|

Getting your Trinity Audio player ready...

|

Chainlink (LINK), a key player in the oracle network space, has been under the spotlight recently due to significant activity from large investors, also known as whales. This surge in whale accumulation, coupled with recent price movements, has analysts buzzing about potential market sentiment and future price direction for LINK.

Whales Accumulating LINK: A Sign of Confidence?

Analyst Ali Martinez, citing data from Santiment, highlights a notable trend: whales have been accumulating LINK over the past three weeks. This buying spree translates to a staggering 8.46 million LINK tokens, valued at roughly $118.44 million. The data is presented in a detailed chart spanning April to July 2024, showcasing both LINK’s price fluctuations and whale accumulation patterns.

A closer look reveals a price dip for LINK in late April, followed by a gradual recovery through May and June, with some volatility continuing into July. Interestingly, the chart also highlights a surge in whale activity (represented by the yellow area) from late June to mid-July. This significant accumulation suggests growing confidence among large investors in Chainlink‘s long-term potential.

Investor Distribution and Support Levels

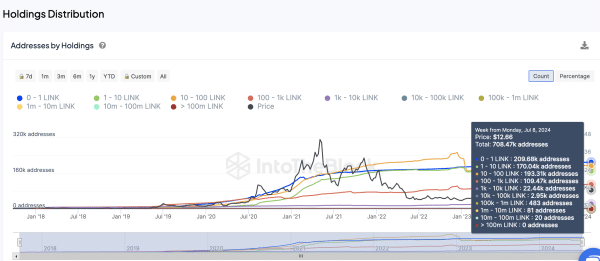

To understand the broader market sentiment, further analysis from IntoTheBlock sheds light on the distribution of LINK holdings across different investor categories. As of July 8th, 2024, the data reveals a high concentration of addresses holding smaller amounts of LINK (between 0 and 10 LINK), indicating widespread participation from retail investors.

However, the real story lies with larger holders, specifically those with balances between 100,000 and 1 million LINK, and those holding 1 million to 10 million LINK. While these addresses represent a smaller number compared to retail investors, the volume they hold is significant. Notably, there has been a slight increase in addresses holding the highest tier (1M-10M LINK) over time, suggesting some ongoing accumulation by whales and institutional investors.

This investor distribution data, combined with previous reports on LINK’s price resistance and support levels, paints a more complete picture. The key support zone identified is between $12.52 and $12.87, where a significant number of addresses (around 9.1K) hold a combined 38.32 million LINK tokens. This strong support base suggests a price floor where many investors are currently in profit.

On the flip side, overcoming resistance levels in the $12.92 to $14.44 range will be crucial for further upward price movement. Analyst Martinez, leveraging data from IntoTheBlock, suggests that breaking the resistance at $14.04 could propel LINK towards $15.50.

Capitulation and Potential Market Bottom

Interestingly, recent data from Santiment hints at LINK potentially nearing a market bottom. This conclusion is based on investor behavior, including a significant spike in capitulation (selling due to fear or frustration) – the highest this year – and substantial realized losses. The data reveals a peak of $60 million in realized losses on July 8th, reflecting a period of high fear, uncertainty, and doubt (FUD) among traders. Historically, such capitulation events can be indicative of a market bottom, suggesting a potential turning point for LINK’s price.

The Verdict: Whale Confidence Meets Market Psychology

While the recent whale accumulation in LINK is certainly a noteworthy development, it’s crucial to consider the broader market sentiment. The high level of capitulation and realized losses suggest a period of FUD, but could also signal a potential market bottom. Whether LINK experiences a sustained price increase will depend on these combined factors, along with the strength of the overall crypto market. Investors are advised to conduct thorough research and due diligence before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!