|

Getting your Trinity Audio player ready...

|

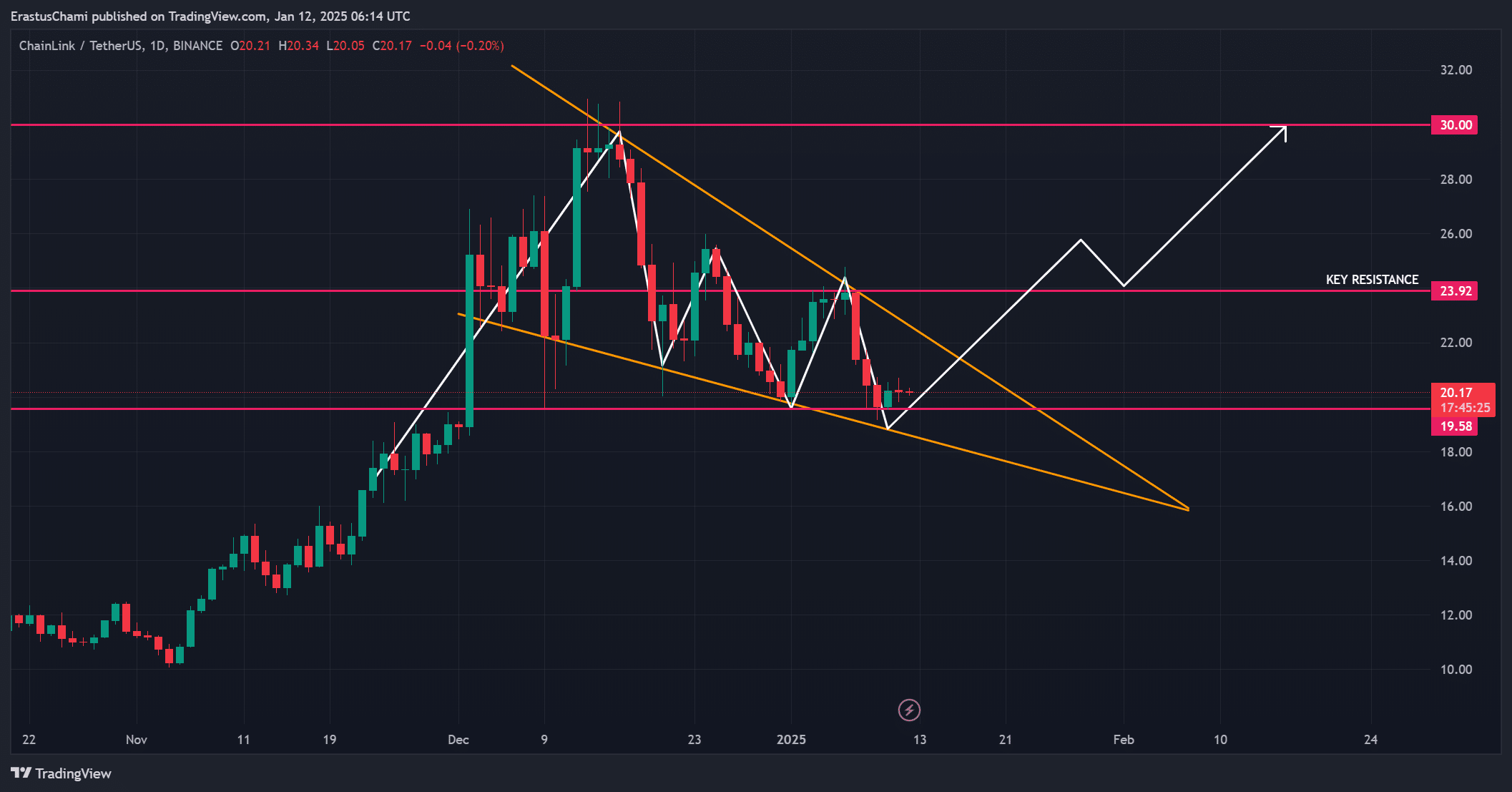

Chainlink [LINK] has recently captured the market’s attention, showing signs of strength amid steady consolidation. Currently trading at $20.17 with a 0.62% uptick at press time, LINK appears poised for a potential breakout, forming a bullish descending wedge pattern. As the price nears a critical resistance level at $23.92, all eyes are on whether LINK can break through and launch a rally toward $30.

