|

Getting your Trinity Audio player ready...

|

Chainlink (LINK) has emerged as a focal point in the cryptocurrency market, recording an impressive 18% rally over the past three days. The token’s rebound from a critical support zone at $19 underscores its resilience, even amid broader market volatility.

Driving this surge is a significant uptick in whale activity. A prominent analyst on X (formerly Twitter) disclosed that large holders have accumulated over 1.40 million LINK in the last 96 hours. This substantial accumulation by major investors signals growing confidence and hints at a potential long-term bullish trajectory for the asset.

Whales have bought over 1.40 million #Chainlink $LINK in the last 96 hours! pic.twitter.com/ixnXYD2CM0

— Ali (@ali_charts) January 5, 2025

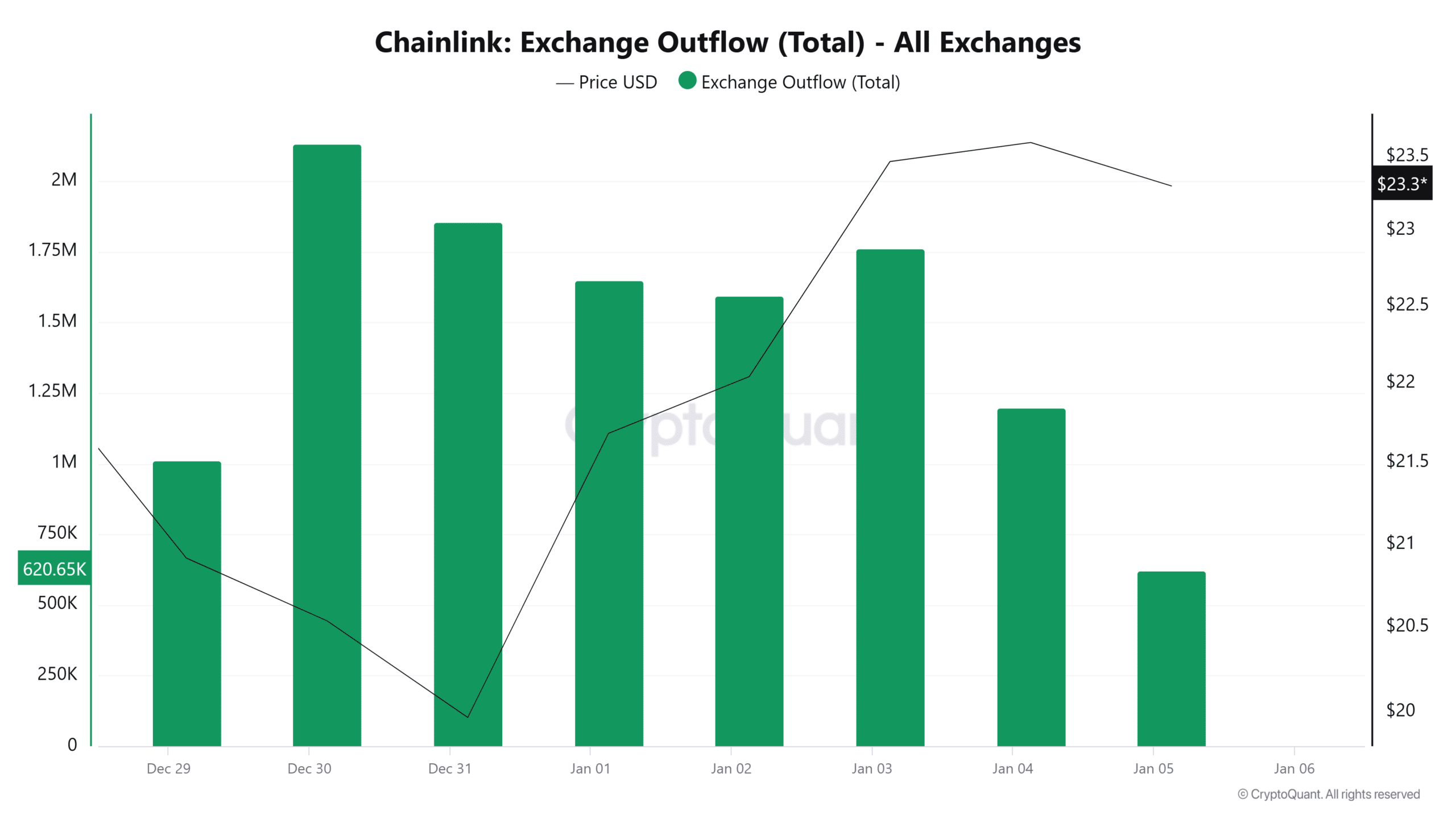

Exchange Outflows Decline, Confidence Builds

On-chain metrics further illustrate LINK’s positive outlook. AMBCrypto’s analysis reveals a steady decline in exchange outflows over the last three days. This trend, which reflects reduced movement of tokens to trading platforms, often suggests that holders are opting to retain their assets rather than prepare for sell-offs. Such behavior points to an optimistic market sentiment.

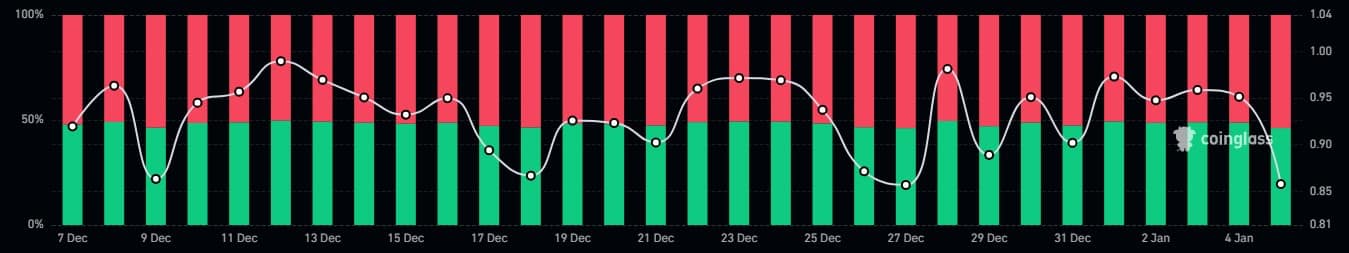

Meanwhile, Coinglass data shows a bearish long/short ratio, with short positions gradually decreasing. This reduction could be linked to profit-taking following LINK’s recent rally. However, the persistent accumulation by whales suggests a strategic focus on long-term value rather than short-term speculation.

Could Whale Activity Propel LINK Higher?

Historically, increased whale activity has often been a precursor to bullish market rallies. If the current trend of accumulation persists, LINK could gain additional upward momentum in the coming days. The diminishing presence of short positions also reduces selling pressure, creating a favorable environment for further price appreciation.

Chainlink’s ability to maintain investor confidence despite market fluctuations speaks to its strength as a leading blockchain protocol. With whale accumulation serving as a strong indicator of potential growth, LINK is well-positioned to test higher resistance levels in the near future.

Also Read: Chainlink Price Forecast: Whale Profit-Taking Triggers 3% Dip – Can LINK Hold $20 Support?

As market dynamics evolve, all eyes remain on Chainlink to determine whether this surge marks the beginning of a sustained bullish run or a temporary rally. For now, the token’s performance continues to capture the attention of crypto investors worldwide.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!