|

Getting your Trinity Audio player ready...

|

- Ripple and a16z earned praise in high-level Senate crypto talks.

- Lawmakers are refining a market structure bill for digital assets.

- Industry leaders see 2025–2026 as pivotal for U.S. crypto regulation.

Stay ahead with real-time updates and insights—Join our Telegram channel!

A closed-door session in Washington, D.C. on September 17 brought together some of the biggest voices in Crypto and U.S. lawmakers aiming to shape the future of digital asset regulation. The ninety-minute meeting marked a rare moment of alignment between policymakers and industry leaders as they refined the latest draft of the Senate’s market structure bill.

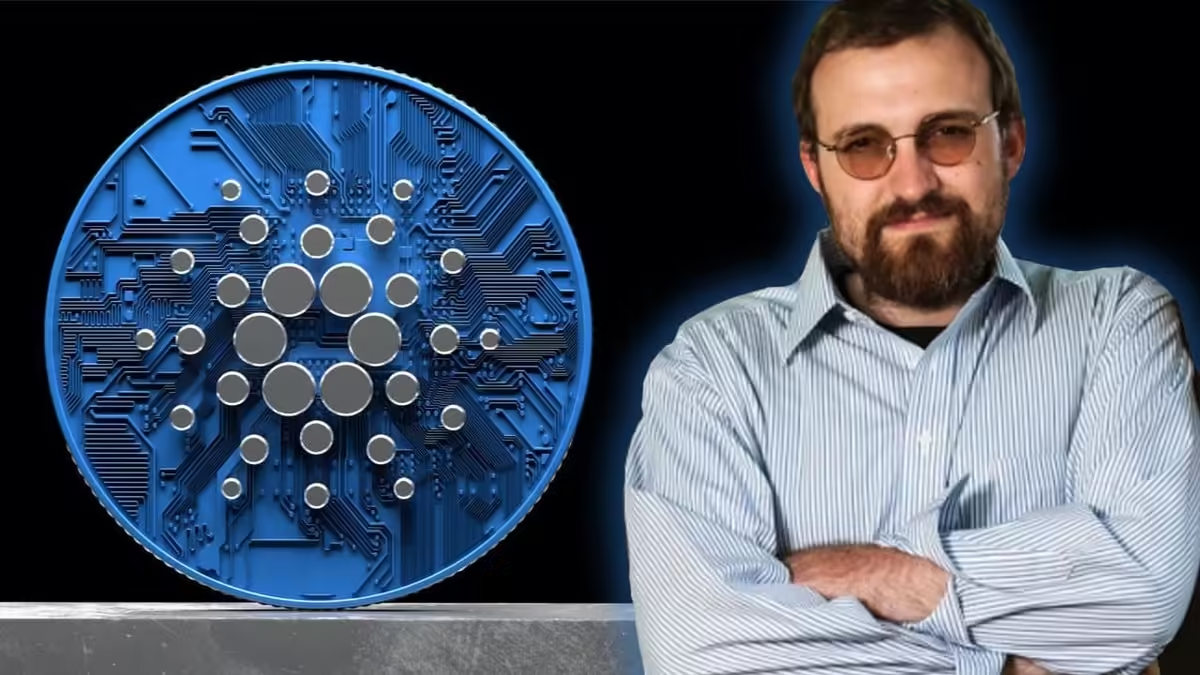

Hoskinson Praises Ripple and a16z’s Policy Push

Cardano founder Charles Hoskinson emerged from the session optimistic, commending Ripple and venture firm a16z for effectively representing industry interests. He acknowledged that while significant work remains, the tone of the discussion signaled genuine progress toward passing bipartisan crypto legislation this year.

Hoskinson’s comments underscore Ripple’s growing influence in U.S. policy circles, particularly after its legal victories over the SEC. His public praise suggested a shift from confrontation toward collaboration between regulators and innovators.

Great meeting today. XRP nation, the ripple folks did really well as did A16Z. Lot more work to do, but great progress is being made on bipartisan legislation being passed this year

— Charles Hoskinson (@IOHK_Charles) September 17, 2025

Ripple’s Monica Long: “Regulatory Clarity Is Coming”

Ripple President Monica Long echoed the optimism. She described blockchain as a “financial revolution” still waiting to be integrated into mainstream finance due to years of regulatory delays. Long pointed to recent momentum—first the GENIUS Act on stablecoins, then the CLARITY Act, and now the Senate’s Responsible Financial Innovation Act (RFIA)—as signs that change is underway.

Also Read: Cardano Breakout Imminent: ADA Eyes $1.25 as Bulls Gather Momentum

She applauded lawmakers like Senators Tim Scott and Cynthia Lummis for engaging with the industry and stressed the need for rules that protect consumers while fostering innovation. Long framed the dialogue as a turning point, noting lawmakers’ growing openness to real-world blockchain applications.

Path Ahead for U.S. Crypto Regulation

The Senate Banking and Agriculture Committees will now continue refining the bill, which will determine which agencies—SEC, CFTC, or FinCEN—oversee digital assets. Achieving the required 60 Senate votes will demand bipartisan support, but industry participants left the meeting hopeful that 2025–2026 could finally deliver the regulatory clarity the U.S. crypto market has long sought.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!