Price Action Points to Bullish Potential

Chainlink’s price action has been trapped within a descending wedge pattern, marked by lower highs and lower lows. While this structure is often associated with bullish breakouts, the key to its success lies in breaking the $23.92 resistance level. If LINK can manage to surpass this barrier, the next target is $30—a psychological level that could trigger significant market interest. On the flip side, failure to break resistance might lead to more consolidation, stalling the bullish scenario and prolonging the wait for a breakout.

On-Chain Metrics Bolster Optimism

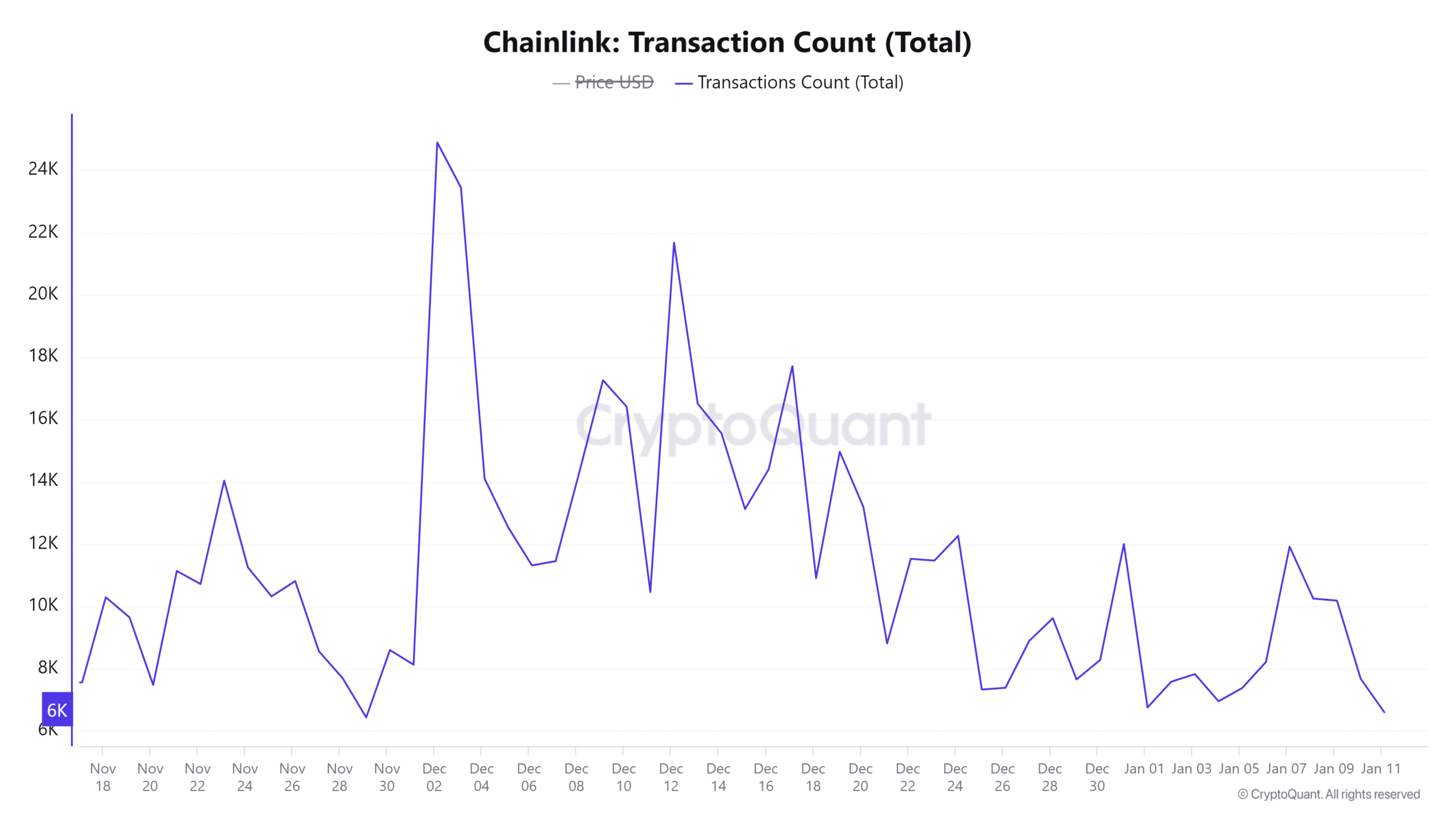

On-chain activity further strengthens the bullish case for LINK. Active addresses have grown by 0.86% in the past 24 hours, signaling an uptick in user engagement. Additionally, transaction counts have risen by 0.88%, indicating increasing demand. These metrics show growing interest in Chainlink, a positive sign for sustaining potential