|

Getting your Trinity Audio player ready...

|

After reaching a recent high of $30.49, Chainlink (LINK) has experienced a notable market correction, dipping to a low of $27.49. As of the latest market update, LINK is trading at $28.22, reflecting a 3.02% decline in the past 24 hours. Despite this retracement, Chainlink remains bullish in the longer term, with impressive gains of 21.43% on the weekly charts and an extraordinary 97.74% increase on the monthly charts.

The current pullback has presented a potential buying and accumulation opportunity for investors. Notably, whale activity has surged during this decline, indicating confidence in Chainlink’s long-term prospects. According to data from Lookonchain, a significant Chainlink whale has accumulated 100,000 LINK tokens, valued at $2.95 million, from Binance in the past 24 hours. Over the past three days, this whale has withdrawn a total of 529,999 LINK tokens worth $15.5 million.

The whale withdrew another 100,000 $LINK($2.95M) from #Binance 6 hours ago.

— Lookonchain (@lookonchain) December 17, 2024

In the past 3 days, this whale has withdrawn a total of 529,999 $LINK($15.5M) from #Binance.

Address:

0x3c9Ea5C4Fec2A77E23Dd82539f4414266Fe8f757 pic.twitter.com/gACJRuPBdG

This increased whale accumulation comes in the wake of a 41.5% surge in whale activity, as reported by IntoTheBlock. This trend suggests that large holders are taking advantage of LINK’s dip to build their positions. As a result, the Large Holders Netflow to Exchange Netflow Ratio has been negative for the past three days, indicating that whales are hoarding LINK and reducing potential selling pressure. This behavior is typically viewed as a bullish sign, as it implies long-term holding intentions from these major investors.

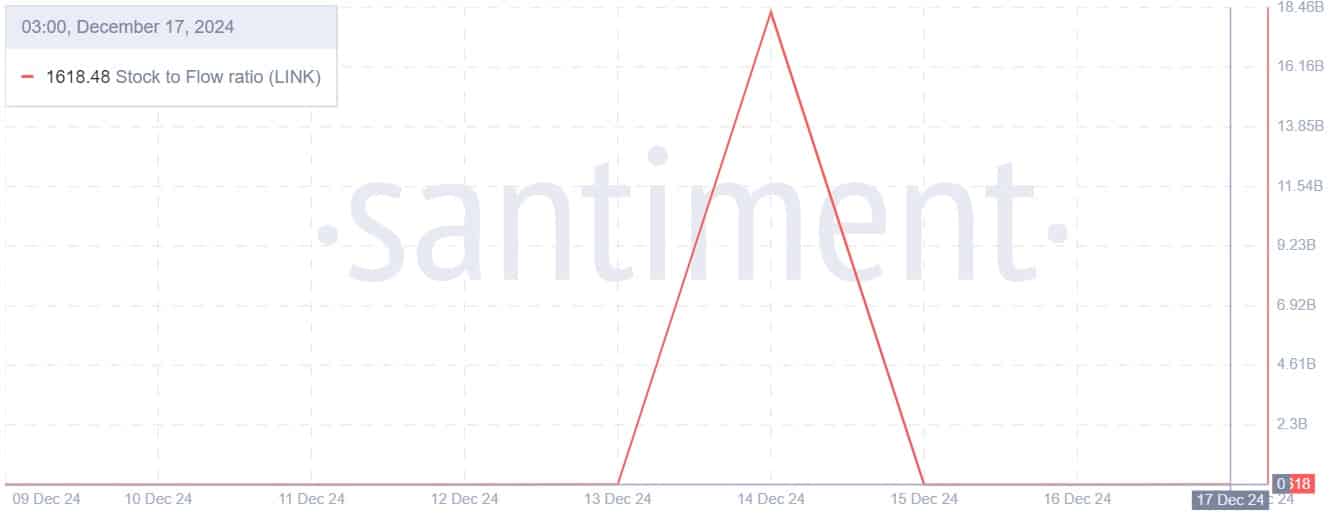

Furthermore, Chainlink’s stock-to-flow ratio (SFR) has experienced a significant spike, rising from 0 to 1618.48. This shift indicates a decrease in supply, suggesting increased scarcity of LINK tokens and contributing to a more favorable market sentiment. A reduction in liquidity, combined with increased demand, could drive the price of LINK higher in the coming weeks.

While LINK has experienced a daily decline, the overall market remains optimistic. If the current bullish sentiment continues, Chainlink could soon reclaim the $30 resistance level and target $32.2. However, if selling pressure intensifies, a further dip to $26.9 remains a possibility.

In conclusion, despite the short-term pullback, Chainlink’s strong whale accumulation and positive market indicators point to a promising future for LINK.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.