|

Getting your Trinity Audio player ready...

|

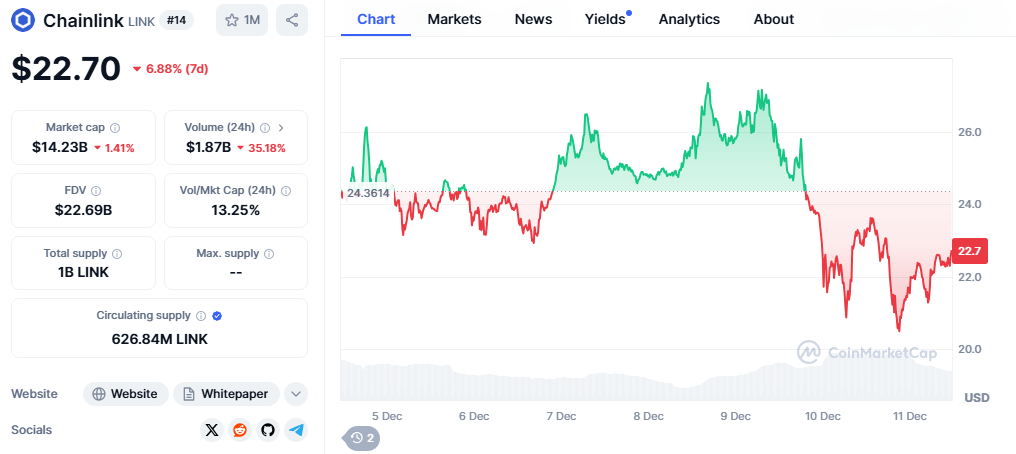

Chainlink (LINK), a leading blockchain oracle network, has formed a distinct ascending triangle pattern on its price chart, indicating a potential surge in bullish momentum. This technical formation suggests that buying pressure is outpacing selling pressure, with aggressive buyers consistently initiating purchases at higher price levels during dips.

What’s Next for Chainlink Price?

The critical resistance level for LINK is currently positioned near the $27 mark. A successful breach of this level could trigger a significant price breakout, potentially propelling LINK to new heights. Supporting this bullish outlook, trading volume data has shown a notable increase during recent price uptrends, indicating robust interest from buyers.

Technical indicators further reinforce the bullish sentiment. The Moving Average Convergence Divergence (MACD) indicator, currently hovering near the zero line, may soon cross above it, signaling a potential upward trend. The Relative Strength Index (RSI) is currently at a neutral level of 52.50, indicating that LINK still has room to climb before entering overbought territory.

Derivatives Market: A Mixed Bag

The derivatives market presents a more complex picture. Open interest, which measures the total number of unsettled derivative contracts, has recently surged, suggesting increased trader engagement and potential price volatility. However, the summed-up futures bid-ask delta reveals a bearish sentiment, with sell orders outpacing buy orders in recent days. This could indicate profit-taking or preparation for a potential price correction.

The recent dip in LINK’s price to $23.13 has led to a 16.40% decline in open interest to $587.95 million, according to Coinglass. Additionally, long liquidations have spiked to $11.18 million, suggesting short-term selling pressure that could weigh on the LINK price.

Chainlink’s ascending triangle pattern and increasing buying interest point to a potential bullish breakout. However, the mixed signals from the derivatives market introduce an element of uncertainty. Traders and investors should closely monitor technical indicators, trading volume, and derivatives market activity to gauge the future direction of LINK’s price.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Sees Surge in Activity but Faces Selling Pressure – Will It Rebound?

Crypto and blockchain enthusiast.