|

Getting your Trinity Audio player ready...

|

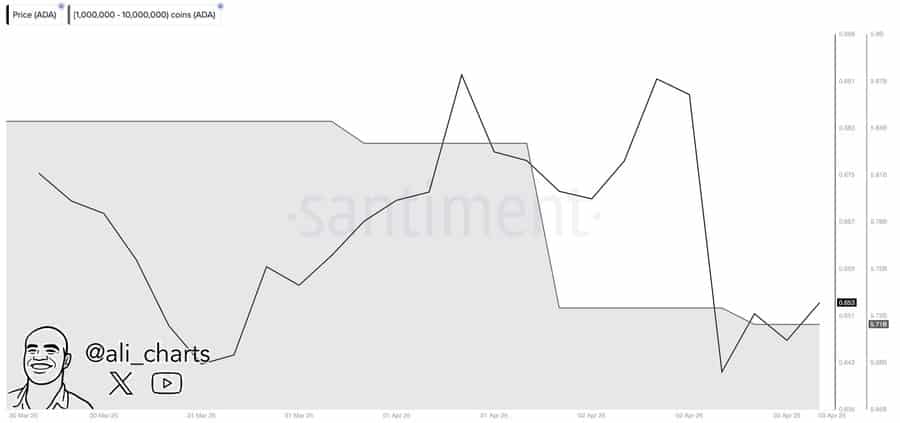

The sentiment surrounding Cardano (ADA) has been notably bearish over the past month, with significant selling pressure dominating the market. Recent data reveals that whales, who control a substantial portion of ADA’s supply, have continued offloading large amounts of the asset. In the past 48 hours alone, a staggering 120 million ADA were sold, signaling a lack of confidence in the market.

The sustained sell-off of ADA by whales suggests that the bearish trend could persist, as these large holders typically have a significant influence on price movements. In addition to the whale activity, data from the derivatives market indicates further selling pressure. Open Interest in both futures and options has seen declines, with 1.01% and 0.27% drops recorded in the past 24 hours. A decrease in Open Interest often reflects the closure of contracts, signaling a loss of market confidence and a potential long liquidation event.

Market sentiment has further been reinforced by the long-to-short ratio, which currently sits at 0.9767. This ratio suggests more selling than buying, a key indicator that ADA’s price may continue to trend downward unless the metric shifts above 1, indicating stronger buying interest.

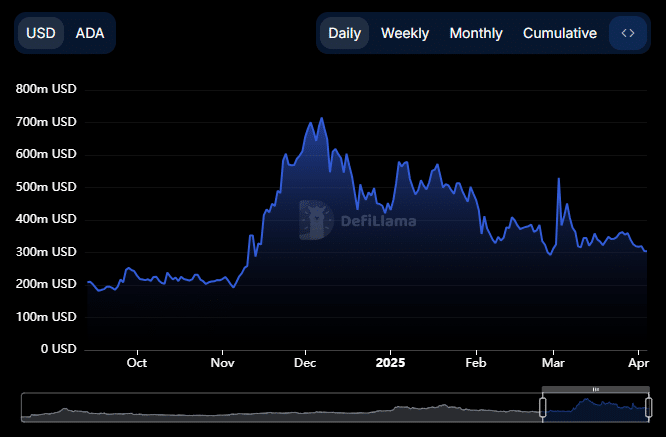

On the DeFi front, the Total Value Locked (TVL) on the Cardano blockchain has also experienced a noticeable decline. From a peak of $319.58 million in April, the TVL has dropped to $304.04 million. This decrease in TVL points to ongoing withdrawals by DeFi investors, further contributing to ADA’s bearish momentum.

Despite these bearish signals, there is a glimmer of hope. Spot market traders have continued to accumulate ADA, with $11.23 million worth purchased over the past week. However, unless broader market sentiment shifts, the impact of these bullish moves may remain limited.

Also Read: Cardano Foundation Unveils Veridian Wallet for Secure, Decentralized Identity Control

In conclusion, Cardano’s short-term outlook appears uncertain, with whales leading the selling pressure, and key market indicators signaling further downside potential unless a reversal occurs.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.