|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has experienced a sharp 17.8% price increase in the past 36 hours, fueled by speculation surrounding a potential Gemini exchange listing and discussions about the U.S. crypto strategic reserve. Despite initial skepticism from Gemini’s co-founder regarding ADA’s inclusion in the reserve, he did not dismiss the possibility of a listing—boosting investor sentiment.

However, a deeper look at market trends suggests that ADA’s rally faces strong resistance, potentially limiting further upside.

Hey @Gemini we finally doing this?

— Charles Hoskinson (@IOHK_Charles) March 2, 2025

Key Resistance at $0.8—A Battle for Bulls

Cardano’s recent price surge aligns with a retest of the critical $0.68 support level, which has held firm over the past three months. However, volatility triggered by the strategic reserve announcement has put bullish momentum at risk.

A key area of concern is the $0.8 level, which initially served as a bearish order block before flipping into a bullish breaker. ADA briefly held above this level but failed to sustain its position, putting bulls on the defensive. The Awesome Oscillator (AO) confirms a shift in momentum, with bearish pressure increasing.

Additionally, the Chaikin Money Flow (CMF) indicator sits at -0.01, signaling neutral capital inflows—suggesting a lack of strong buying pressure to sustain ADA’s rally.

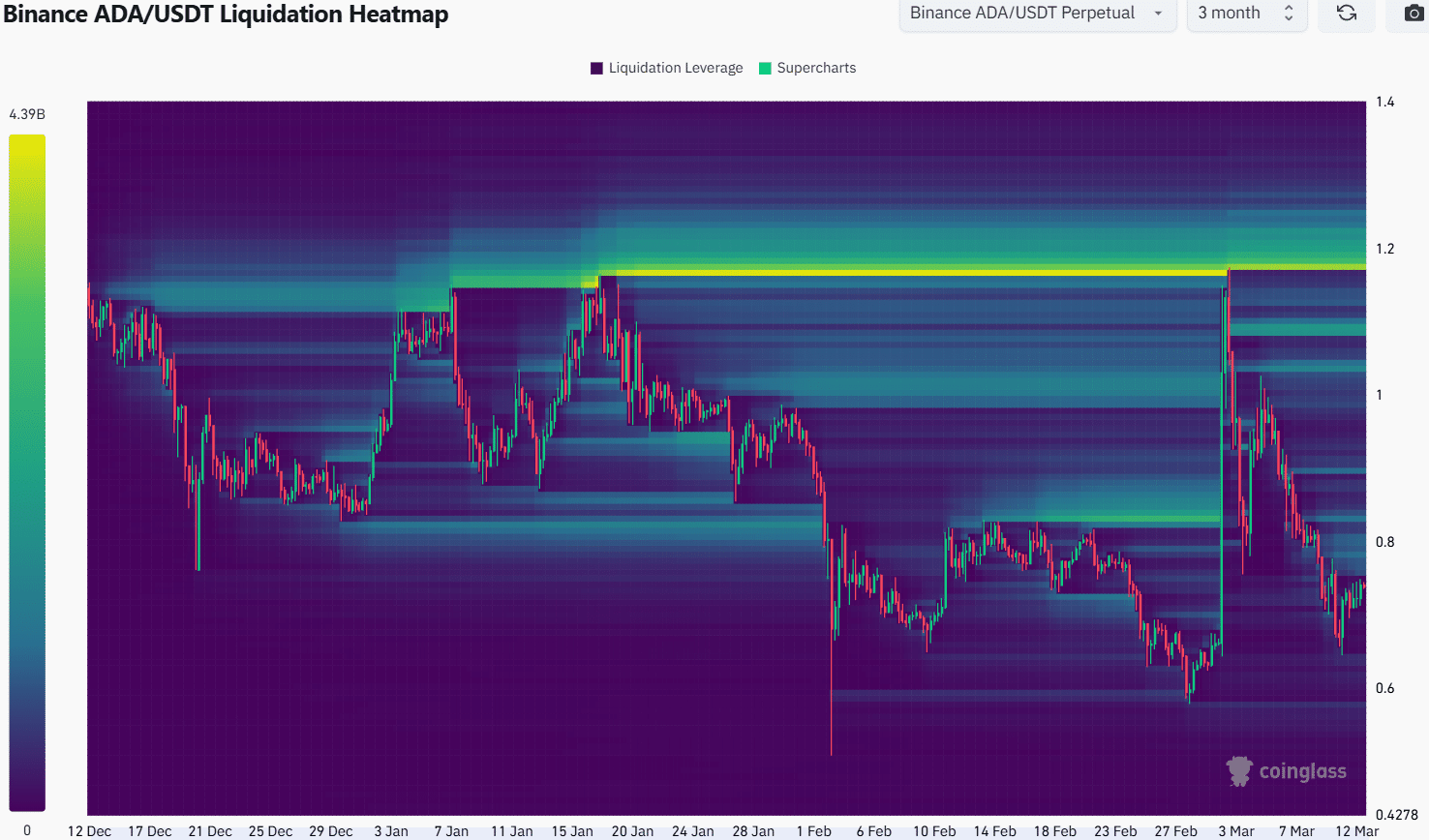

Liquidation Heatmap Hints at $1 Potential

Looking at Cardano’s liquidation heatmap, significant liquidity clusters emerge at $0.8, $0.83, and $1.17. The two-week heatmap reveals a northward pull toward $1, where a significant liquidation zone exists. However, this movement hinges on ADA’s ability to break key resistance zones, particularly at $0.9—a level aligned with mid-range resistance at $0.907.

For traders, the critical zone to watch is $0.8. A sustained move above this level could propel ADA toward $0.9 and, potentially, $1.03-$1.09. Conversely, failure to reclaim $0.8 could see a return to the $0.68 range lows.

While ADA’s recent rally is encouraging, weak spot market buying pressure and a market-wide bearish bias suggest caution. Traders should closely monitor the $0.8 level to gauge ADA’s next move—whether it extends its gains or faces another retracement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!