rallies. Exchange reserves for LINK have also decreased by 0.11%, suggesting reduced selling pressure. This shift in supply-demand dynamics could pave the way for a price surge.

Market Sentiment Favors a Bullish Outlook

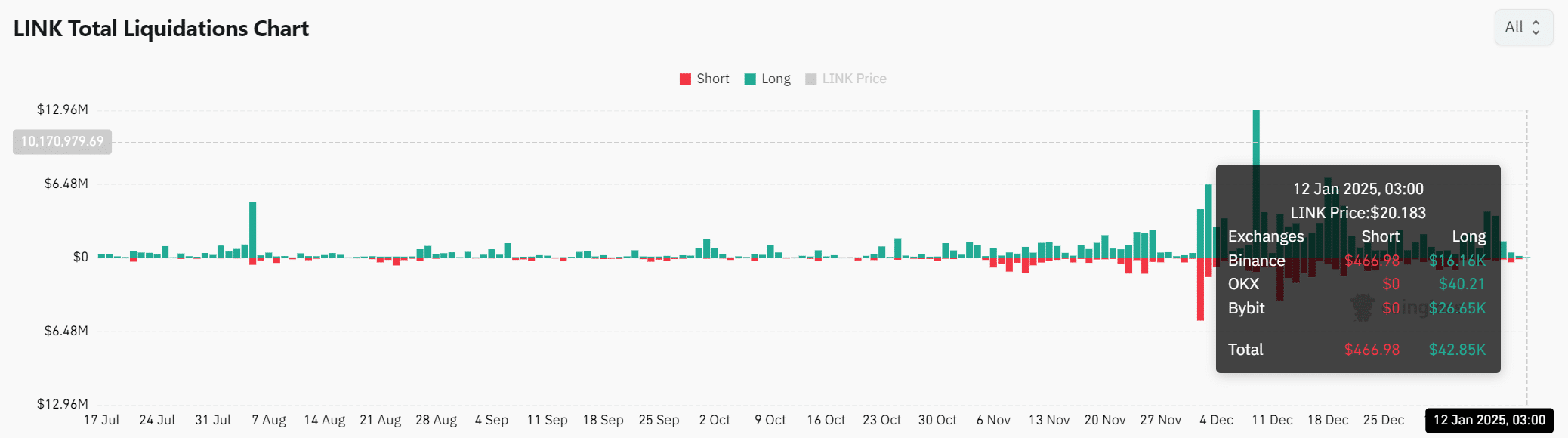

Market sentiment surrounding LINK is becoming more optimistic. Open interest has surged by 5.42%, hitting $724.59 million, a sign of growing confidence and participation. Moreover, liquidation data reveals more shorts than longs, indicating that traders are positioning themselves for a potential upside.

In summary, Chainlink is positioned for a breakout, driven by a bullish wedge pattern, favorable on-chain metrics, and positive market sentiment. Breaking the $23.92 resistance could trigger a rally to $30, marking the next key move for LINK.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Eyes Bullish Breakout: 46% Surge in New Addresses & Rising Outflows

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.