|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has been making significant strides in the cryptocurrency market, with a 51% surge in the past week. As of November 14th, ADA was trading at $0.55, having reclaimed its position among the top 10 cryptocurrencies by market capitalization.

Technical Analysis: A Bullish Outlook

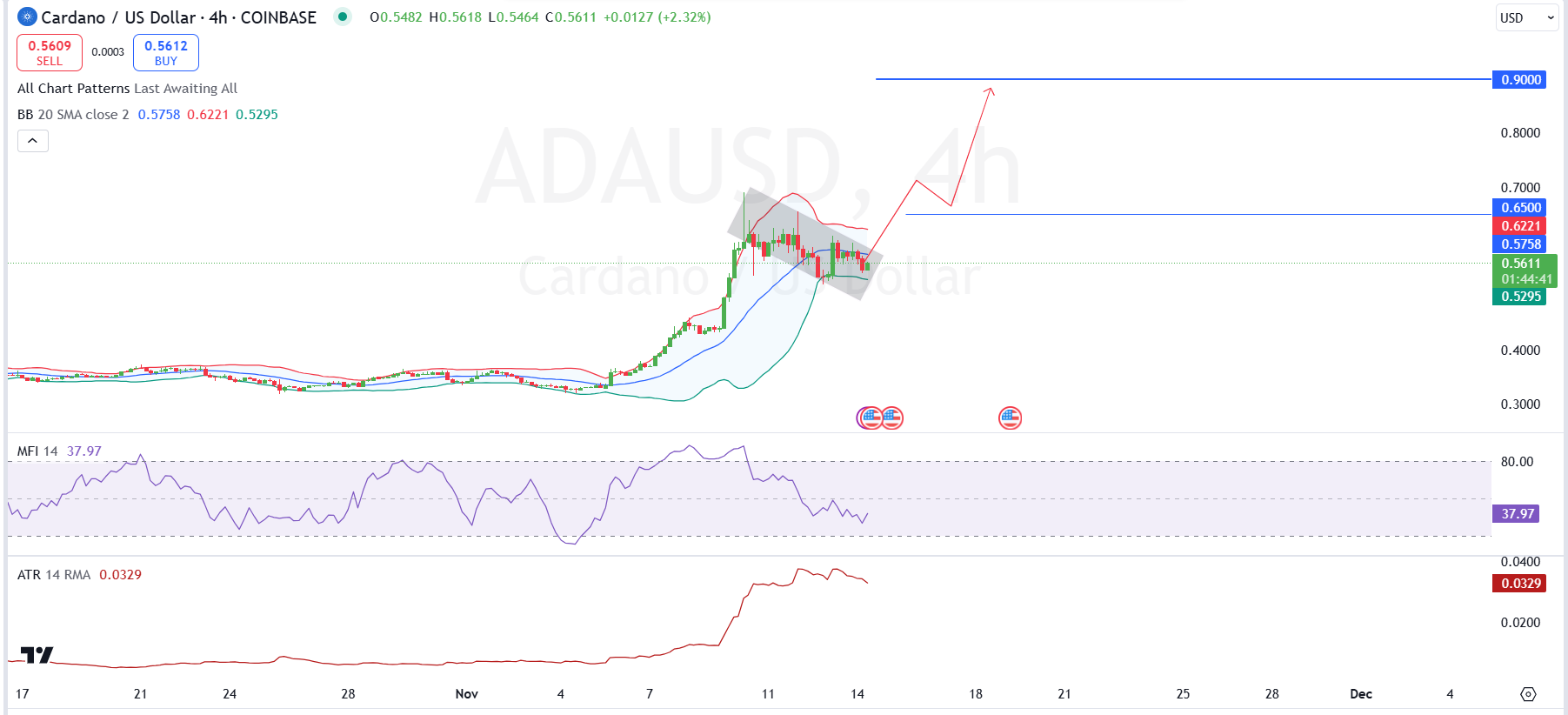

A technical analysis of ADA’s chart reveals a promising outlook. The Bollinger Bands are currently squeezed, suggesting that a significant price movement may be imminent. If ADA breaks above the upper band, it could trigger a strong bullish rally towards the $0.90 level.

Also Read: Cardano & Ripple CEOs Bridge The Gap – Hoskinson Praises Garlinghouse Amidst 24% & 50% Price Surges

The Money Flow Index (MFI) is currently below the overbought level, indicating that there is still room for further price increases.

