|

Getting your Trinity Audio player ready...

|

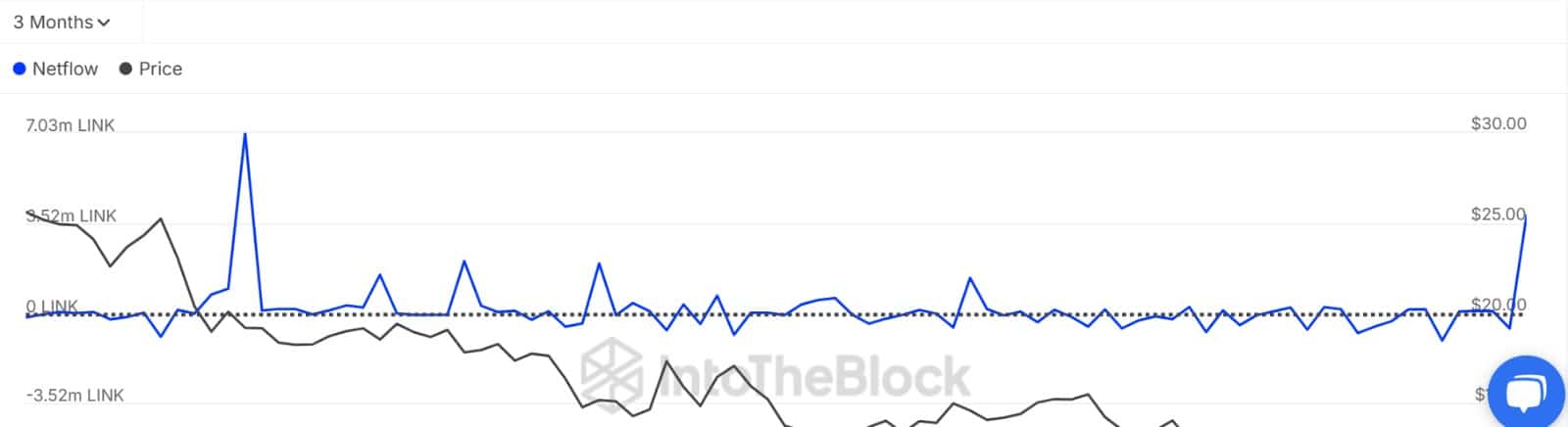

After a challenging period marked by declining prices since hitting a high of $27 three months ago, Chainlink [LINK] is witnessing a significant shift in market sentiment. Over the past month, a notable return of buyers has fueled a positive turnaround for the altcoin. Data from IntoTheBlock reveals consistent outflows from exchanges, indicating a strong accumulation trend among investors. In the last 30 days alone, net outflows of LINK have surpassed $120 million.

Keep an eye on altcoin exchange flows👀$LINK has seen consistent outflows from exchanges over the past month, hinting at ongoing accumulation. In total, net outflows surpass $120 million worth of LINK in the last 30 days. pic.twitter.com/XbU4qsGuWd

— IntoTheBlock (@intotheblock) April 22, 2025

This substantial spike in outflows underscores growing demand for Chainlink, with investors actively acquiring the digital asset. Reinforcing this trend is Chainlink’s Exchange Netflow, which has remained consistently negative for the past 12 days. This sustained negative netflow suggests a strong bullish outlook among investors, with those accumulating seemingly holding firm control over the market dynamics.

Whale Activity Signals Strong Confidence in Chainlink

The accumulation trend is particularly pronounced among large holders, commonly referred to as whales. Notably, large holders’ netflow has surged to a two-month high of 3.81 million LINK tokens. This significant influx indicates a strong return of these influential investors to the market, further bolstering the bullish sentiment surrounding Chainlink. With both overall exchange netflow and whale netflow pointing towards accumulation, it suggests a widespread expectation of price appreciation across all market participants.

Strengthening Fundamentals Underpin Bullish Momentum

Beyond capital flows, Chainlink’s underlying fundamentals are also exhibiting positive growth. The number of active addresses on the network has seen a significant increase, rising from 2.3k to 3.6k in just four days – a jump of 1.3k. An increase in active addresses typically signifies growing interest and engagement with the network, often preceding a bullish price trend.

Also Read: Chainlink (LINK) Dips 3% but Accumulation Signals Hint at Imminent Breakout

What the Future Holds for LINK Price Action

Riding this wave of positive sentiment and strengthening fundamentals, Chainlink has experienced strong upward momentum. At the time of writing, LINK was trading at $14.95, marking a substantial 12.05% increase on the daily chart and a 22.38% rise over the past week. This recent price surge has enabled Chainlink to break out from a descending triangle pattern that had constrained its price action for the previous two months. Following this breakout, the next significant resistance level to watch lies around $16.12.

However, the sharp price increase also means that many investors who were previously holding unrealized losses are now back in profit. Should these holders decide to capitalize on the recent gains by taking profit, a potential pullback towards the $13.7 level could occur. Nevertheless, the underlying accumulation trend and strengthening fundamentals suggest a positive outlook for Chainlink in the medium term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.