|

Getting your Trinity Audio player ready...

|

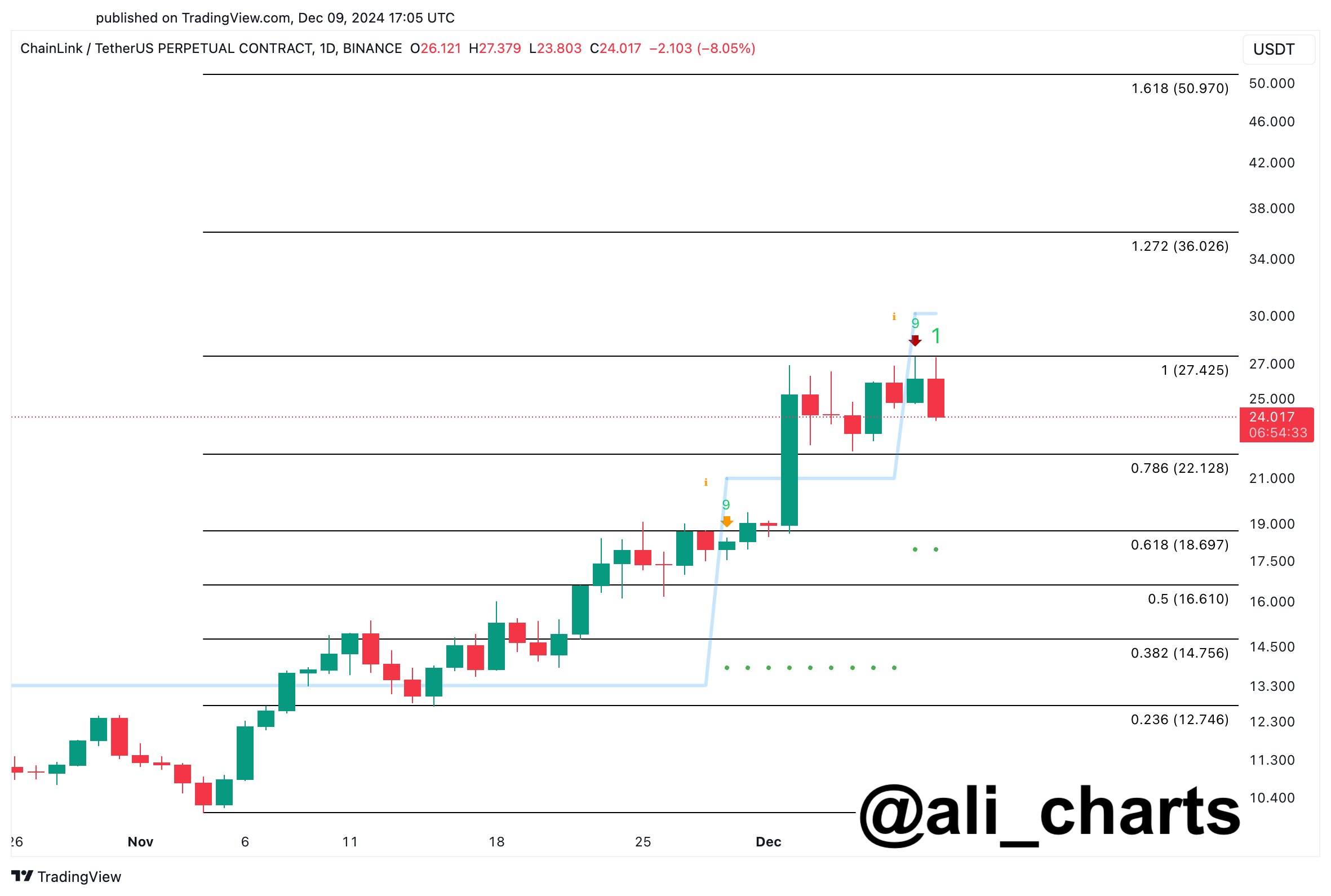

Chainlink (LINK) has recently experienced a notable increase in network activity, with daily active addresses growing by a staggering 142% over the past month. Averaging 8,220 active addresses, this surge in adoption signals a growing interest in the decentralized oracle network. According to a recent updates, analysts are anticipating a potential 30% surge for LINK, with key resistance at $27 in focus. However, despite this growth, LINK’s price has faced significant downward pressure, dropping over 12% in the last 24 hours, now sitting at $22.89.

Rising Activity Amid Price Struggles

Chainlink’s increased network activity is evident in the numbers: daily transactions have averaged 11,260 over the past week, according to IntoTheBlock. This uptick in user engagement highlights the growing adoption of the LINK token, particularly in decentralized finance (DeFi) applications. However, this positive momentum has not been enough to support the token’s price, which has taken a hit recently. The sharp drop in LINK’s value coincides with growing selling pressure, which is starting to erode market confidence.

Selling Pressure and Whale Activity

Crypto analyst Ali Martinez highlighted the intensifying selling pressure on LINK, pointing to the TD Sequential indicator, which signals a possible decline. Santiment data also revealed an increase in LINK’s supply on exchanges, while off-exchange holdings saw a decline.

In addition, whale activity has played a role in the recent price drop, with over $25 million worth of LINK being deposited into centralized exchanges. These large-scale movements have triggered fears of further price declines, with the $20.66 support level now under scrutiny.

Also Read: Chainlink (LINK) Eyes Bullish Breakout: Ascending Triangle Pattern Signals Over 30% Gain Potential

Potential for Trend Reversal

Despite the bearish sentiment, there is hope for a reversal. The Fear and Greed Index is currently showing a “fear” phase at 38%, indicating that market participants may be approaching a turning point. For LINK to stabilize and regain upward momentum, it needs to reclaim the $24.30 mark. Failure to do so could result in further liquidation risks, prolonging the downtrend.

At this critical juncture, Chainlink’s price movement will depend on whether bulls can step in and counteract the current selling pressure. Analysts remain divided on whether LINK will break past resistance or face more challenges in the short term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.