|

Getting your Trinity Audio player ready...

|

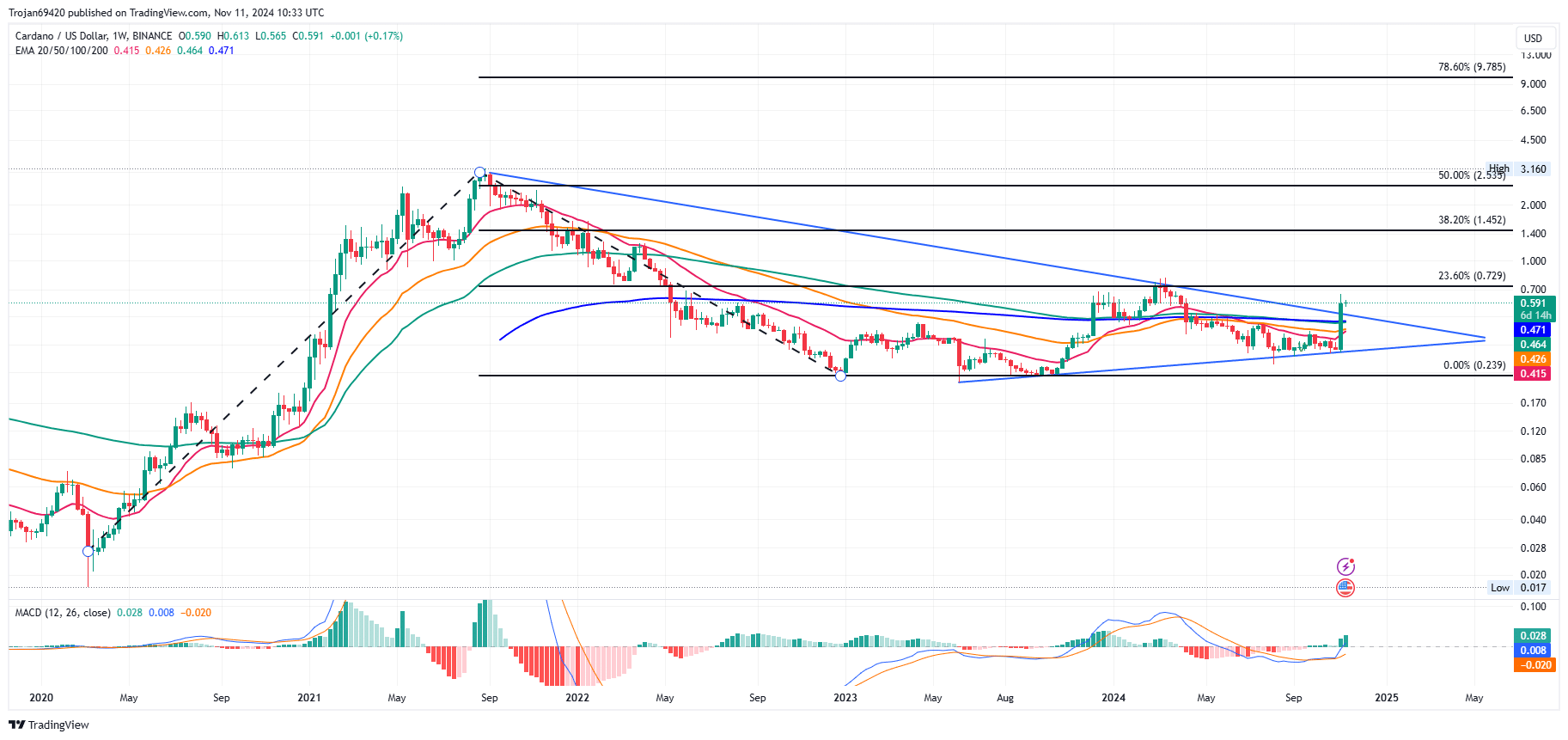

Cardano (ADA) has been on a remarkable bull run, surging by a staggering 77% in just one week. The cryptocurrency’s recent breakout from a descending triangle pattern has ignited a bullish momentum, propelling its price towards the highly anticipated $1 psychological level.

A closer look at Cardano’s technical indicators reveals a strong bullish bias. The 50-day and 100-day exponential moving averages (EMAs) have crossed over, indicating a potential uptrend. Additionally, the 20-day EMA has crossed above the 200-day EMA, further strengthening the bullish outlook.

On the weekly chart, Cardano formed a symmetrical triangle pattern during its recent consolidation phase. The recent breakout from this pattern, confirmed by a powerful bullish engulfing candle, signals a continuation of the uptrend.

Is The $1 Target A Realistic Possibility?

With the current bullish momentum, Cardano has the potential to break the $1 resistance level and reach new heights. Fibonacci retracement levels suggest that the next significant resistance lies at the 23.6% level, around $0.729. A successful breakout above this level could open the door for a potential rally to the 38.2% level, which aligns with the $1 target.

However, it’s important to note that the cryptocurrency market is highly volatile, and price predictions can be uncertain. While the technical indicators and market sentiment are currently bullish, it’s crucial to monitor the market closely for any signs of a potential reversal.

Key Support and Resistance Levels

- Support Levels: $0.50, Broken resistance trendline

- Resistance Levels: $0.60, $0.729, $1.00

Cardano’s recent bullish breakout has generated significant excitement among investors. The technical indicators and on-chain metrics suggest that the cryptocurrency has the potential to continue its upward trajectory and reach the $1 milestone. However, investors should exercise caution and manage their risk, as the cryptocurrency market is subject to rapid price fluctuations.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.