|

Getting your Trinity Audio player ready...

|

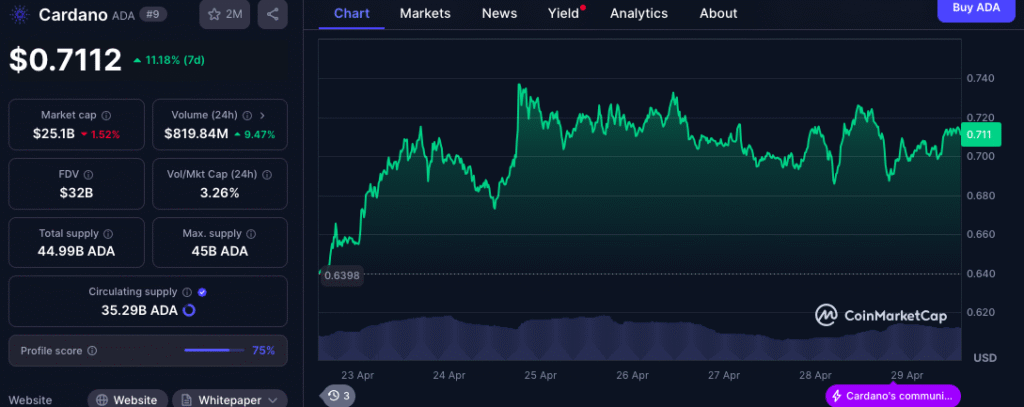

Cardano (ADA) is exhibiting strong bullish momentum, fueling optimism among traders for a potential surge towards the coveted $1 mark. The cryptocurrency has broken past the $0.70 threshold for the first time since March, now encountering crucial resistance levels that will likely dictate its short-term trajectory.

According to prominent crypto analyst Ali Charts, Cardano’s price is currently testing a significant resistance point at $0.74. A successful breach of this level could pave the way for a substantial upward movement towards $0.88. Over the past week, ADA has demonstrated impressive gains, climbing by over 12%, indicating a notable increase in investor confidence.

Trading volume has also experienced a significant upswing, jumping by 33% in the last 24 hours to reach $723 million. This heightened activity suggests that buyers are actively engaging as Cardano attempts to overcome resistance barriers situated between $0.7150 and $0.7200. Failure to decisively break through these levels, however, could lead to a price retracement towards the $0.6800 support. As of the latest data, ADA is trading around $0.7088, marking a daily increase of 2.04% as it recovers from a recent low of $0.6500.

Whale Accumulation and ETF Speculation Bolster Bullish Sentiment

Adding to the positive outlook for Cardano is the increasing accumulation by large holders, commonly known as whales. Data from Santiment reveals that wallets holding between 10 million and 100 million ADA now control a significant 35.5% of the total supply, a notable increase from 33% in January. This sustained accumulation by major investors often signals an expectation of future price appreciation. Similarly, wallets holding between 1 million and 10 million ADA have also seen their share of the supply grow to 15.83%.

Furthermore, speculation surrounding the potential approval of a spot ADA Exchange Traded Fund (ETF) is gaining traction. Following the appointment of Paul Atkins as the new chair of the Securities and Exchange Commission (SEC), optimism regarding ETF approvals across the cryptocurrency market has risen. Polymarket data reflects this sentiment, showing a significant jump to 51% in the probability of an ADA ETF being approved this year. The recent backing for Ripple’s XRP has further fueled these expectations within the broader altcoin market.

Technical Indicators Point to Continued Upward Potential

Technical analysis further supports the bullish narrative for Cardano. A Golden Cross formation has recently emerged on the 4-hour chart, a classic indicator often associated with the beginning of an upward trend. Following this bullish crossover, the price experienced a sharp rise and has since been trading above the 50-period Simple Moving Average (SMA), which has now established itself as a support level. The formation of higher highs and higher lows in the price action also reinforces the positive momentum.

The Money Flow Index (MFI) currently sits at 55.33, indicating a neutral to slightly bullish sentiment without being overbought. This suggests that there is still room for potential price appreciation if the underlying bullish sentiment persists. On a broader timeframe, Cardano’s price action is contained within a falling channel established in the first half of 2025. The recent price reversal from the channel’s bottom and its current movement towards the channel’s midpoint and upper boundary suggest further upward potential.

According to Ali Charts, a decisive break above the upper Bollinger Band around $0.77 to $0.78 could pave the way for continued gains towards $0.88. Therefore, if Cardano successfully breaches this key resistance area, it would strongly validate the bullish signals highlighted by the recent Golden Cross formation.

Current resistance levels are identified between $0.70 and $0.72, with further support lying at the lower boundary of the channel, between $0.55 and $0.57. If these resistance levels hold, Cardano may revisit the lower support before attempting another breakout. Notably, ADA Futures Open Interest (OI) has increased by nearly 1.5% intraday, reaching $796.15 million, while the derivatives volume has seen a 22.5% surge to $1.56 billion, indicating heightened trading activity and interest in Cardano’s future price movements.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Cardano to $10? Hoskinson’s Bold ADA Price Prediction & Roadmap Impact

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!