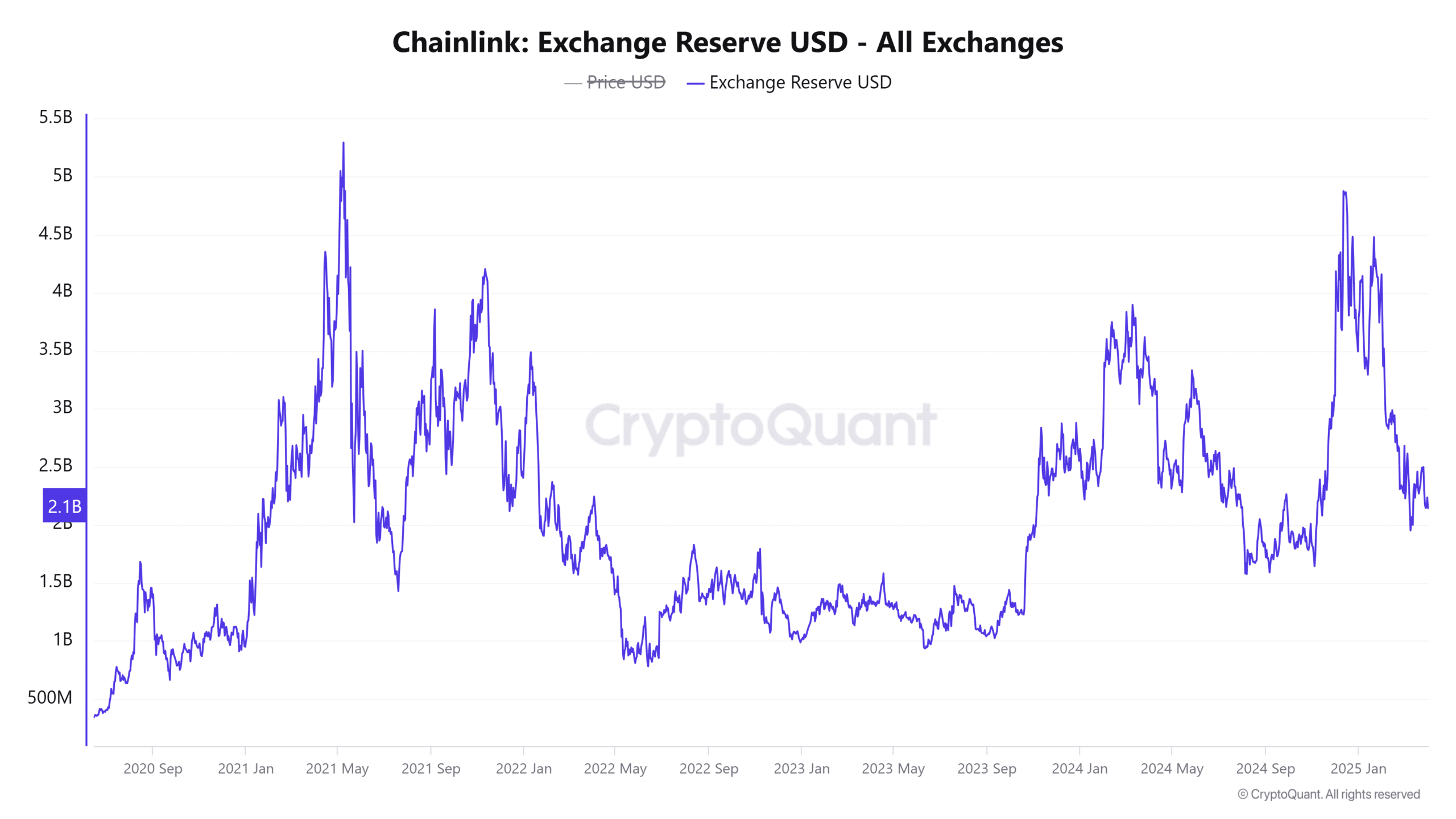

Exchange Reserves Declining—A Bullish Signal?

CryptoQuant data shows a 3.11% drop in exchange reserves, bringing the total reserve value to $2.15 billion. A decline in exchange reserves typically signals investor accumulation, reducing immediate sell pressure and often preceding price rallies.

Chainlink’s price action remains at a crucial juncture. If LINK successfully breaks above $15.68 with strong volume, a 35% rally to $18.18 becomes a strong possibility. Whale accumulation, a low MVRV risk, decreasing exchange reserves, and steady network activity all support a bullish outlook.

Also Read: Chainlink (LINK) Price Teeters on the Edge: Will Bears Push It Below $10 in April?

However, failure to maintain support above $12.57 could shift momentum bearish. LINK’s next move hinges on whether bulls can generate enough momentum to escape its current consolidation phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.