|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has shown signs of life in the past 24 hours, rebounding from a recent price slump. The cryptocurrency managed to recoup some of its losses, offering a glimmer of hope for investors. However, the sustainability of this uptrend remains uncertain due to several factors.

After a four-day decline that saw its price dip from around $0.40 to $0.39, ADA has managed to claw its way back to the $0.41 level. This recovery has been accompanied by a strengthening Relative Strength Index (RSI), suggesting a potential shift in market sentiment from bearish to neutral.

While the price action is encouraging, a closer look at trading volume tells a different story. Cardano’s trading volume has plummeted by over 15% in the last 24 hours, raising concerns about the strength of the ongoing rally. A decline in trading volume can indicate waning investor interest, which could hinder the cryptocurrency’s ability to sustain its upward trajectory.

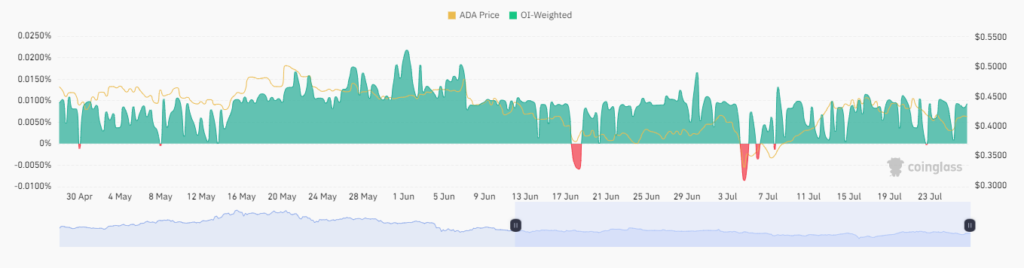

Further analysis of Cardano’s Open Interest reveals a slight decrease, suggesting that some traders are closing their positions. This metric, which measures the total number of outstanding derivative contracts, is another cause for caution. A sustained decline in Open Interest could signal decreasing market confidence and potentially limit future price gains.

In conclusion, while Cardano’s recent price recovery is a positive development, the underlying metrics suggest a complex picture. The cryptocurrency faces challenges in sustaining its momentum due to declining trading volume and Open Interest. Investors should closely monitor these indicators to gauge the strength of the ongoing recovery and assess the potential for future price movements.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!