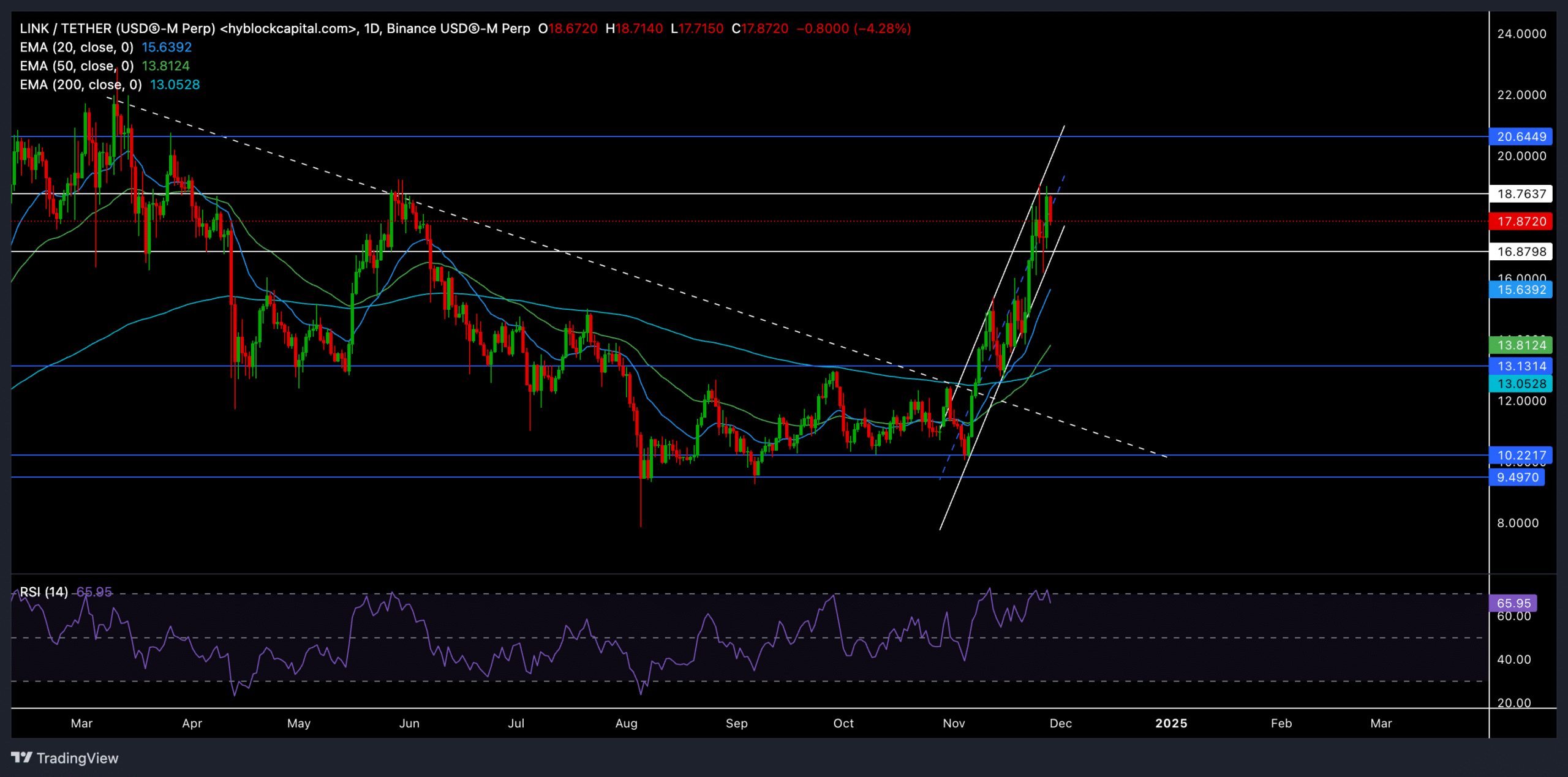

Chainlink (LINK) has been on a tear, recently soaring by over 74% to reach a 6-month high near the $18.7 resistance level. This impressive rally has propelled LINK above key exponential moving averages (EMAs), signaling a strong bullish momentum.