Additionally, the decreasing Average True Range (ATR) suggests that volatility may be declining, which could lead to more stable price movements.

On-Chain Analysis: Key Price Levels and Holder Behavior

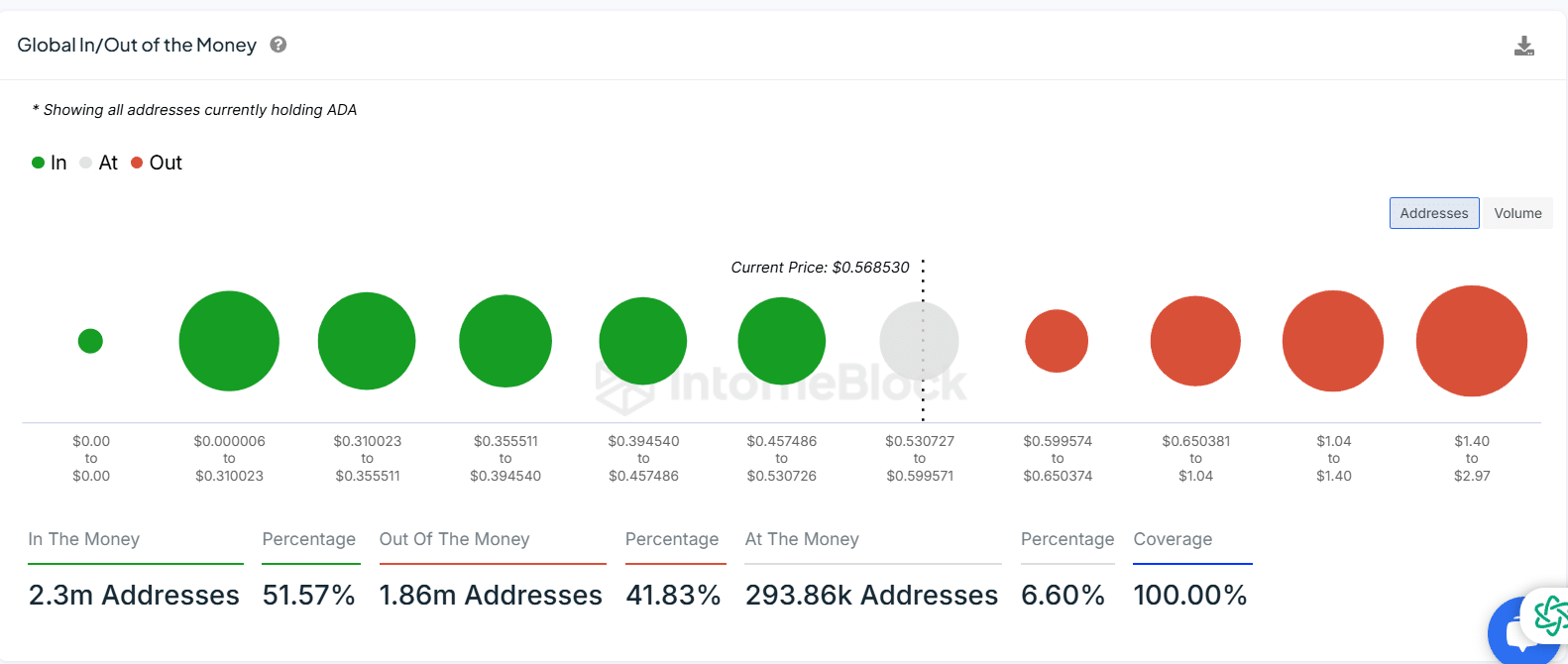

On-chain analysis provides valuable insights into ADA’s price dynamics. Two key price levels have been identified:

$0.2: A significant number of ADA holders would be “Out of the Money” at this price level. If ADA were to drop to this level, it could trigger a wave of selling pressure, potentially leading to further price declines.

$1.99: At this price level, a large number of ADA holders would move into profit. This could lead to increased profit-taking and resistance, slowing down the upward momentum.

An analysis of ADA’s holder behavior reveals interesting trends. The number of long-term holders has been steadily increasing, indicating strong underlying support. However, the number of short-term traders has also increased, suggesting that some investors may be taking advantage of the recent price rally.

Cardano’s recent price surge and positive technical indicators suggest that the cryptocurrency has strong bullish momentum. However, it’s important to consider the potential impact of key price levels and changing holder behavior. As always, it’s crucial to conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!