Technical Analysis – A Bullish Outlook

LINK’s price action has formed a clear uptrend, characterized by higher highs and higher lows. The recent surge above the 20-day, 50-day, and 200-day EMAs underscores the strong buying pressure behind the token.

A breakout above the $18.7 resistance could pave the way for further gains, potentially pushing LINK towards the next major resistance at $20. However, a failure to break above this level might trigger a near-term correction towards the $15 support.

The Relative Strength Index (RSI) currently sits at 65.95, indicating bullish momentum but approaching overbought territory. A potential bearish divergence between the RSI and price action could signal a short-term pullback. However, the strong support from the EMAs suggests that the overall bullish trend remains intact.

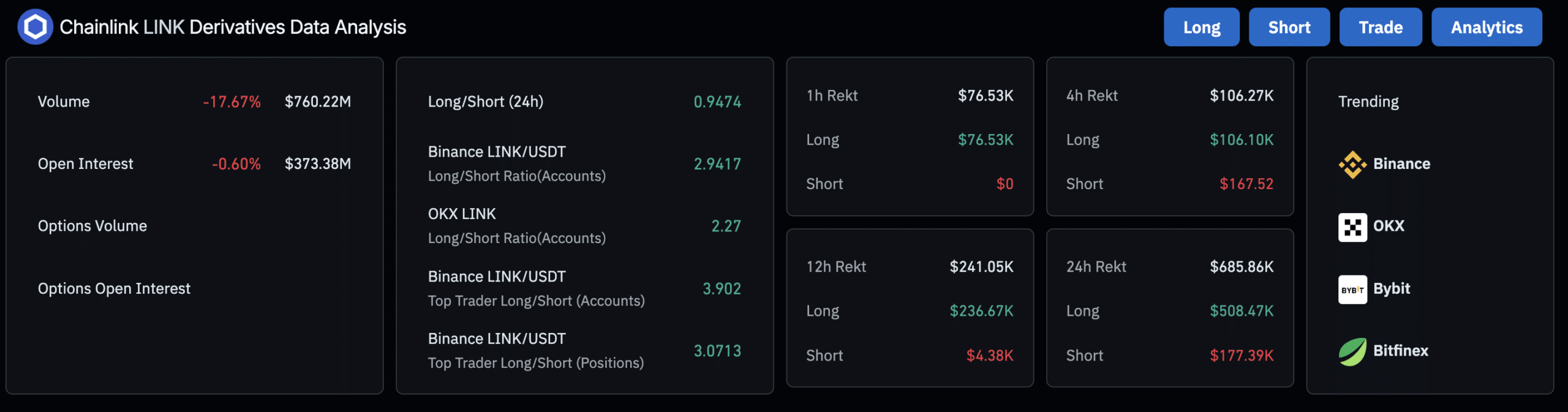

Derivatives Market Sentiment: A Mixed Bag

While LINK’s trading volume has declined by 17.67% to $760.22 million, and open interest has slightly decreased, traders appear cautious as the price approaches the $18.7 resistance. The long/short ratio across exchanges is currently 0.9474, indicating a balanced sentiment among traders. However, platforms like Binance and OKX show a stronger preference for long positions, suggesting that many traders are optimistic about LINK’s potential upside.

Chainlink’s recent surge has been impressive, but the $18.7 resistance level poses a significant challenge. A successful breakout could ignite further bullish momentum, while a failure to break above this level might lead to a short-term correction. Traders should closely monitor Bitcoin’s price action and broader market sentiment for clues on LINK’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Gains 53% in a Month – Why Analysts Predict a $100 Price Target for This Bull Run